Question

1. The company issued common stock for $70,000 in buildings, $30,000 in equipment, and $75,000 in cash. Account: Account: Account: Account: 2. Purchased inventory on

1. The company issued common stock for $70,000 in buildings, $30,000 in equipment, and $75,000 in cash.

Account:

Account:

Account:

Account:

2. Purchased inventory on account, $83,375

Account:

Account:

Paid for freight in with cash (shipping inventory), $5,750.

Account:

Account:

3. Sold products at a price of $190,000 on account, the products cost $74,000:

The transaction for the sale price would be:

Account:

Account:

The transaction for the product costs would be:

Account:

Account:

4. Paid cash for a previous 'on account' order, $83,375

Account:

Account:

5. Purchased supplies for cash, $30,000.

Account:

Account:

6. Paid a cash advance for business insurance for three months, $15,000

Account:

Account:

7. Your company returned 50 damaged units of inventory costing $75, each.

Account:

Account:

8. Received professional services (accounting and legal services) on account, $5,500.

Account:

Account:

9. Paid salaries in cash, $19,250

Account:

Account:

10. Received cash of $190,000 for a previously recorded sale

Account:

Account:

11. Purchased inventory on account, $131,250, 2/10, n/30.

Account:

Account:

12. Sold products at a price of $220,000, 1/10, n/30. The products cost the company $85,700. (Use the GROSS Method!)

The transaction for the sales price would be:

Account:

Account:

The transaction for the cost of the products would be:

Account:

Account:

13. Paid the shipping cost for the sale in cash, $16,500

Account:

Account:

14. PAID CASH within the discount period for the following previously recorded purchase.

NOTE: The transaction below has ALREADY BEEN RECORDED!

Purchased inventory on account, $131,250, 2/10, n/30.

You are now recording the cash payment for this previous transaction. Assume the payment is within the discount period and determine the appropriate amounts and accounts to record this cash payment

Account:

Account:

Account:

15. RECIEVED CASH within the discount period for the following previously recorded sale.

NOTE: The transaction below has ALREADY BEEN RECORDED!

Sold products at a price of $220,000, 1/10, n/30.

You are now recording the cash receipt for this previous transaction. Assume the receipt is within the discount period and determine the appropriate amounts and accounts to record this cash receipt.

Account:

Account:

Account:

Here is the format wanted:

Help would be greatly appreciated ASAP!!

