Answered step by step

Verified Expert Solution

Question

1 Approved Answer

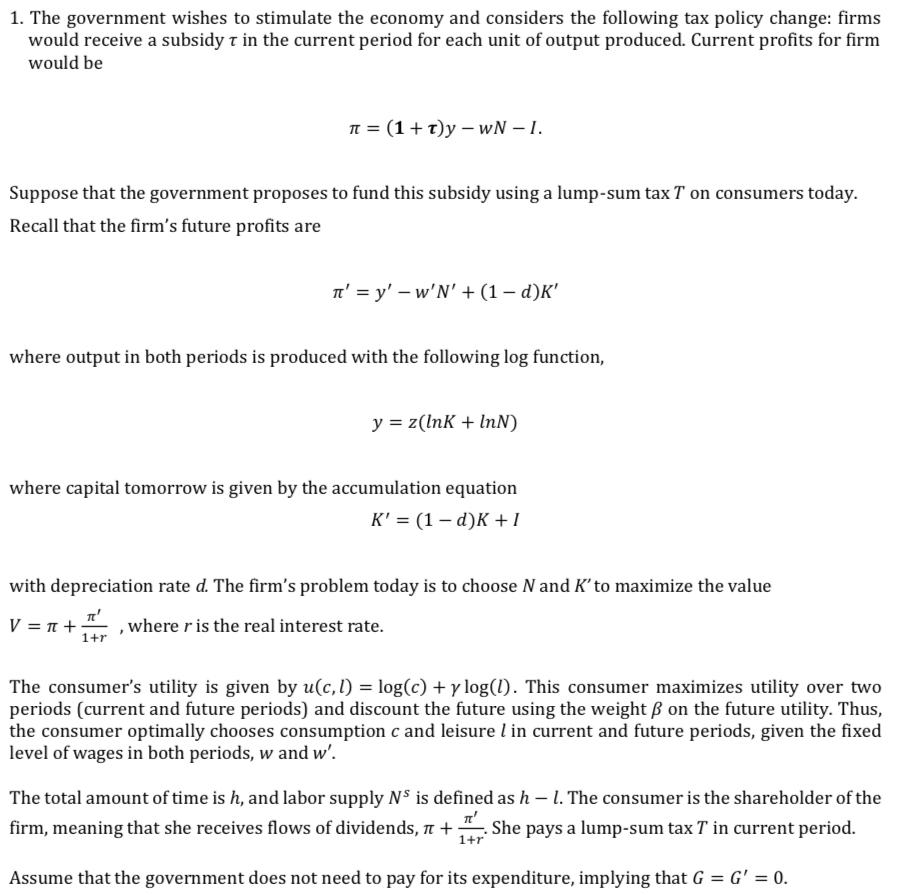

1. The government wishes to stimulate the economy and considers the following tax policy change: firms would receive a subsidy 7 in the current

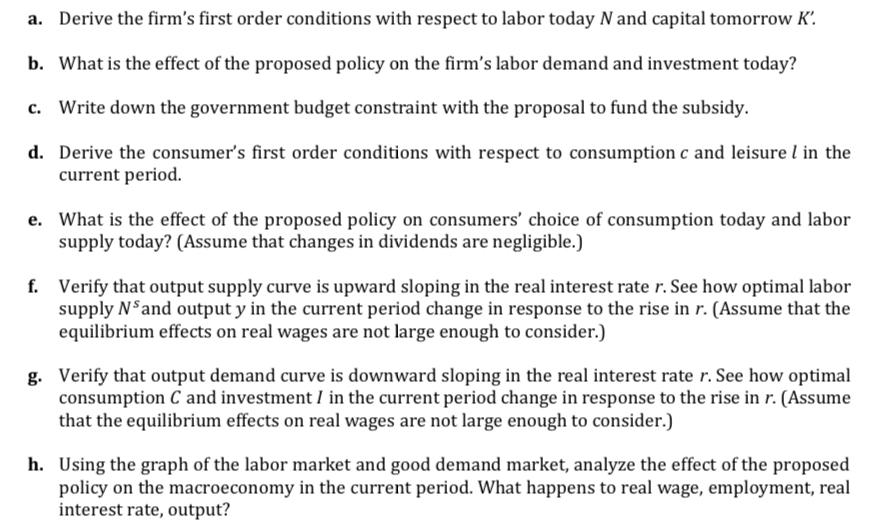

1. The government wishes to stimulate the economy and considers the following tax policy change: firms would receive a subsidy 7 in the current period for each unit of output produced. Current profits for firm would be = (1 + r)y - wWN - I. Suppose that the government proposes to fund this subsidy using a lump-sum tax T on consumers today. Recall that the firm's future profits are ' = y' - w'N' + (1 - d)K' where output in both periods is produced with the following log function, 1+r y = z(Ink + InN) where capital tomorrow is given by the accumulation equation K' (1-d)K+I with depreciation rate d. The firm's problem today is to choose N and K' to maximize the value V = n + where r is the real interest rate. The consumer's utility is given by u(c, l) = log(c) + y log(1). This consumer maximizes utility over two periods (current and future periods) and discount the future using the weight on the future utility. Thus, the consumer optimally chooses consumption c and leisure l in current and future periods, given the fixed level of wages in both periods, w and w'. The total amount of time is h, and labor supply NS is defined as h - 1. The consumer is the shareholder of the firm, meaning that she receives flows of dividends, + She pays a lump-sum tax T in current period. 1+r Assume that the government does not need to pay for its expenditure, implying that G = G' = 0. a. Derive the firm's first order conditions with respect to labor today N and capital tomorrow K'. b. What is the effect of the proposed policy on the firm's labor demand and investment today? c. Write down the government budget constraint with the proposal to fund the subsidy. d. Derive the consumer's first order conditions with respect to consumption c and leisure I in the current period. e. What is the effect of the proposed policy on consumers' choice of consumption today and labor supply today? (Assume that changes in dividends are negligible.) f. Verify that output supply curve is upward sloping in the real interest rate r. See how optimal labor supply Ns and output y in the current period change in response to the rise in r. (Assume that the equilibrium effects on real wages are not large enough to consider.) g. Verify that output demand curve is downward sloping in the real interest rate r. See how optimal consumption C and investment I in the current period change in response to the rise in r. (Assume that the equilibrium effects on real wages are not large enough to consider.) h. Using the graph of the labor market and good demand market, analyze the effect of the proposed policy on the macroeconomy in the current period. What happens to real wage, employment, real interest rate, output?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Deriving the Firms FirstOrder Conditions To maximize the value V 1r where represents current profits and represents future profits we need to take the firstorder conditions with respect to labor tod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started