Answered step by step

Verified Expert Solution

Question

1 Approved Answer

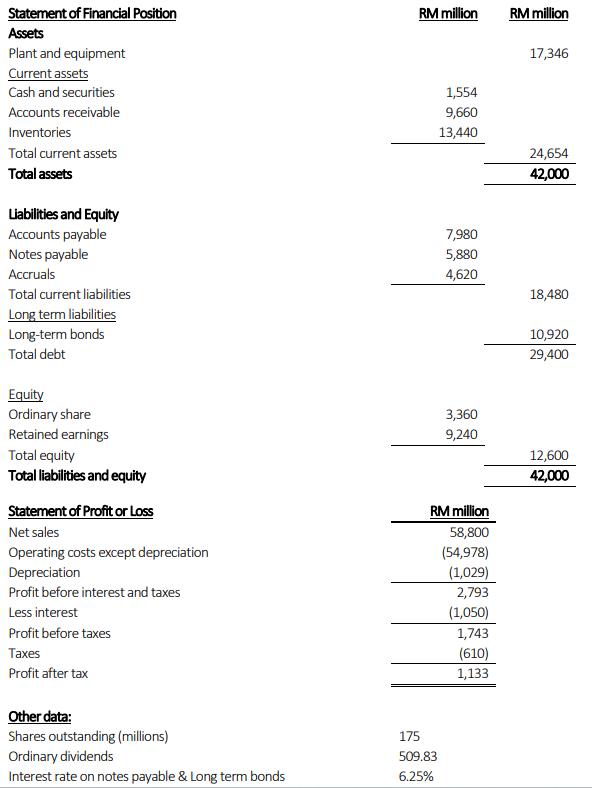

1. The financial statements shown below are for Suria Bhd for the year ended 31 December 2022: Statement of Financial Position Assets Plant and equipment

1. The financial statements shown below are for Suria Bhd for the year ended 31 December 2022:

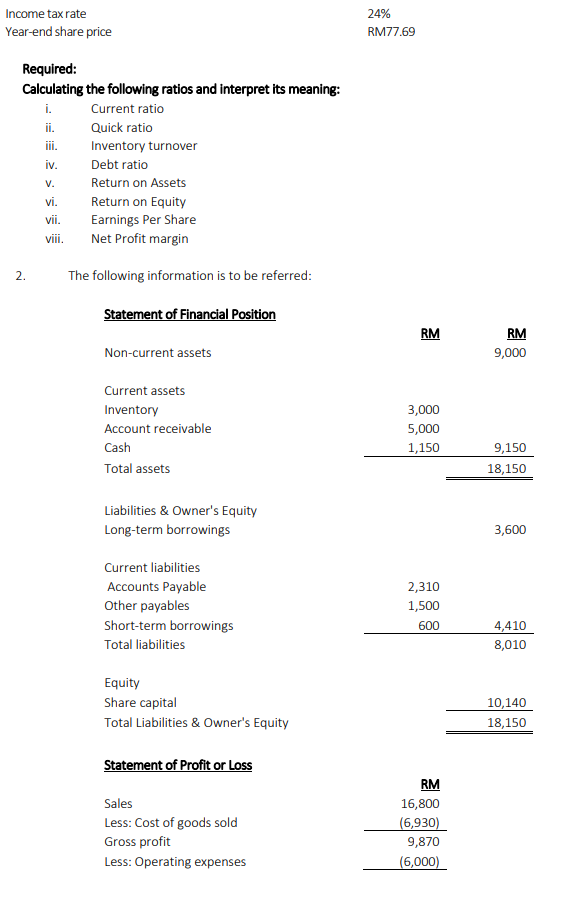

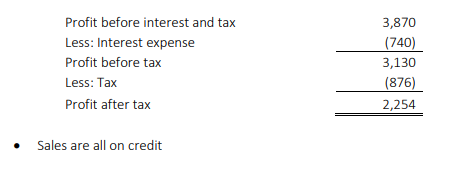

Statement of Financial Position Assets Plant and equipment Current assets Cash and securities Accounts receivable Inventories Total current assets Total assets Labilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long term liabilities Long-term bonds Total debt Equity Ordinary share Retained earnings Total equity Total liabilities and equity Statement of Profit or Loss Net sales Operating costs except depreciation Depreciation Profit before interest and taxes Less interest Profit before taxes Taxes Profit after tax Other data: Shares outstanding (millions) Ordinary dividends Interest rate on notes payable \& Long term bonds RMmillionRMmillion 17,346 1,5549,66013,440 24,65442,000 RM million 58,800(54,978)(1,029)2,793(1,050)1,743(610)1,133 175 509.83 6.25% Required: Calculating the following ratios and interpret its meaning: i. Current ratio ii. Quick ratio iii. Inventory turnover iv. Debt ratio v. Return on Assets vi. Return on Equity vii. Earnings Per Share viii. Net Profit margin 2. The following information is to be referred: - Sales are all on credit

Statement of Financial Position Assets Plant and equipment Current assets Cash and securities Accounts receivable Inventories Total current assets Total assets Labilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long term liabilities Long-term bonds Total debt Equity Ordinary share Retained earnings Total equity Total liabilities and equity Statement of Profit or Loss Net sales Operating costs except depreciation Depreciation Profit before interest and taxes Less interest Profit before taxes Taxes Profit after tax Other data: Shares outstanding (millions) Ordinary dividends Interest rate on notes payable \& Long term bonds RMmillionRMmillion 17,346 1,5549,66013,440 24,65442,000 RM million 58,800(54,978)(1,029)2,793(1,050)1,743(610)1,133 175 509.83 6.25% Required: Calculating the following ratios and interpret its meaning: i. Current ratio ii. Quick ratio iii. Inventory turnover iv. Debt ratio v. Return on Assets vi. Return on Equity vii. Earnings Per Share viii. Net Profit margin 2. The following information is to be referred: - Sales are all on credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started