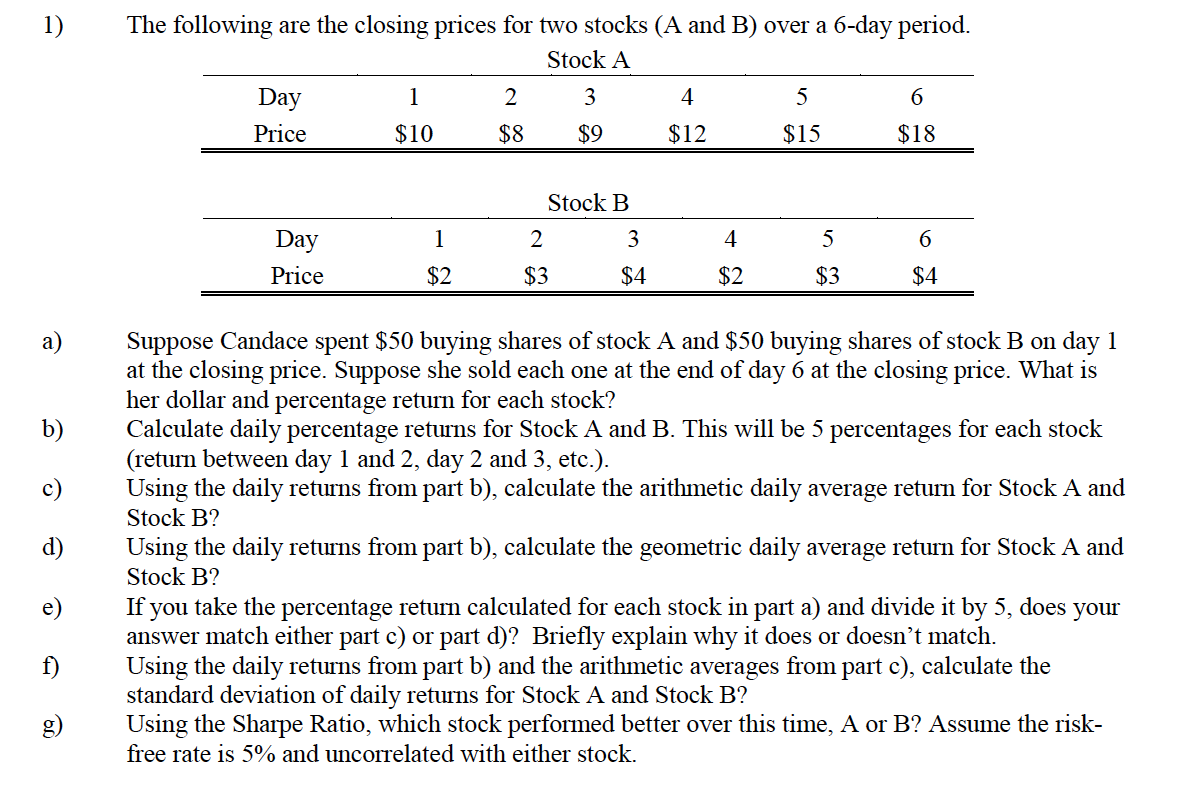

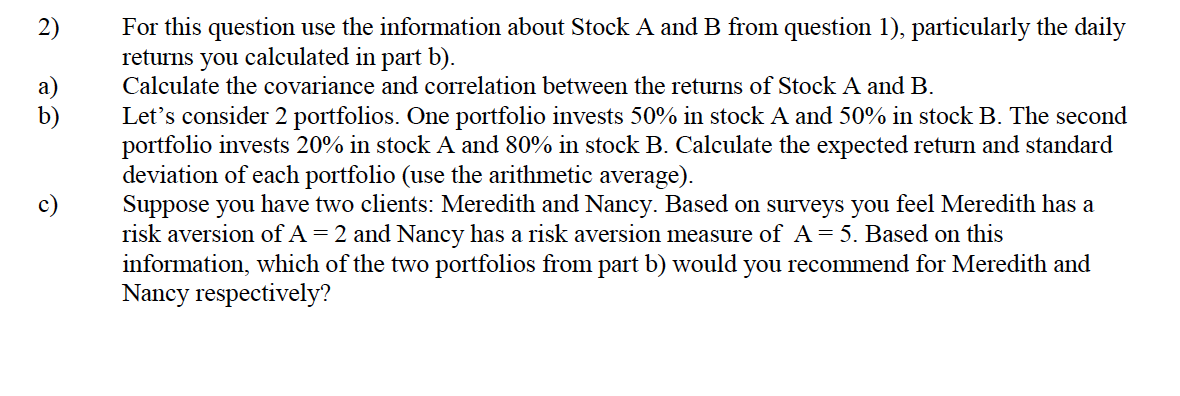

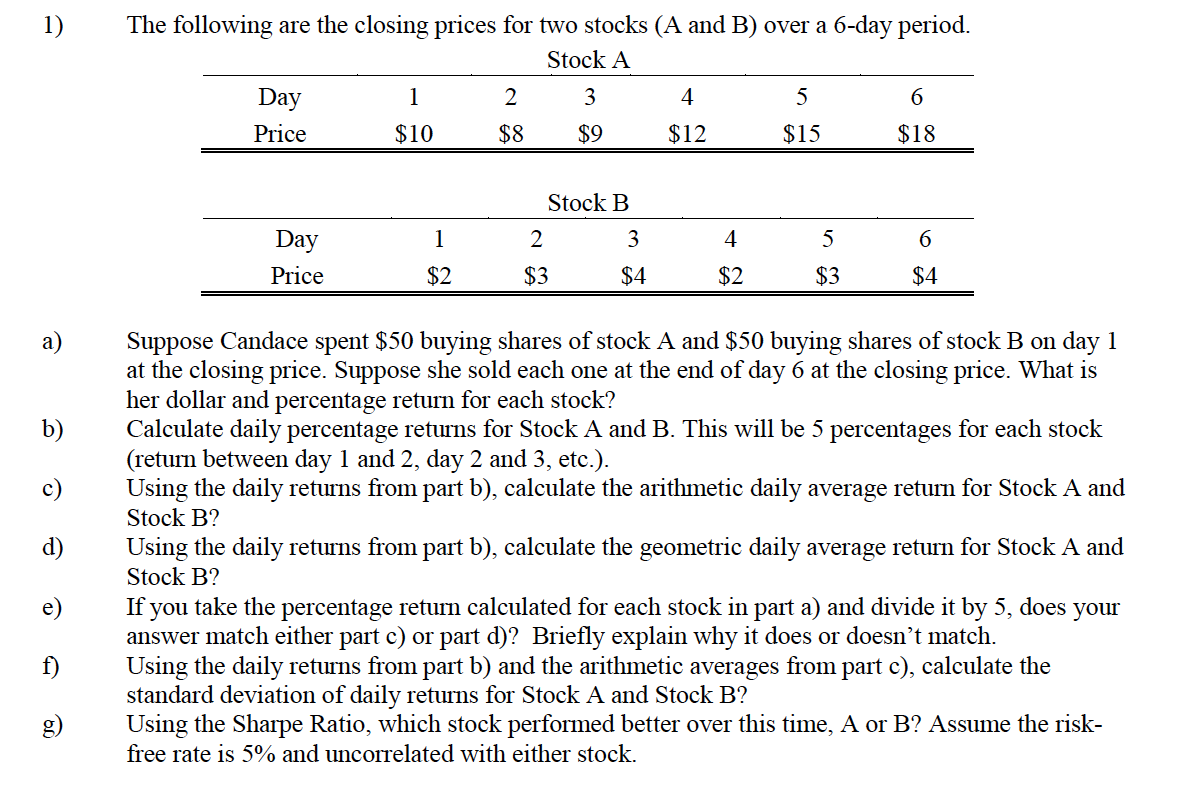

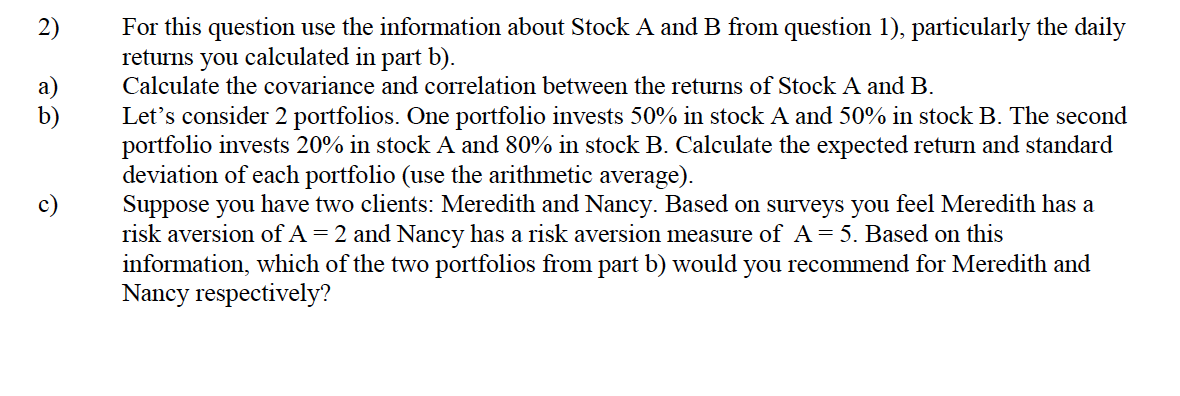

1) The following are the closing prices for two stocks (A and B) over a 6-day period. Stock A Day 1 2 3 4 5 Price $10 $8 $9 $12 $15 $18 1 Stock B 2 3 $3 $4 Day Price 6 4 $2 5 $3 $2 $4 a) Suppose Candace spent $50 buying shares of stock A and $50 buying shares of stock B on day 1 at the closing price. Suppose she sold each one at the end of day 6 at the closing price. What is her dollar and percentage return for each stock? Calculate daily percentage returns for Stock A and B. This will be 5 percentages for each stock (return between day 1 and 2, day 2 and 3, etc.). Using the daily returns from part b), calculate the arithmetic daily average return for Stock A and Stock B? Using the daily returns from part b), calculate the geometric daily average return for Stock A and Stock B? If you take the percentage return calculated for each stock in part a) and divide it by 5, does your answer match either part c) or part d)? Briefly explain why it does or doesn't match. Using the daily returns from part b) and the arithmetic averages from part c), calculate the standard deviation of daily returns for Stock A and Stock B? Using the Sharpe Ratio, which stock performed better over this time, A or B? Assume the risk- free rate is 5% and