Question

1. The demand function for an item is P = -Q + 15, while the supply function is P = 0.5Q +3. Taxes are subject

1. The demand function for an item is P = -Q + 15, while the supply function is P = 0.5Q +3. Taxes are subject to a tax of Rp3, - per unit.

a. What is the price of the balance and the amount of balance before and after tax!

b. What is the total government tax, consumer tax and producer tax!

c. Graphic image

2. The demand function for an item is shown by the equation P = -Q + 15, while the supply is P = 0.5Q + 3.

A subsidy of 1.5 is given for each unit of goods sold. a. What is the price of the balance before and after the subsidy

b. Determine the subsidies provided by the government, subsidies received by consumers and subsidies received by producers.

c. Draw the graph.

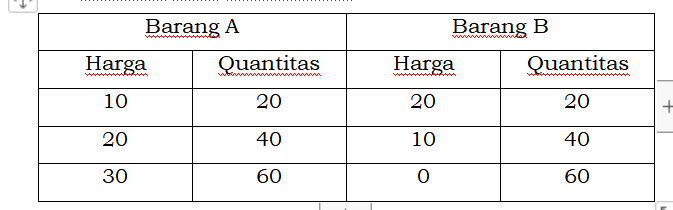

3. Determine the elasticity of demand for goods A and B below and explain the type of elasticity!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started