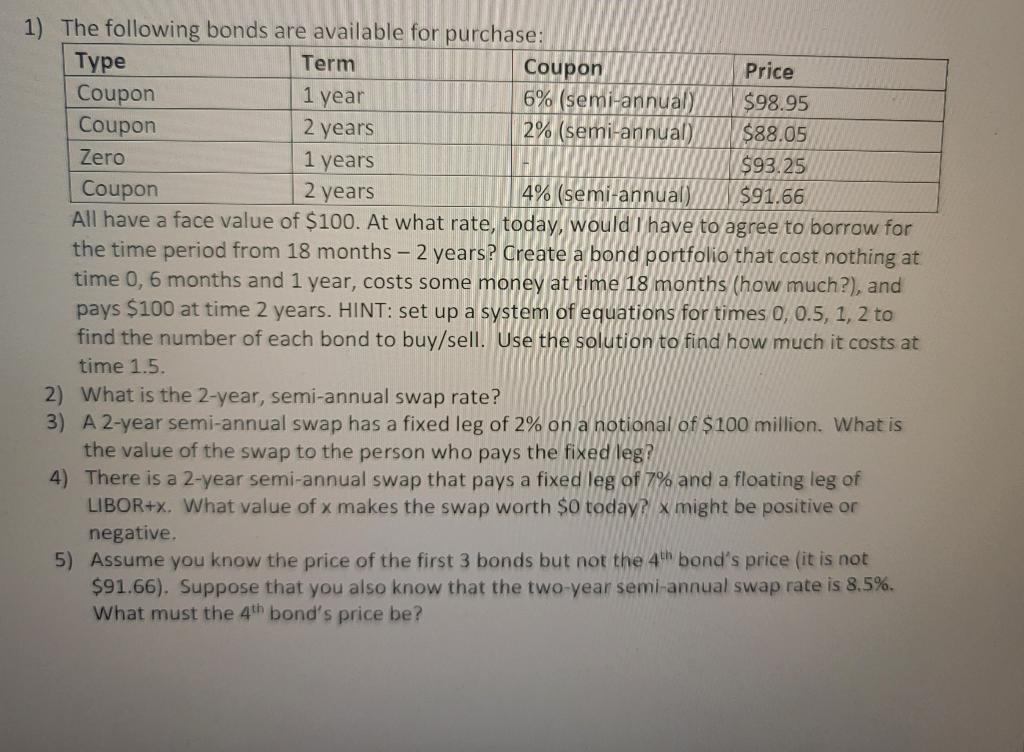

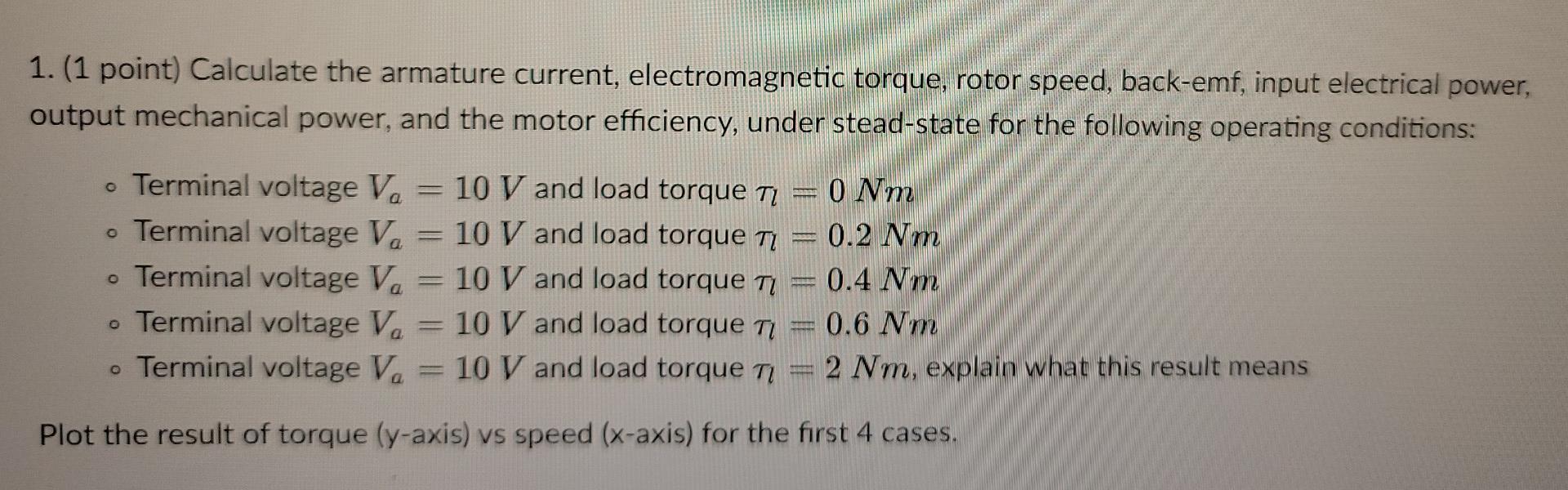

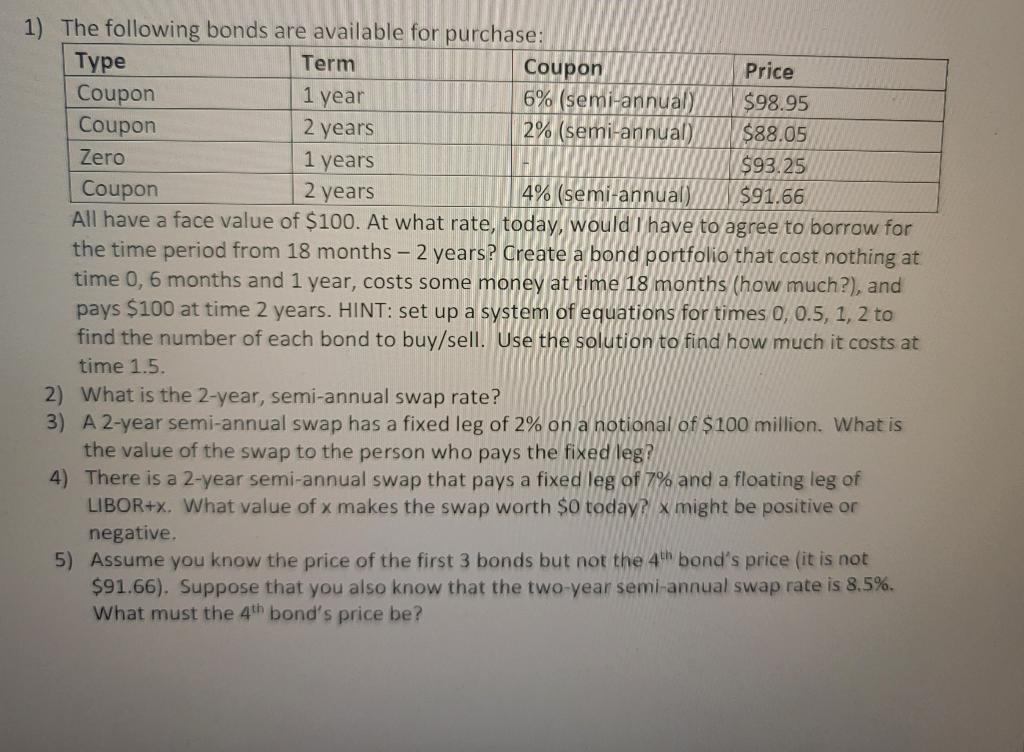

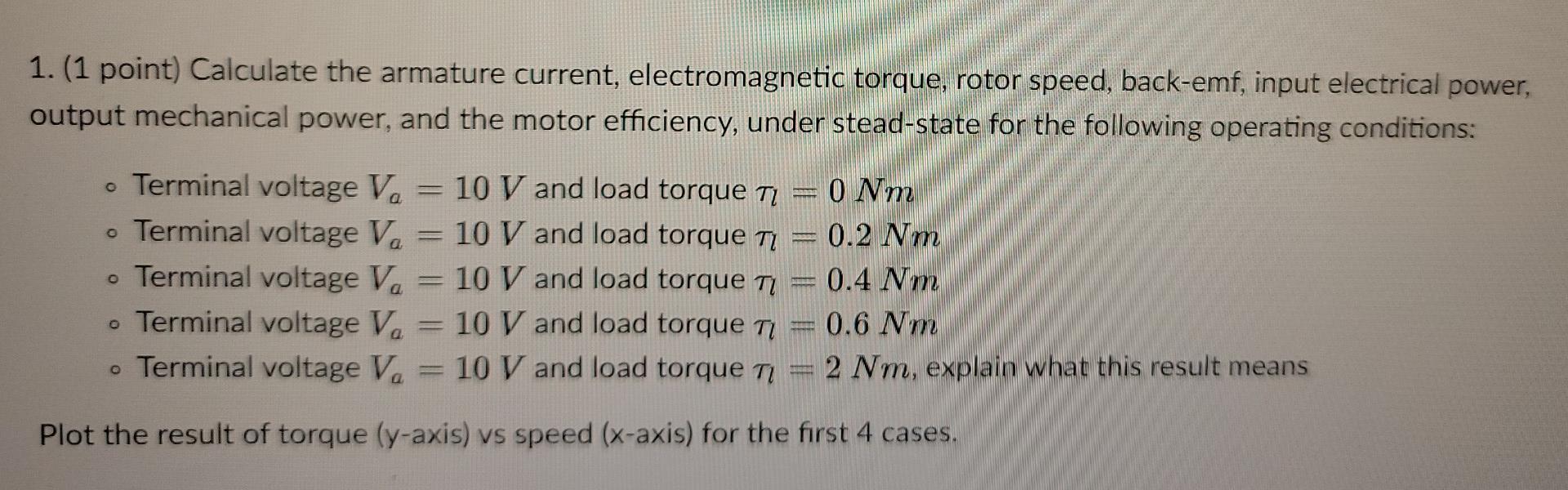

1) The following bonds are available for purchase: Type Term Coupon Price Coupon 1 year 6% (semi-annual) $98.95 Coupon 2 years 2% (semi-annual) $88.05 Zero 1 years $93.25 Coupon 2 years 4% (semi-annual) $91.66 All have a face value of $100. At what rate, today, would I have to agree to borrow for the time period from 18 months - 2 years? Create a bond portfolio that cost nothing at time 0, 6 months and 1 year, costs some money at time 18 months (how much?), and pays $100 at time 2 years. HINT: set up a system of equations for times 0, 0.5, 1, 2 to find the number of each bond to buy/sell. Use the solution to find how much it costs at time 1.5. 2) What is the 2-year, semi-annual swap rate? 3) A 2-year semi-annual swap has a fixed leg of 2% on a notional of $100 million. What is the value of the swap to the person who pays the fixed leg? 4) There is a 2-year semi-annual swap that pays a fixed leg of 7% and a floating leg of LIBOR+x. What value of x makes the swap worth $0 today? x might be positive or negative. 