Answered step by step

Verified Expert Solution

Question

1 Approved Answer

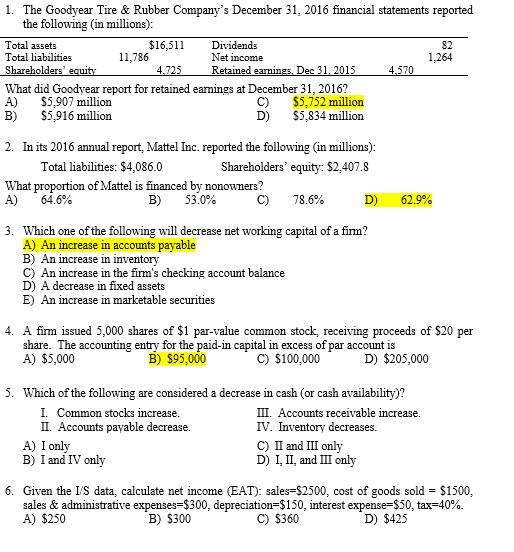

1. The Goodyear Tire & Rubber Company's December 31, 2016 financial statements reported the following (in millions): $16,511 Dividends Net income Shareholders' equity 4.725

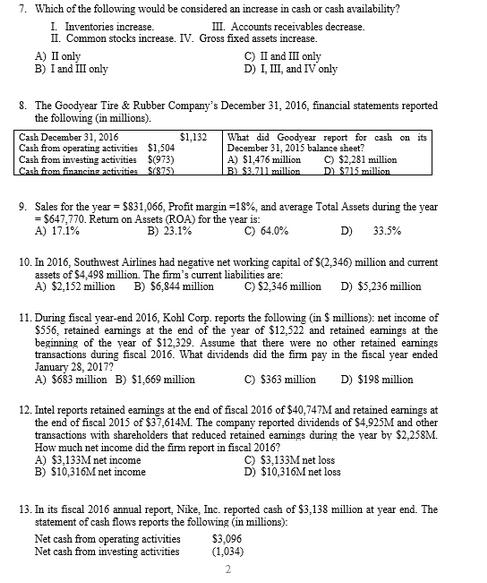

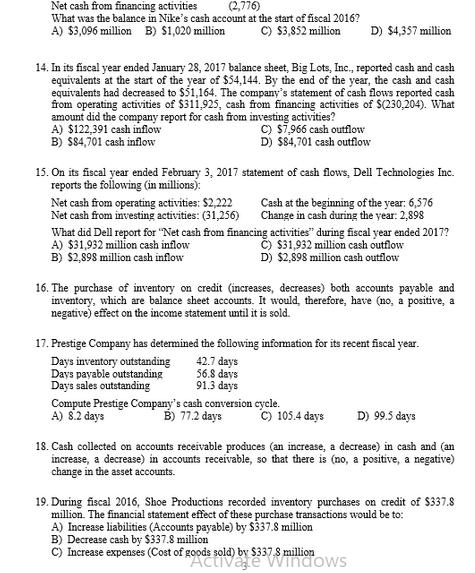

1. The Goodyear Tire & Rubber Company's December 31, 2016 financial statements reported the following (in millions): $16,511 Dividends Net income Shareholders' equity 4.725 Retained earnings. Dec 31, 2015 What did Goodyear report for retained earnings at December 31, 2016? A) $5,907 million C) $5,752 million B) $5,916 million D) $5,834 million Total assets Total liabilities 11,786 2. In its 2016 annual report, Mattel Inc. reported the following (in millions): Total liabilities: $4,086.0 Shareholders' equity: $2,407.8 C) 78.6% 3. Which one of the following will decrease net working capital of a firm? A) An increase in accounts payable What proportion of Mattel is financed by nonowners? 64.6% B) 53.0% A) B) An increase in inventory C) An increase in the firm's checking account balance D) A decrease in fixed assets E) An increase in marketable securities A) I only B) I and IV only 4.570 4. A firm issued 5,000 shares of $1 par-value common stock, receiving proceeds of $20 per share. The accounting entry for the paid-in capital in excess of par account is A) $5,000 B) $95,000 C) $100,000 D) $205,000 5. Which of the following are considered a decrease in cash (or cash availability)? I. Common stocks increase. II. Accounts payable decrease. D) 62.9% C) II and III only D) I, II, and III only 82 1,264 III. Accounts receivable increase. IV. Inventory decreases. = $1500, 6. Given the I/S data, calculate net income (EAT): sales-$2500, cost of goods sold = sales & administrative expenses-$300, depreciation-$150, interest expense-$50, tax=40%. A) $250 B) $300 C) $360 D) $425 7. Which of the following would be considered an increase in cash or cash availability? I. Inventories increase. III. Accounts receivables decrease. II. Common stocks increase. IV. Gross fixed assets increase. A) II only B) I and III only 8. The Goodyear Tire & Rubber Company's December 31, 2016, financial statements reported the following (in millions). Cash December 31, 2016 Cash from operating activities $1,504 Cash from investing activities $(973) Cash from financing activities $(875) $1,132 C) II and III only D) I, III, and IV only What did Goodyear report for cash on its December 31, 2015 balance sheet? C) $2,281 million D) $715 million 9. Sales for the year = $831,066, Profit margin =18%, and average Total Assets during the year = $647,770. Return on Assets (ROA) for the year is: A) 17.1% B) 23.1% C) 64.0% D) 33.5% A) $3,133M net income B) $10,316M net income A) $1,476 million B) $3.711 million 10. In 2016, Southwest Airlines had negative net working capital of $(2,346) million and current assets of $4,498 million. The firm's current liabilities are: A) $2,152 million B) $6,844 million C) $2,346 million D) $5,236 million 11. During fiscal year-end 2016, Kohl Corp. reports the following (in $ millions): net income of $556, retained earnings at the end of the year of $12,522 and retained earnings at the beginning of the year of $12,329. Assume that there were no other retained earnings transactions during fiscal 