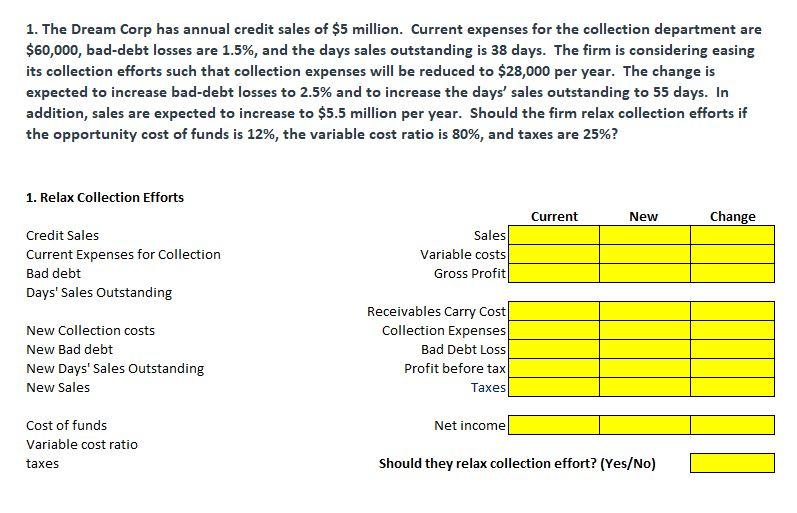

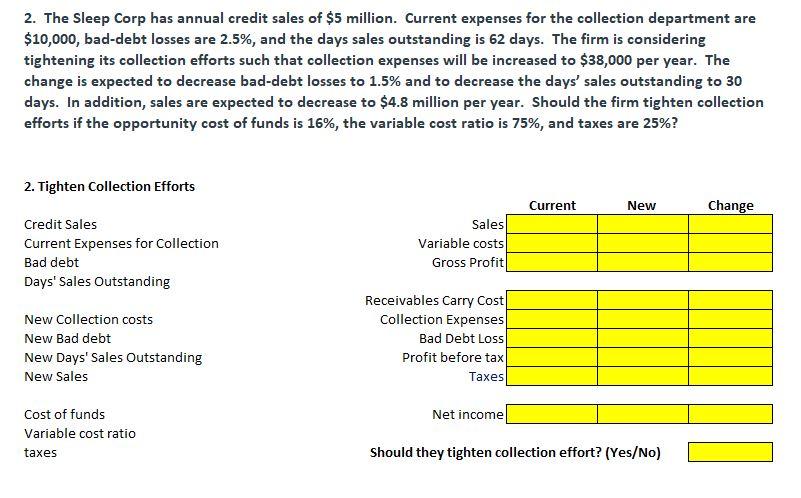

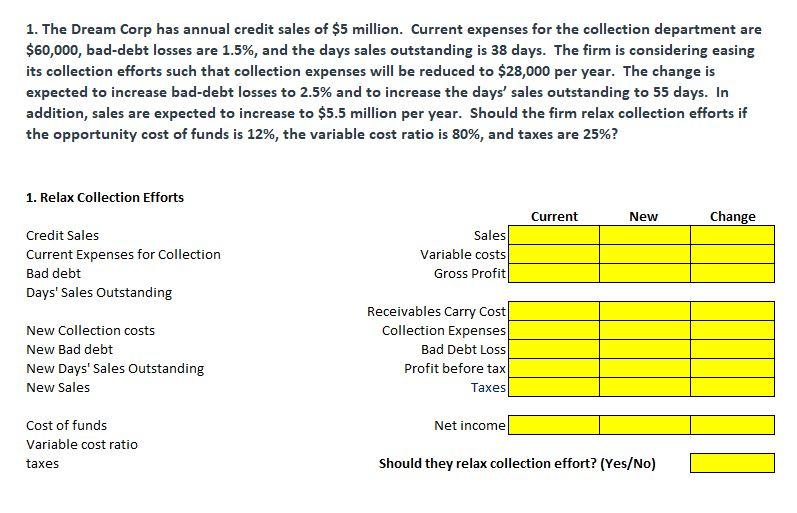

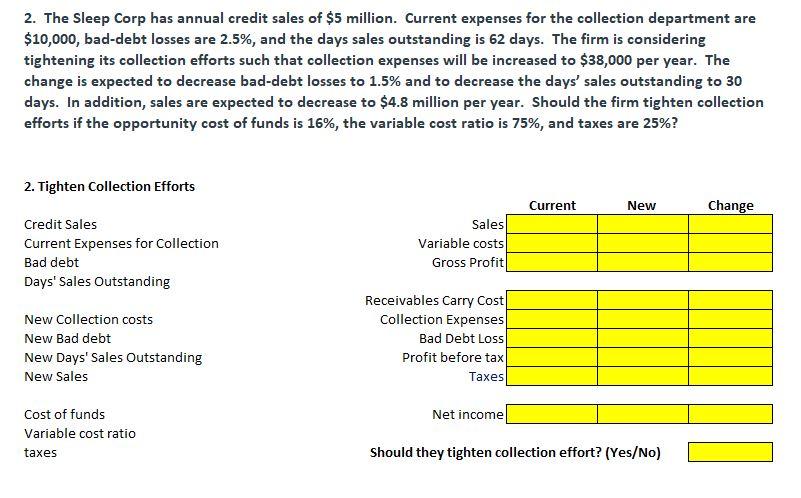

1. The Dream Corp has annual credit sales of $5 million. Current expenses for the collection department are $60,000, bad-debt losses are 1.5%, and the days sales outstanding is 38 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to $28,000 per year. The change is expected to increase bad-debt losses to 2.5% and to increase the days' sales outstanding to 55 days. In addition, sales are expected to increase to $5.5 million per year. Should the firm relax collection efforts if the opportunity cost of funds is 12%, the variable cost ratio is 80%, and taxes are 25% ? 2. The Sleep Corp has annual credit sales of $5 million. Current expenses for the collection department are $10,000, bad-debt losses are 2.5%, and the days sales outstanding is 62 days. The firm is considering tightening its collection efforts such that collection expenses will be increased to $38,000 per year. The change is expected to decrease bad-debt losses to 1.5% and to decrease the days' sales outstanding to 30 days. In addition, sales are expected to decrease to $4.8 million per year. Should the firm tighten collection efforts if the opportunity cost of funds is 16%, the variable cost ratio is 75%, and taxes are 25% ? 1. The Dream Corp has annual credit sales of $5 million. Current expenses for the collection department are $60,000, bad-debt losses are 1.5%, and the days sales outstanding is 38 days. The firm is considering easing its collection efforts such that collection expenses will be reduced to $28,000 per year. The change is expected to increase bad-debt losses to 2.5% and to increase the days' sales outstanding to 55 days. In addition, sales are expected to increase to $5.5 million per year. Should the firm relax collection efforts if the opportunity cost of funds is 12%, the variable cost ratio is 80%, and taxes are 25% ? 2. The Sleep Corp has annual credit sales of $5 million. Current expenses for the collection department are $10,000, bad-debt losses are 2.5%, and the days sales outstanding is 62 days. The firm is considering tightening its collection efforts such that collection expenses will be increased to $38,000 per year. The change is expected to decrease bad-debt losses to 1.5% and to decrease the days' sales outstanding to 30 days. In addition, sales are expected to decrease to $4.8 million per year. Should the firm tighten collection efforts if the opportunity cost of funds is 16%, the variable cost ratio is 75%, and taxes are 25%