5) Assume you know the price of the first 3 bonds but not the 4th bond's price (it is not $91.66). Suppose that you also know that the two-year semi-annual swap rate is 8.5%. What must the 4th bond's price be? 1.(1 point) Calculate the armature current, electromagnetic torque, rotor speed, back-emf, input electrical power, output mechanical power, and the motor efficiency, under stead-state for the following operating conditions: . Terminal voltage V. . Terminal voltage V. . Terminal voltage Va . Terminal voltage Va . Terminal voltage V. 10 V and load torque ti 10 V and load torque TI 10 V and load torque ti 10 V and load torque Ti 10 V and load torque ni MERE 0 Nm 0.2 Nm 0.4 Nm 0.6 Nm 2 Nm, explain what this result means Plot the result of torque (y-axis) vs speed (x-axis) for the first 4 cases. 1) The following bonds are available for purchase: Type Term Coupon Price Coupon 1 year 6% (semi-annual) $98.95 Coupon 2 years 2% (semi-annual) $88.05 Zero 1 years $93.25 Coupon 2 years 4% (semi-annual) $91.66 All have a face value of $100. At what rate, today, would I have to agree to borrow for the time period from 18 months - 2 years? Create a bond portfolio that cost nothing at time 0, 6 months and 1 year, costs some money at time 18 months (how much?), and pays $100 at time 2 years. HINT: set up a system of equations for times 0, 0.5, 1, 2 to find the number of each bond to buy/sell. Use the solution to find how much it costs at time 1.5. 2) What is the 2-year, semi-annual swap rate? 3) A 2-year semi-annual swap has a fixed leg of 2% on a notional of $100 million. What is the value of the swap to the person who pays the fixed leg? 4) There is a 2-year semi-annual swap that pays a fixed leg of 7% and a floating leg of LIBOR+x. What value of x makes the swap worth $0 today? x might be positive or negative. 5) Assume you know the price of the first 3 bonds but not the 4th bond's price (it is not $91.66). Suppose that you also know that the two-year semi-annual swap rate is 8.5%. What must the 4th bond's price be? 1.(1 point) Calculate the armature current, electromagnetic torque, rotor speed, back-emf, input electrical power, output mechanical power, and the motor efficiency, under stead-state for the following operating conditions: . Terminal voltage V. . Terminal voltage V. . Terminal voltage Va . Terminal voltage Va . Terminal voltage V. 10 V and load torque ti 10 V and load torque TI 10 V and load torque ti 10 V and load torque Ti 10 V and load torque ni MERE 0 Nm 0.2 Nm 0.4 Nm 0.6 Nm 2 Nm, explain what this result means Plot the result of torque (y-axis) vs speed (x-axis) for the first 4 cases