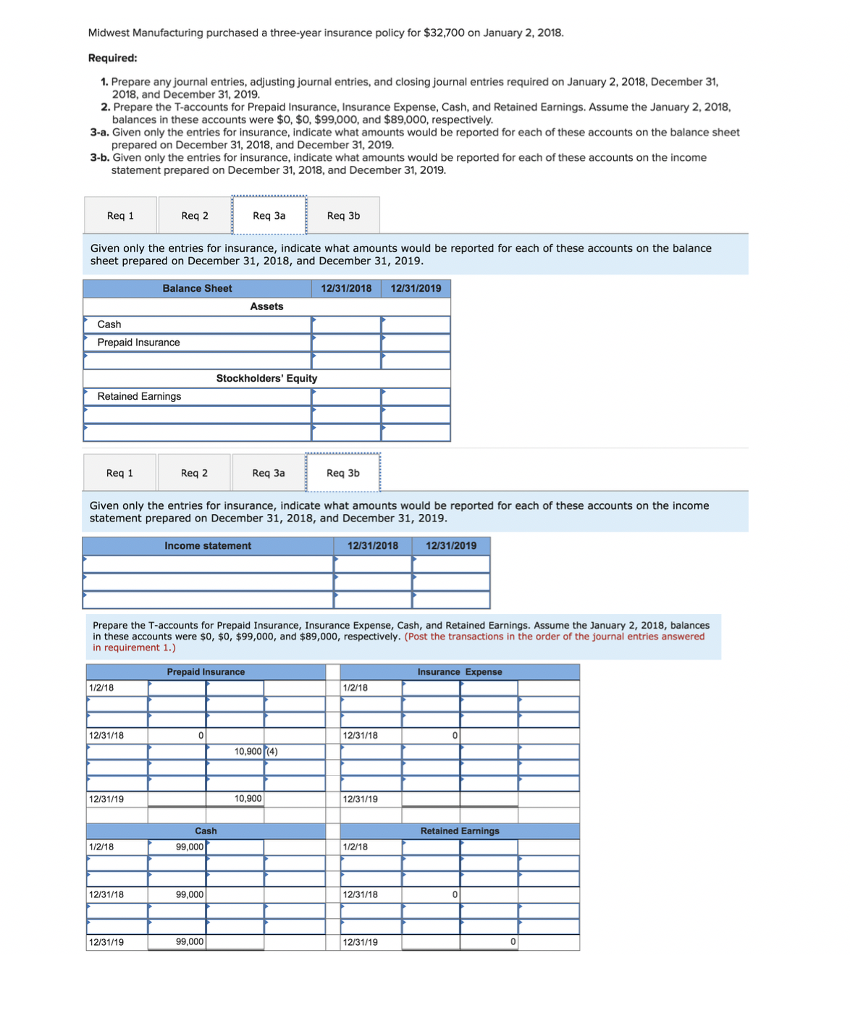

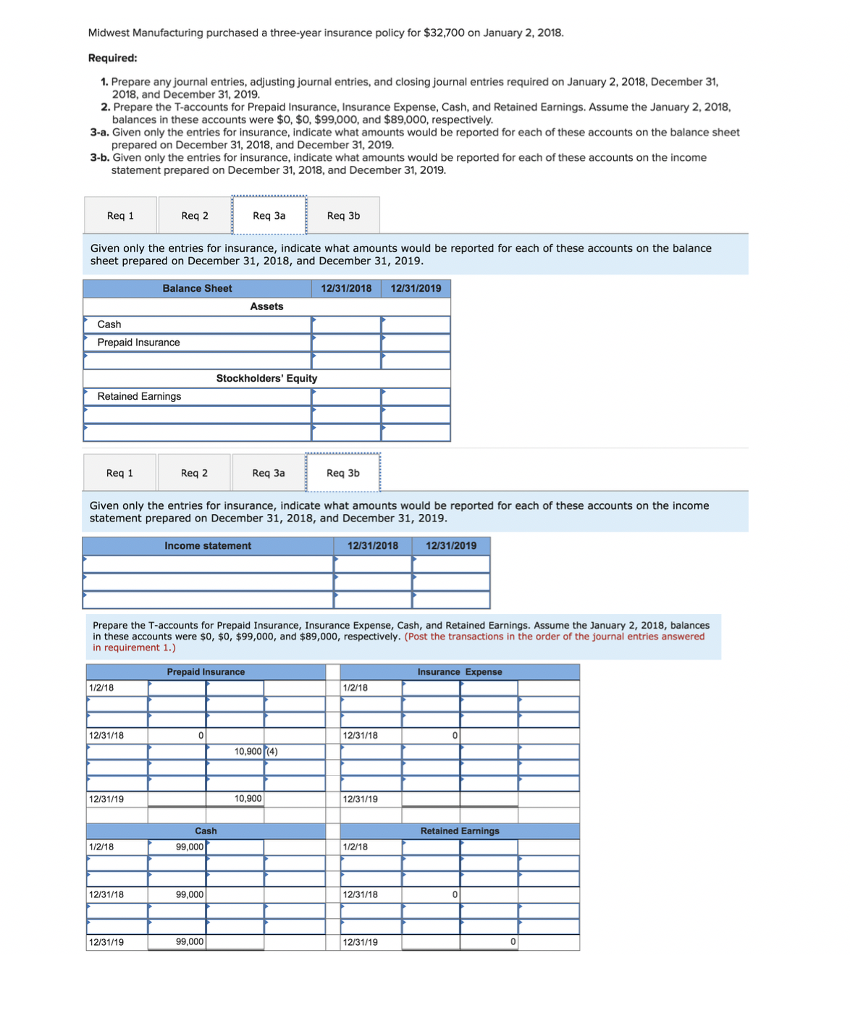

1) the first one question goes to 3a 2) the second question goes to 3b 3) the third question (the big chart) goes with 2

1) the first one question goes to 3a 2) the second question goes to 3b 3) the third question (the big chart) goes with 2

Midwest Manufacturing purchased a three-year insurance policy for $32,700 on January 2, 2018. Required: 1. Prepare any journal entries, adjusting journal entries, and closing journal entries required on January 2, 2018, December 31, 2. Prepare the T-accounts for Prepaid Insurance, Insurance Expense, Cash, and Retained Earnings. Assume the January 2, 2018, 3-a. Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the balance sheet 2018, and December 31, 2019. balances in these accounts were $o, $0, $99,000, and $89,000, respectively. prepared on December 31, 2018, and December 31, 2019. statement prepared on December 31, 2018, and December 31, 2019. 3-b. Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the income Req 1 Req 2 Req 3a Req 3b Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the balance sheet prepared on December 31, 2018, and December 31, 2019 Balance Sheet 12/31/2018 12/31/2019 Assets Cash Prepaid Insurance Stockholders' Equity Retained Earnings Req 1 Req 2 Req 3a Req 3b Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the income statement prepared on December 31, 2018, and December 31, 2019 Income statement 12/31/2018 12/31/2019 Prepare the T-accounts for Prepaid Insurance, Insurance Expense, Cash, and Retained Earnings. Assume the January 2, 2018, balances in these accounts were s0, $0, $99,000, and $89,000, respectively. (Post the transactions in the order of the journal entries answered in requirement 1.) 