Question

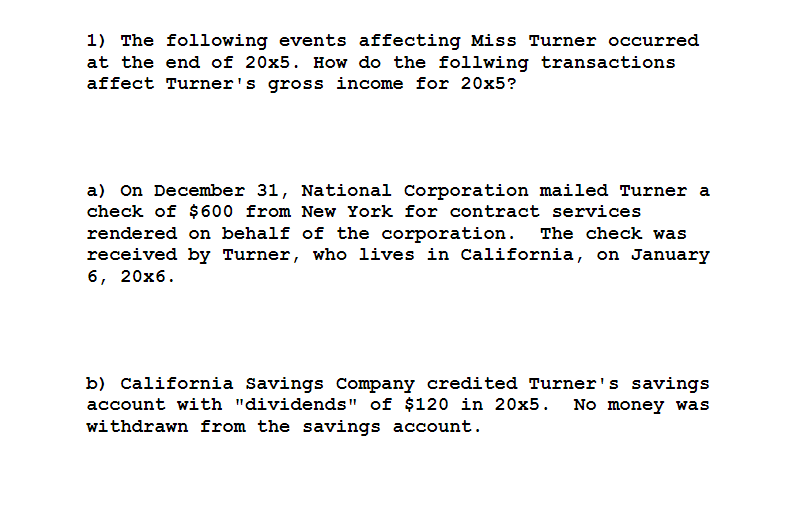

1) The following events affecting Miss Turner occurred at the end of 20x5. How do the follwing transactions affect Turner's gross income for 20x5?

1) The following events affecting Miss Turner occurred at the end of 20x5. How do the follwing transactions affect Turner's gross income for 20x5? a) On December 31, National Corporation mailed Turner a check of $600 from New York for contract services rendered on behalf of the corporation. The check was received by Turner, who lives in California, on January 6, 20x6. b) California Savings Company credited Turner's savings account with "dividends" of $120 in 20x5. No money was withdrawn from the savings account.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets delve deeper into each transaction and how it affects Miss Turners gross income for 20x5 a Nati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for business decision making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

6th Edition

978-1119191674, 047053477X, 111919167X, 978-0470534779

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App