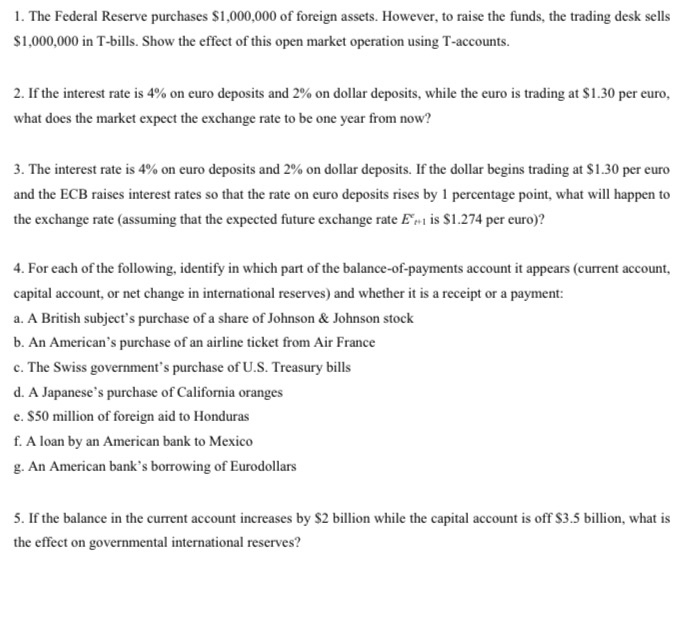

1. The Federal Reserve purchases $1,000,000 of foreign assets. However, to raise the funds, the trading desk sells $1,000,000 in T-bills. Show the effect of this open market operation using T-accounts. 2. If the interest rate is 4% on euro deposits and 2% on dollar deposits, while the euro is trading at $1.30 per euro, what does the market expect the exchange rate to be one year from now? 3. The interest rate is 4% on euro deposits and 2% on dollar deposits. If the dollar begins trading at $1.30 per euro and the ECB raises interest rates so that the rate on euro deposits rises by 1 percentage point, what will happen to the exchange rate (assuming that the expected future exchange rate Er is $1.274 per euro)? 4. For each of the following, identify in which part of the balance-of-payments account it appears (current account, capital account, or net change in international reserves) and whether it is a receipt or a payment: a. A British subject's purchase of a share of Johnson & Johnson stock b. An American's purchase of an airline ticket from Air France c. The Swiss government's purchase of U.S. Treasury bills d. A Japanese's purchase of California oranges e. $50 million of foreign aid to Honduras f. A loan by an American bank to Mexico g. An American bank's borrowing of Eurodollars 5. If the balance in the current account increases by $2 billion while the capital account is off $3.5 billion, what is the effect on governmental international reserves? 1. The Federal Reserve purchases $1,000,000 of foreign assets. However, to raise the funds, the trading desk sells $1,000,000 in T-bills. Show the effect of this open market operation using T-accounts. 2. If the interest rate is 4% on euro deposits and 2% on dollar deposits, while the euro is trading at $1.30 per euro, what does the market expect the exchange rate to be one year from now? 3. The interest rate is 4% on euro deposits and 2% on dollar deposits. If the dollar begins trading at $1.30 per euro and the ECB raises interest rates so that the rate on euro deposits rises by 1 percentage point, what will happen to the exchange rate (assuming that the expected future exchange rate Er is $1.274 per euro)? 4. For each of the following, identify in which part of the balance-of-payments account it appears (current account, capital account, or net change in international reserves) and whether it is a receipt or a payment: a. A British subject's purchase of a share of Johnson & Johnson stock b. An American's purchase of an airline ticket from Air France c. The Swiss government's purchase of U.S. Treasury bills d. A Japanese's purchase of California oranges e. $50 million of foreign aid to Honduras f. A loan by an American bank to Mexico g. An American bank's borrowing of Eurodollars 5. If the balance in the current account increases by $2 billion while the capital account is off $3.5 billion, what is the effect on governmental international reserves