1/2/18 1/2/18 12/31/18 12/31/18 10,900 (4) 12/31/19 10,900 12/31/19 Cash 1/2118 99,000 1/2/18 12/31/18 99,000 12/31/18 12/31/19 99,000 12/3119 Midwest Manufacturing purchased a three-year insurance policy for $32,700 on January 2, 2018. Required: 1. Prepare any journal entries, adjusting journal entries, and closing journal entries required on January 2, 2018, December 31, 2. Prepare the T-accounts for Prepaid Insurance, Insurance Expense, Cash, and Retained Earnings. Assume the January 2, 2018, 3-a. Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the balance sheet 2018, and December 31, 2019. balances in these accounts were $o, $0, $99,000, and $89,000, respectively. prepared on December 31, 2018, and December 31, 2019. statement prepared on December 31, 2018, and December 31, 2019. 3-b. Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the income Req 1 Req 2 Req 3a Req 3b Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the balance sheet prepared on December 31, 2018, and December 31, 2019 Balance Sheet 12/31/2018 12/31/2019 Assets Cash Prepaid Insurance Stockholders' Equity Retained Earnings Req 1 Req 2 Req 3a Req 3b Given only the entries for insurance, indicate what amounts would be reported for each of these accounts on the income statement prepared on December 31, 2018, and December 31, 2019 Income statement 12/31/2018 12/31/2019 Prepare the T-accounts for Prepaid Insurance, Insurance Expense, Cash, and Retained Earnings. Assume the January 2, 2018, balances in these accounts were s0, $0, $99,000, and $89,000, respectively. (Post the transactions in the order of the journal entries answered in requirement 1.) 1/2/18 1/2/18 12/31/18 12/31/18 10,900 (4) 12/31/19 10,900 12/31/19 Cash 1/2118 99,000 1/2/18 12/31/18 99,000 12/31/18 12/31/19 99,000 12/3119

1) the first one question goes to 3a 2) the second question goes to 3b 3) the third question (the big chart) goes with 2

1) the first one question goes to 3a 2) the second question goes to 3b 3) the third question (the big chart) goes with 2