Answered step by step

Verified Expert Solution

Question

1 Approved Answer

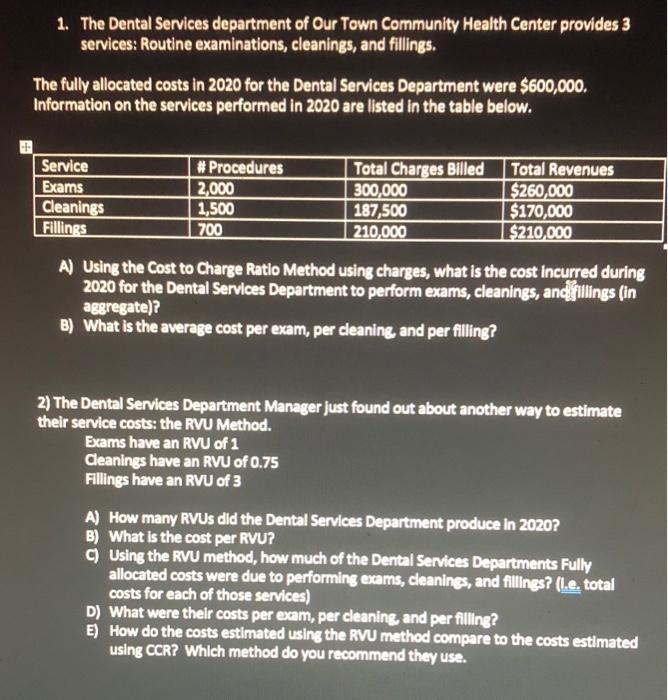

1. The Dental Services department of Our Town Community Health Center provides 3 services: Routine examinations, cleanings, and fillings. The fully allocated costs in

1. The Dental Services department of Our Town Community Health Center provides 3 services: Routine examinations, cleanings, and fillings. The fully allocated costs in 2020 for the Dental Services Department were $600,000. Information on the services performed in 2020 are listed in the table below. Service Exams Cleanings Fillings # Procedures 2,000 1,500 700 Total Charges Billed 300,000 187,500 210,000 Total Revenues $260,000 $170,000 $210,000 A) Using the Cost to Charge Ratio Method using charges, what is the cost incurred during 2020 for the Dental Services Department to perform exams, cleanings, and fillings (in aggregate)? B) What is the average cost per exam, per cleaning, and per filling? 2) The Dental Services Department Manager just found out about another way to estimate their service costs: the RVU Method. Exams have an RVU of 1 Cleanings have an RVU of 0.75 Fillings have an RVU of 3 A) How many RVUS did the Dental Services Department produce in 2020? B) What is the cost per RVU? C) Using the RVU method, how much of the Dental Services Departments Fully allocated costs were due to performing exams, cleanings, and fillings? (1.e. total costs for each of those services) D) What were their costs per exam, per cleaning, and per filling? E) How do the costs estimated using the RVU method compare to the costs estimated using CCR? Which method do you recommend they use.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Using the Cost to Charge Ratio Method using charges what is the cost incurred during 2020 for the Dental Services Department to perform exams cleanings and fillings in aggregate The cost to charge rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started