uncorrelated with either stock. TO 2) b) For this question use the information about Stock A and B from question 1), particularly the daily returns you calculated in part b). Calculate the covariance and correlation between the returns of Stock A and B. Let's consider 2 portfolios. One portfolio invests 50% in stock A and 50% in stock B. The second portfolio invests 20% in stock A and 80% in stock B. Calculate the expected return and standard deviation of each portfolio (use the arithmetic average). Suppose you have two clients: Meredith and Nancy. Based on surveys you feel Meredith has a risk aversion of A = 2 and Nancy has a risk aversion measure of A= 5. Based on this information, which of the two portfolios from part b) would you recommend for Meredith and Nancy respectively? 1) The following are the closing prices for two stocks (A and B) over a 6-day period. Stock A Day 1 2 3 4 5 Price $10 $8 $9 $12 $15 $18 1 Stock B 2 3 $3 $4 Day Price 6 4 $2 5 $3 $2 $4 a) Suppose Candace spent $50 buying shares of stock A and $50 buying shares of stock B on day 1 at the closing price. Suppose she sold each one at the end of day 6 at the closing price. What is her dollar and percentage return for each stock? Calculate daily percentage returns for Stock A and B. This will be 5 percentages for each stock (return between day 1 and 2, day 2 and 3, etc.). Using the daily returns from part b), calculate the arithmetic daily average return for Stock A and Stock B? Using the daily returns from part b), calculate the geometric daily average return for Stock A and Stock B? If you take the percentage return calculated for each stock in part a) and divide it by 5, does your answer match either part c) or part d)? Briefly explain why it does or doesn't match. Using the daily returns from part b) and the arithmetic averages from part c), calculate the standard deviation of daily returns for Stock A and Stock B? Using the Sharpe Ratio, which stock performed better over this time, A or B? Assume the risk- free rate is 5% and uncorrelated with either stock. TO 2) b) For this question use the information about Stock A and B from question 1), particularly the daily returns you calculated in part b). Calculate the covariance and correlation between the returns of Stock A and B. Let's consider 2 portfolios. One portfolio invests 50% in stock A and 50% in stock B. The second portfolio invests 20% in stock A and 80% in stock B. Calculate the expected return and standard deviation of each portfolio (use the arithmetic average). Suppose you have two clients: Meredith and Nancy. Based on surveys you feel Meredith has a risk aversion of A = 2 and Nancy has a risk aversion measure of A= 5. Based on this information, which of the two portfolios from part b) would you recommend for Meredith and Nancy respectively