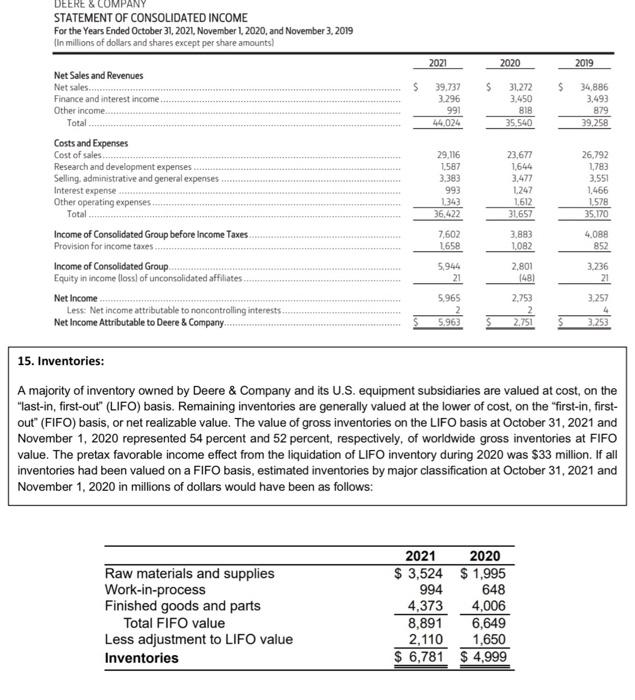

1. The income statement for fiscal years ended October 31, 2021, November 1, 2020, and November 3, 2019, of the Deere \& Company is attached below. Deere \& Co also provides a disclosure note regarding its inventory valuation. Please use the information to answer the following questions. a. What will be the company's "Cost of sales" and "Income of Consolidated Group before Income Taxes" for the fiscal year ended October 31, 2021, had it used FIFO to account for all of its inventories? "Income of Consolidated Group before Income Taxes" is essentially Deere's Income Before Taxes (1 point). b. How much income taxes that the firm was able to defer in 2021 by using LIFO to account for its inventories? Assume that the firm's tax rate is 22%. ( 0.5 point). c. Assume that the firm's tax rate is 22%, as of October 31,2021 , what is the firm's cumulative tax savings by using LIFO instead of solely using FIFO? ( 0.5 point). STATEMENT OF CONSOLIDATED INCOME For the Years Ended October 31, 2021, November 1, 2020, and November 3, 2019 (In millions of dollars and shares except per share amounts) 15. Inventories: A majority of inventory owned by Deere \& Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, firstout" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 31, 2021 and November 1,2020 represented 54 percent and 52 percent, respectively, of worldwide gross inventories at FIFO value. The pretax favorable income effect from the liquidation of LIFO inventory during 2020 was $33 million. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31, 2021 and November 1, 2020 in millions of dollars would have been as follows: 1. The income statement for fiscal years ended October 31, 2021, November 1, 2020, and November 3, 2019, of the Deere \& Company is attached below. Deere \& Co also provides a disclosure note regarding its inventory valuation. Please use the information to answer the following questions. a. What will be the company's "Cost of sales" and "Income of Consolidated Group before Income Taxes" for the fiscal year ended October 31, 2021, had it used FIFO to account for all of its inventories? "Income of Consolidated Group before Income Taxes" is essentially Deere's Income Before Taxes (1 point). b. How much income taxes that the firm was able to defer in 2021 by using LIFO to account for its inventories? Assume that the firm's tax rate is 22%. ( 0.5 point). c. Assume that the firm's tax rate is 22%, as of October 31,2021 , what is the firm's cumulative tax savings by using LIFO instead of solely using FIFO? ( 0.5 point). STATEMENT OF CONSOLIDATED INCOME For the Years Ended October 31, 2021, November 1, 2020, and November 3, 2019 (In millions of dollars and shares except per share amounts) 15. Inventories: A majority of inventory owned by Deere \& Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, firstout" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 31, 2021 and November 1,2020 represented 54 percent and 52 percent, respectively, of worldwide gross inventories at FIFO value. The pretax favorable income effect from the liquidation of LIFO inventory during 2020 was $33 million. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 31, 2021 and November 1, 2020 in millions of dollars would have been as follows