Answered step by step

Verified Expert Solution

Question

1 Approved Answer

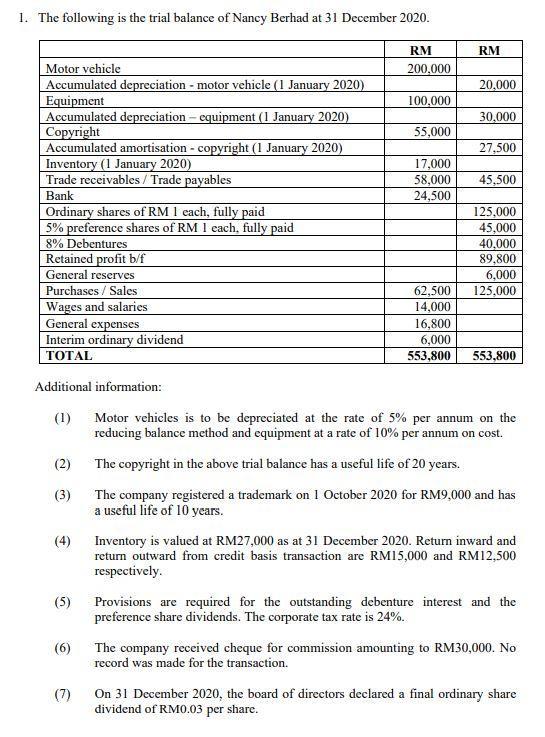

1. The following is the trial balance of Nancy Berhad at 31 December 2020. RM RM Motor vehicle Accumulated depreciation - motor vehicle (1

1. The following is the trial balance of Nancy Berhad at 31 December 2020. RM RM Motor vehicle Accumulated depreciation - motor vehicle (1 January 2020) Equipment Accumulated depreciation - equipment (1 January 2020) Copyright Accumulated amortisation - copyright (1 January 2020) Inventory (1 January 2020) Trade receivables / Trade payables Bank Ordinary shares of RM I each, fully paid 5% preference shares of RM 1 each, fully paid 8% Debentures Retained profit b/f 200,000 20,000 100,000 30,000 55,000 27,500 17,000 58,000 24,500 45,500 125,000 45.000 40,000 89,800 General reserves Purchases / Sales Wages and salaries General expenses Interim ordinary dividend AL 6,000 62,500 14,000 125,000 16,800 6,000 553,800 553,800 Additional information: Motor vehicles is to be depreciated at the rate of 5% per annum on the reducing balance method and equipment at a rate of 10% per annum on cost. (1) (2) The copyright in the above trial balance has a useful life of 20 years. (3) The company registered a trademark on 1 October 2020 for RM9,000 and has a useful life of 10 years. (4) Inventory is valued at RM27,000 as at 31 December 2020. Return inward and return outward from credit basis transaction are RM15,000 and RM12,500 respectively. (5) Provisions are required for the outstanding debenture interest and the preference share dividends. The corporate tax rate is 24%. The company received cheque for commission amounting to RM30,000. No record was made for the transaction. (6) On 31 December 2020, the board of directors declared a final ordinary share dividend of RMO.03 per share. (7) (8) Transfer to general reserves amounting RM 8,000. Provision is to be made for taxation on the current year's profit amounting to (9) RM12,500 and provision for deferred taxation amounting to RM5,525. Required: Prepare the following statements using vertical format presentation: (a) Statement of Profit or Loss for the year ended 31 December 2020. (b) Statement of Financial Position as at 31 December 2020.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

clASSMAte Date Page Working Notes 12 year depreciat ion of Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started