1. The Easterbrook Electronics is known for the high quality of its stereo speakers internationally. It requires your assistance in determining the Weighted Average

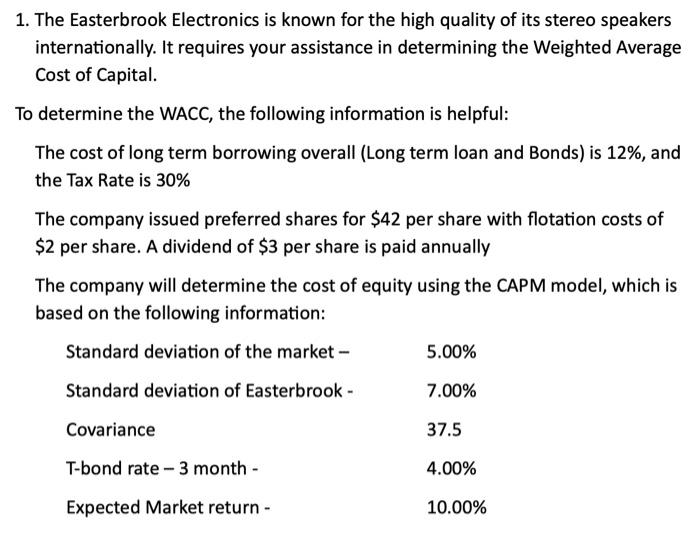

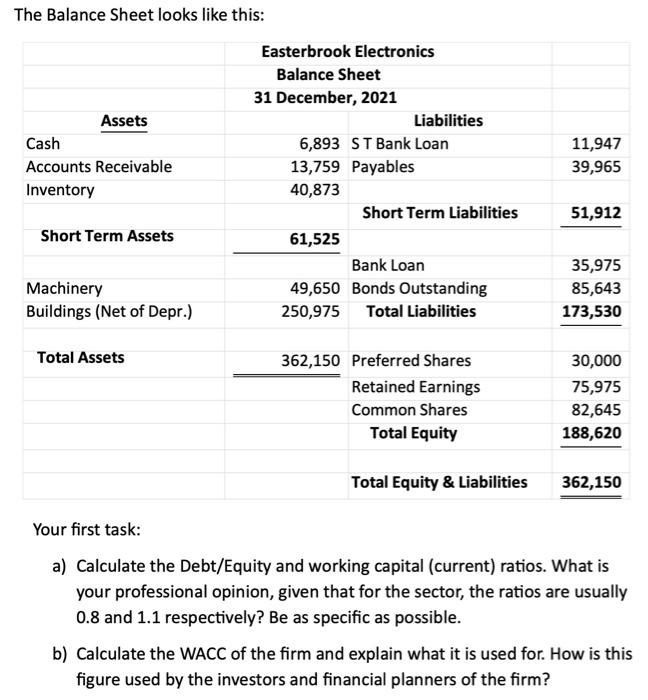

1. The Easterbrook Electronics is known for the high quality of its stereo speakers internationally. It requires your assistance in determining the Weighted Average Cost of Capital. To determine the WACC, the following information is helpful: The cost of long term borrowing overall (Long term loan and Bonds) is 12%, and the Tax Rate is 30% The company issued preferred shares for $42 per share with flotation costs of $2 per share. A dividend of $3 per share is paid annually The company will determine the cost of equity using the CAPM model, which is based on the following information: Standard deviation of the market - 5.00% Standard deviation of Easterbrook - 7.00% Covariance 37.5 T-bond rate 3 month - 4.00% Expected Market return - 10.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started