2016. What dividends did the firm pay in the fiscal year ended January 28, 2017? C) $363 million D) $198 million A) $683 million B) $1,669 million 12. Intel reports retained earnings at the end of fiscal 2016 of $40,747M and retained earnings at the end of fiscal 2015 of $37,614M. The company reported dividends of $4,925M and other transactions with shareholders that reduced retained earnings during the year by $2,258M. How much net income did the firm report in fiscal 2016? Net cash from operating activities Net cash from investing activities C) $3,133M net loss D) $10,316M net loss 13. In its fiscal 2016 annual report, Nike, Inc. reported cash of $3,138 million at year end. The statement of cash flows reports the following (in millions): $3,096 (1,034) 2 Net cash from financing activities (2,776) What was the balance in Nike's cash account at the start of fiscal 2016? A) $3,096 million B) $1,020 million C) $3,852 million 14. In its fiscal year ended January 28, 2017 balance sheet, Big Lots, Inc., reported cash and cash equivalents at the start of the year of $54,144. By the end of the year, the cash and cash equivalents had decreased to $51,164. The company's statement of cash flows reported cash from operating activities of $311,925, cash from financing activities of $(230,204). What amount did the company report for cash from investing activities? A) $122,391 cash inflow C) $7,966 cash outflow D) $84,701 cash outflow B) $84,701 cash inflow 15. On its fiscal year ended February 3, 2017 statement of cash flows, Dell Technologies Inc. reports the following (in millions): Net cash from operating activities: $2,222 Net cash from investing activities: (31,256) D) $4,357 million Cash at the beginning of the year: 6,576 Change in cash during the year: 2,898 What did Dell report for "Net cash from financing activities" during fiscal year ended 2017? A) $31,932 million cash inflow B) $2,898 million cash inflow C) $31,932 million cash outflow D) $2,898 million cash outflow 16. The purchase of inventory on credit (increases, decreases) both accounts payable and inventory, which are balance sheet accounts. It would, therefore, have (no, a positive, a negative) effect on the income statement until it is sold. Days inventory outstanding Days payable outstanding Day's sales outstanding 17. Prestige Company has determined the following information for its recent fiscal year. 42.7 days 56.8 days 91.3 days Compute Prestige Company's cash conversion cycle. A) 8.2 days B) 77.2 days C) 105.4 days D) 99.5 days 18. Cash collected on accounts receivable produces (an increase, a decrease) in cash and (an increase, a decrease) in accounts receivable, so that there is (no, a positive, a negative) change in the asset accounts. 19. During fiscal 2016, Shoe Productions recorded inventory purchases on credit of $337.8 million. The financial statement effect of these purchase transactions would be to: A) Increase liabilities (Accounts payable) by $337.8 million B) Decrease cash by $337.8 million C) Increase expenses (Cost of goods told) by $337,8 million Windows

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Retained Earnings at December 31 2016 for Goodyear Retained earnings at Dec 31 2015 4570 million Net Income 1264 million Dividends 82 million Retained Earnings at Dec 31 2016 Retained Earnings at De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started