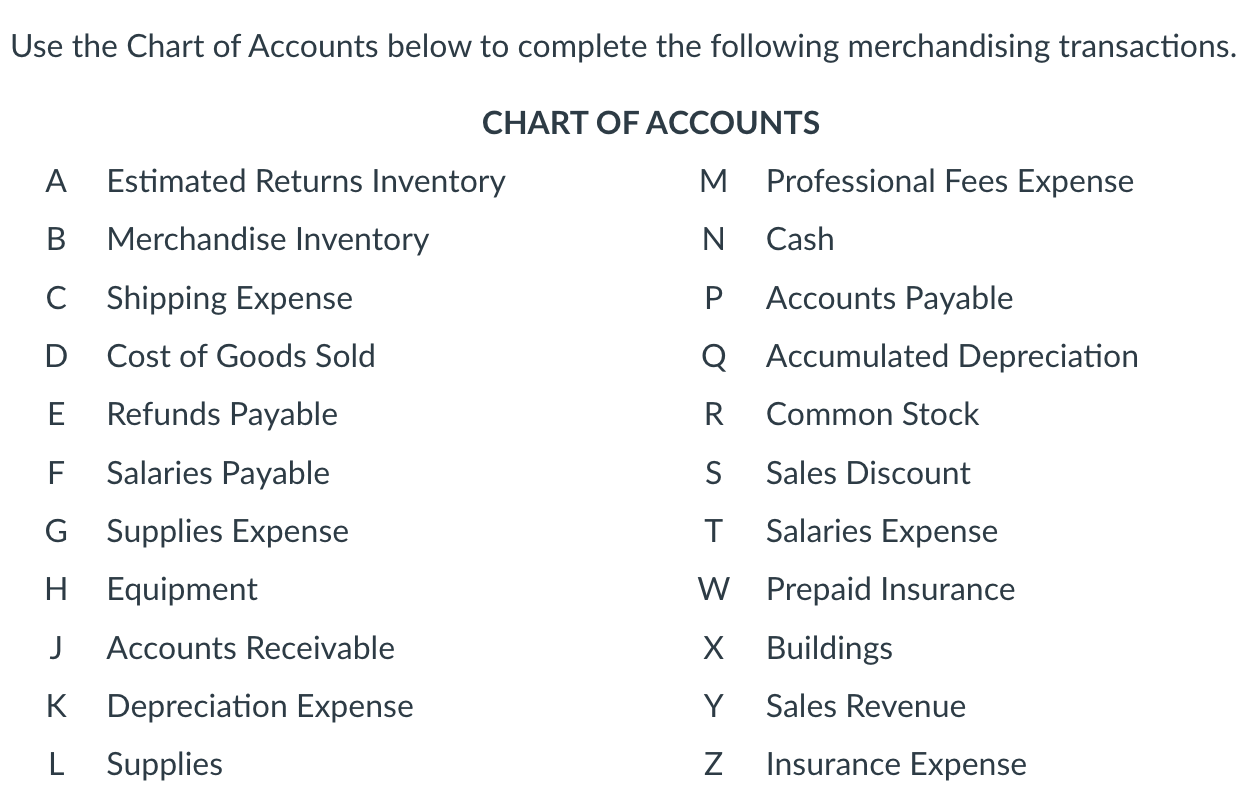

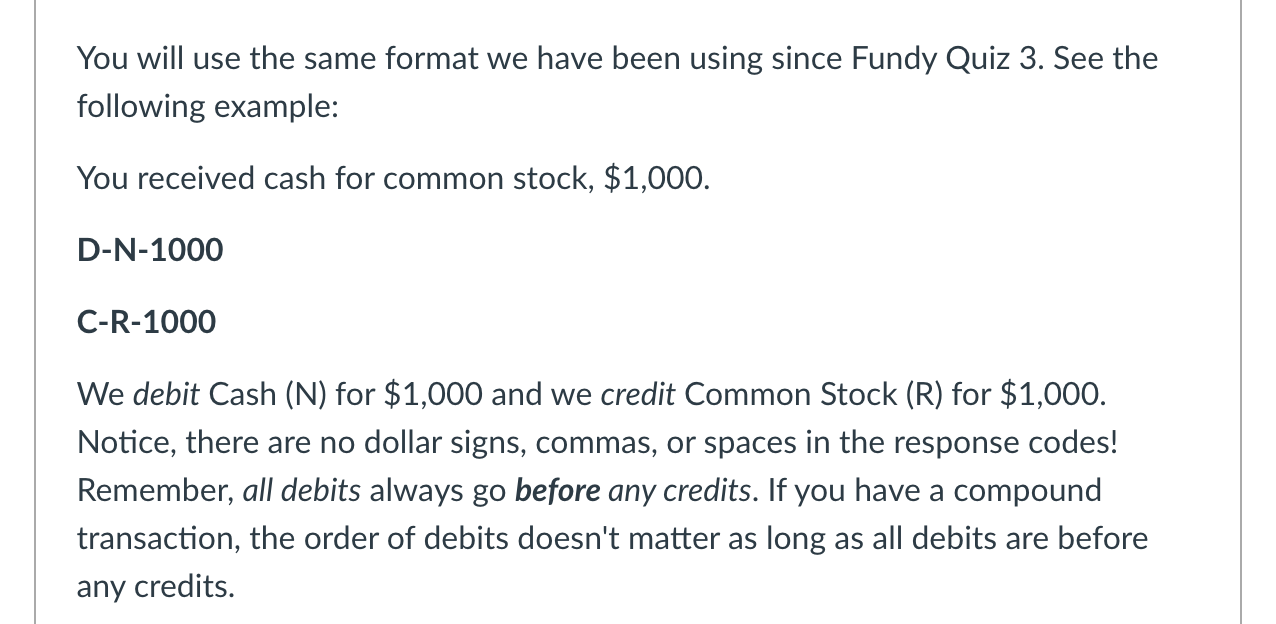

Ise the Chart of Arrounts helnwe tn romnlete the follnweing merrhandicing trancartinno You will use the same format we have been using since Fundy Quiz 3. See the following example: You received cash for common stock, $1,000. D-N-1000 C-R-1000 We debit Cash (N) for $1,000 and we credit Common Stock (R) for $1,000. Notice, there are no dollar signs, commas, or spaces in the response codes! Remember, all debits always go before any credits. If you have a compound transaction, the order of debits doesn't matter as long as all debits are before any credits. Ise the Chart of Arrounts helnwe tn romnlete the follnweing merrhandicing trancartinno You will use the same format we have been using since Fundy Quiz 3. See the following example: You received cash for common stock, $1,000. D-N-1000 C-R-1000 We debit Cash (N) for $1,000 and we credit Common Stock (R) for $1,000. Notice, there are no dollar signs, commas, or spaces in the response codes! Remember, all debits always go before any credits. If you have a compound transaction, the order of debits doesn't matter as long as all debits are before any credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started