Answered step by step

Verified Expert Solution

Question

1 Approved Answer

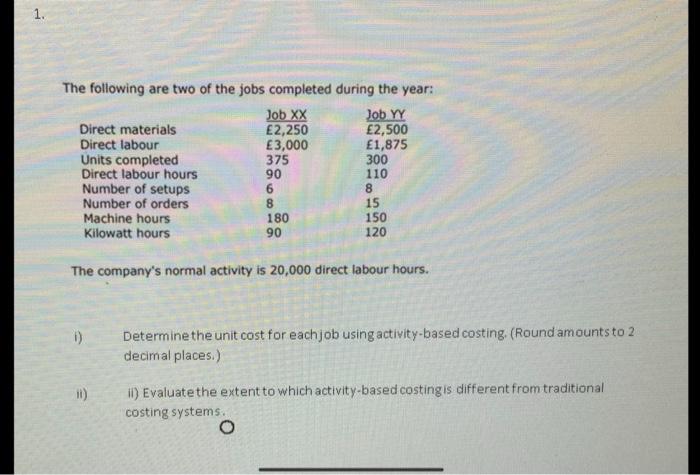

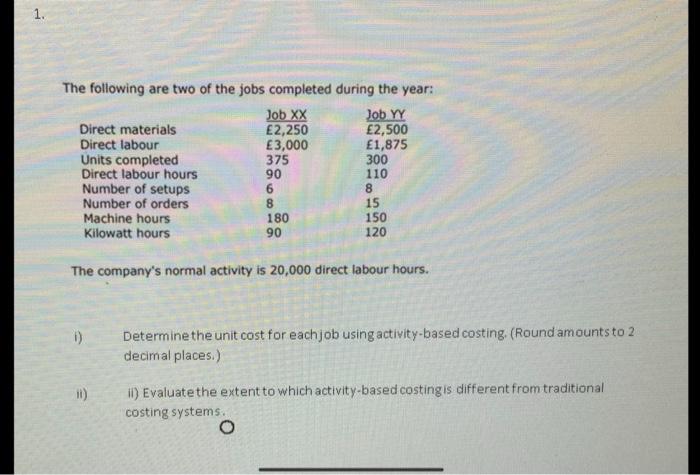

1. The following are two of the jobs completed during the year: Job XX Job YY Direct materials 2,250 2,500 Direct labour 3,000 1,875 Units

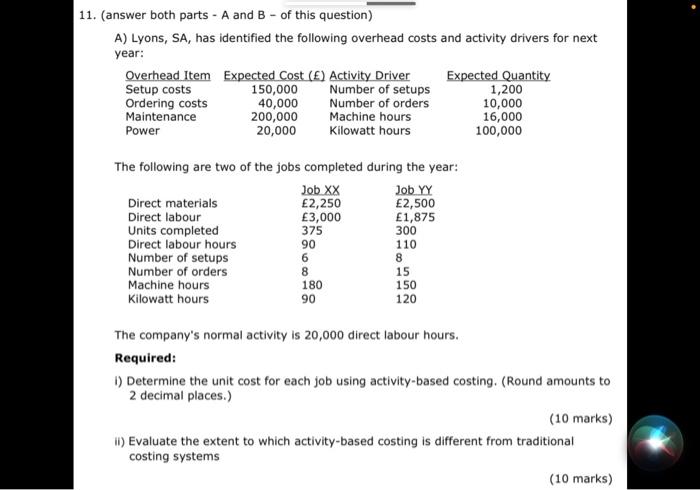

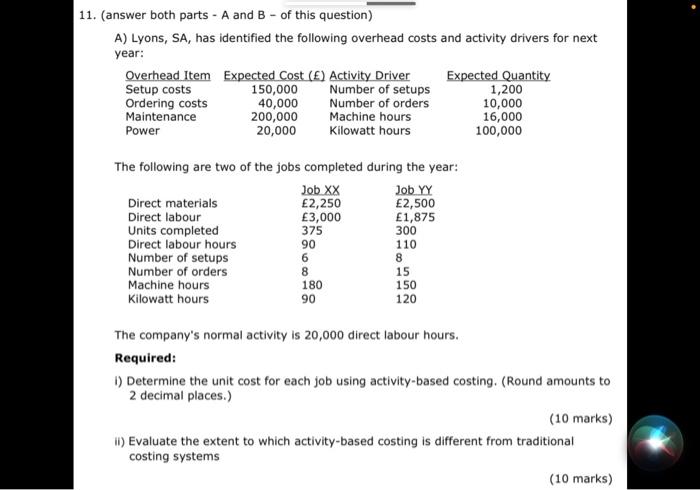

1. The following are two of the jobs completed during the year: Job XX Job YY Direct materials 2,250 2,500 Direct labour 3,000 1,875 Units completed 375 300 Direct labour hours 90 110 Number of setups 6 8 Number of orders 8 15 Machine hours 180 150 Kilowatt hours 90 120 The company's normal activity is 20,000 direct labour hours. Determine the unit cost for eachjob using activity-based costing, (Round amounts to 2 decimal places.) 11) 11) Evaluate the extent to which activity-based costing is different from traditional costing systems. O 11. (answer both parts - A and B - of this question) A) Lyons, SA, has identified the following overhead costs and activity drivers for next year: Overhead Item Expected Cost () Activity Driver Expected Quantity Setup costs 150,000 Number of setups 1,200 Ordering costs 40,000 Number of orders 10,000 Maintenance 200,000 Machine hours 16,000 Power 20,000 Kilowatt hours 100,000 The following are two of the jobs completed during the year: Job xx Job YY Direct materials 2,250 2,500 Direct labour 3,000 1,875 Units completed 375 300 Direct labour hours 90 110 Number of setups 6 8 Number of orders 8 15 Machine hours 180 150 Kilowatt hours 90 120 The company's normal activity is 20,000 direct labour hours. Required: D) Determine the unit cost for each job using activity-based costing. (Round amounts to 2 decimal places.) (10 marks) ) Evaluate the extent to which activity-based costing is different from traditional costing systems (10 marks)

1. The following are two of the jobs completed during the year: Job XX Job YY Direct materials 2,250 2,500 Direct labour 3,000 1,875 Units completed 375 300 Direct labour hours 90 110 Number of setups 6 8 Number of orders 8 15 Machine hours 180 150 Kilowatt hours 90 120 The company's normal activity is 20,000 direct labour hours. Determine the unit cost for eachjob using activity-based costing, (Round amounts to 2 decimal places.) 11) 11) Evaluate the extent to which activity-based costing is different from traditional costing systems. O 11. (answer both parts - A and B - of this question) A) Lyons, SA, has identified the following overhead costs and activity drivers for next year: Overhead Item Expected Cost () Activity Driver Expected Quantity Setup costs 150,000 Number of setups 1,200 Ordering costs 40,000 Number of orders 10,000 Maintenance 200,000 Machine hours 16,000 Power 20,000 Kilowatt hours 100,000 The following are two of the jobs completed during the year: Job xx Job YY Direct materials 2,250 2,500 Direct labour 3,000 1,875 Units completed 375 300 Direct labour hours 90 110 Number of setups 6 8 Number of orders 8 15 Machine hours 180 150 Kilowatt hours 90 120 The company's normal activity is 20,000 direct labour hours. Required: D) Determine the unit cost for each job using activity-based costing. (Round amounts to 2 decimal places.) (10 marks) ) Evaluate the extent to which activity-based costing is different from traditional costing systems (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started