Question

1. The (Euro) is trading at $1.1100 versus the USD. A basket of goods in the US costs $100 and 108 in Europe. For

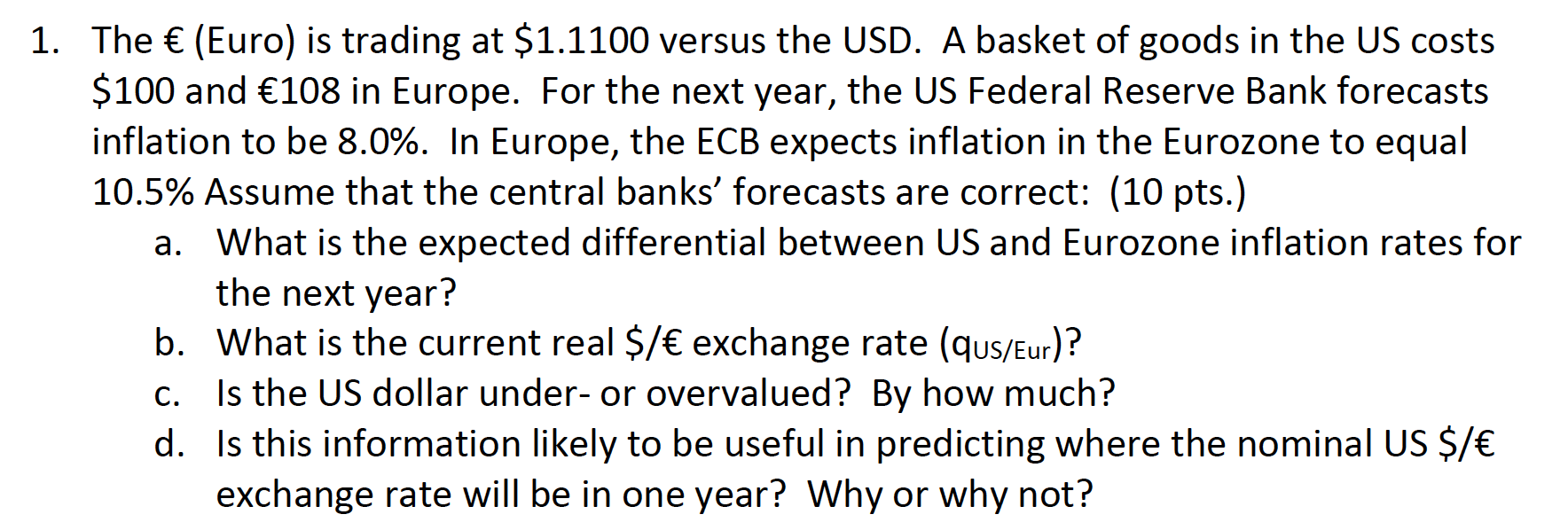

1. The (Euro) is trading at $1.1100 versus the USD. A basket of goods in the US costs $100 and 108 in Europe. For the next year, the US Federal Reserve Bank forecasts inflation to be 8.0%. In Europe, the ECB expects inflation in the Eurozone to equal 10.5% Assume that the central banks' forecasts are correct: (10 pts.) a. What is the expected differential between US and Eurozone inflation rates for the next year? b. What is the current real $/ exchange rate (qus/Eur)? C. Is the US dollar under- or overvalued? By how much? d. Is this information likely to be useful in predicting where the nominal US $/ exchange rate will be in one year? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 a The expected differential between US and Eurozone inflation rates for the next ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Mathematics In Canada

Authors: Ernest Jerome

7th edition

978-0071091411, 71091416, 978-0070009899

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App