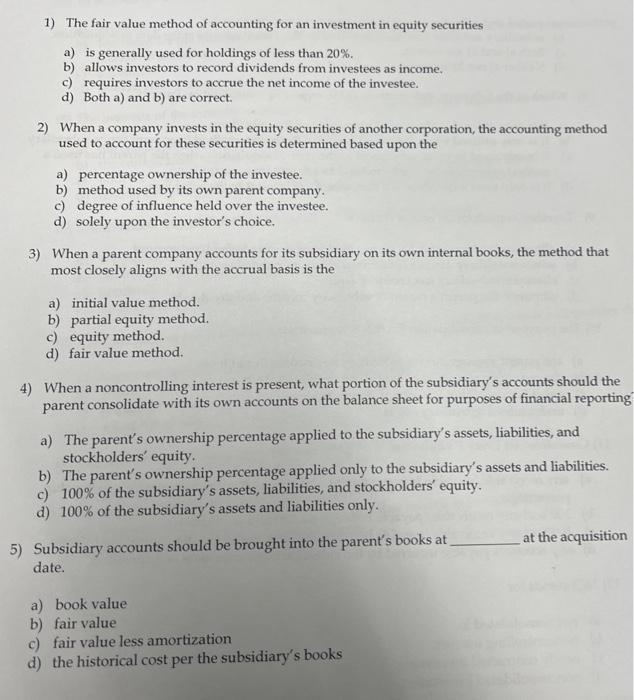

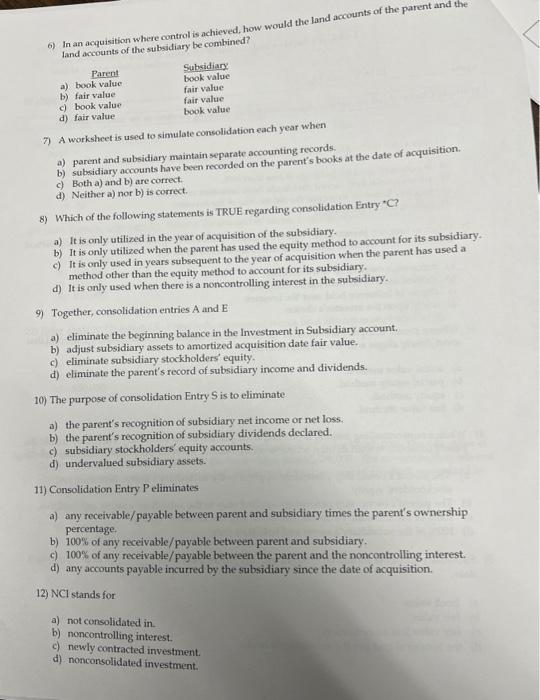

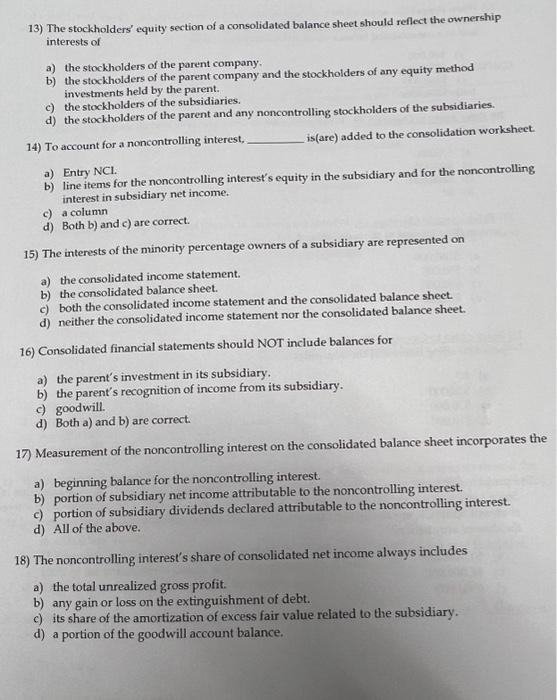

1) The fair value method of accounting for an investment in equity securities a) is generally used for holdings of less than 20%. b) allows investors to record dividends from investees as income. c) requires investors to accrue the net income of the investee. d) Both a) and b) are correct. 2) When a company invests in the equity securities of another corporation, the accounting method used to account for these securities is determined based upon the a) percentage ownership of the investee. b) method used by its own parent company. c) degree of influence held over the investee. d) solely upon the investor's choice. 3) When a parent company accounts for its subsidiary on its own internal books, the method that most closely aligns with the accrual basis is the a) initial value method. b) partial equity method. c) equity method. d) fair value method. 4) When a noncontrolling interest is present, what portion of the subsidiary's accounts should the parent consolidate with its own accounts on the balance sheet for purposes of financial reportin a) The parent's ownership percentage applied to the subsidiary's assets, liabilities, and stockholders' equity. b) The parent's ownership percentage applied only to the subsidiary's assets and liabilities. c) 100% of the subsidiary's assets, liabilities, and stockholders' equity. d) 100% of the subsidiary's assets and liabilities only. 5) Subsidiary accounts should be brought into the parent's books at at the acquisition date. a) book value b) fair value c) fair value less amortization d) the historical cost per the subsidiary's books 6) In an acquisition where control is achieved, how would the land accounts of the parent and the land accounts of the subsidiary be combined? Parent a) book value b) fair value c) book value d) fair value Subsidiary. book value fair value fair value book value 7) A worksheet is used to simulate consolidation each year when a) parent and subsidiary maintain separate accounting records. b) subsidiary accounts have been recorded on the parent's books at the date of acquisition. c) Both a) and b) are correct. d) Neither a) nor b) is correct. 8) Which of the following statements is TRUE regarding consolidation Entry * C ? a) It is only utilized in the year of acquisition of the subsidiary. b) It is only utilized when the parent has used the equity method to account for its subsidiary. c) It is only used in years subsequent to the year of acquisition when the parent has used a method other than the equity method to account for its subsidiary. d) It is only used when there is a noncontrolling interest in the subsidiary. 