Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The machinery falls into the MACRS 3-year class. (The depreciation rates for Year 1 through Year 4 are equal to 0.3333,0.4445,0.1481, and 0.0741 .)

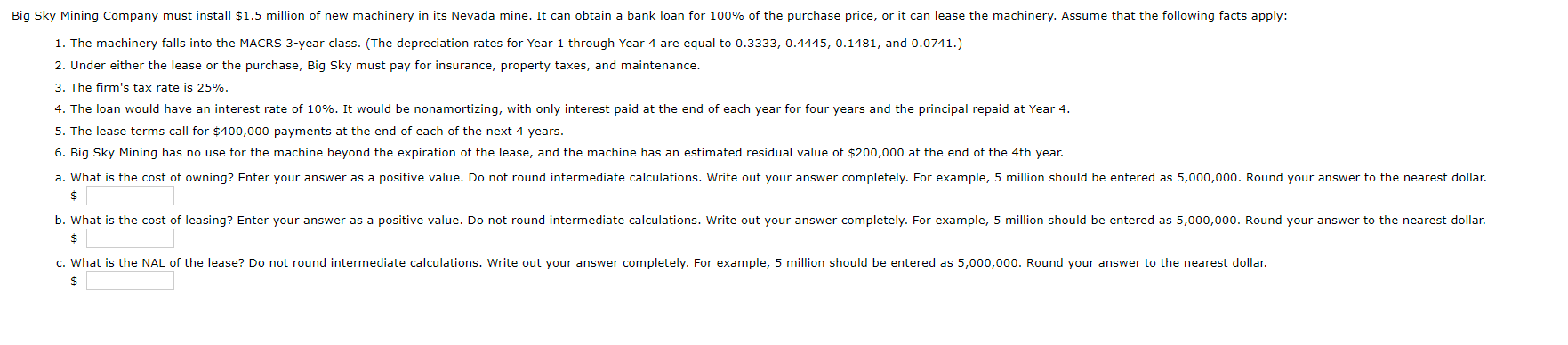

1. The machinery falls into the MACRS 3-year class. (The depreciation rates for Year 1 through Year 4 are equal to 0.3333,0.4445,0.1481, and 0.0741 .) 2. Under either the lease or the purchase, Big Sky must pay for insurance, property taxes, and maintenance. 3. The firm's tax rate is 25%. 4. The loan would have an interest rate of 10%. It would be nonamortizing, with only interest paid at the end of each year for four years and the principal repaid at Year 4 . 5. The lease terms call for $400,000 payments at the end of each of the next 4 years. 6. Big Sky Mining has no use for the machine beyond the expiration of the lease, and the machine has an estimated residual value of $200,000 at the end of the 4 th year. \$ $ \$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started