9) Together, consolidation entries A and E a) eliminate the beginning balance in the Investment in Subsidiary account. b) adjust subsidiary assets to amortized acquisition date fair value. c) eliminate subsidiary stockholders' equity. d) eliminate the parent's record of subsidiary income and dividends. 10) The purpose of consolidation Entry S is to eliminate a) the parent's recognition of subsidiary net income or net loss. b) the parent's recognition of subsidtary dividends declared. c) subsidiary stockholders' equity accounts. d) undervalued subsidiary assets. 11) Consolidation Entry P eliminates a) any receivable/payable between parent and subsidiary times the parent's ownership percentage. b) 100% of any receivable/payable between parent and subsidiary. c) 100% of any receivable/ payable between the parent and the noncontrolling interest. d) any accounts payable incurred by the subsidiary since the date of acquisition. 12) NCl stands for a) not consolidated in. b) noncontrolling interest. c) newly contracted investment. d) nonconsolidated investment. 13) The stockholders' equity section of a consolidated balance sheet should reflect the ownership interests of a) the stockholders of the parent company. b) the stockholders of the parent company and the stockholders of any equity method investments held by the parent. c) the stockholders of the subsidiaries. d) the stockholders of the parent and any noncontrolling stockholders of the subsidiaries. 14) To account for a noncontrolling interest, is(are) added to the consolidation workshect. a) Entry NCl. b) line items for the noncontrolling interest's equity in the subsidiary and for the noncontrolling interest in subsidiary net income. c) a column d) Both b) and c) are correct. 15) The interests of the minority percentage owners of a subsidiary are represented on a) the consolidated income statement. b) the consolidated balance sheet. c) both the consolidated income statement and the consolidated balance sheet. d) neither the consolidated income statement nor the consolidated balance sheet. 16) Consolidated financial statements should NOT include balances for a) the parent's investment in its subsidiary. b) the parent's recognition of income from its subsidiary. c) goodwill. d) Both a) and b) are correct. 17) Measurement of the noncontrolling interest on the consolidated balance sheet incorporates the a) beginning balance for the noncontrolling interest. b) portion of subsidiary net income attributable to the noncontrolling interest. c) portion of subsidiary dividends declared attributable to the noncontrolling interest. d) All of the above. 18) The noncontrolling interest's share of consolidated net income always includes a) the total unrealized gross profit. b) any gain or loss on the extinguishment of debt. c) its share of the amortization of excess fair value related to the subsidiary. d) a portion of the goodwill account balance