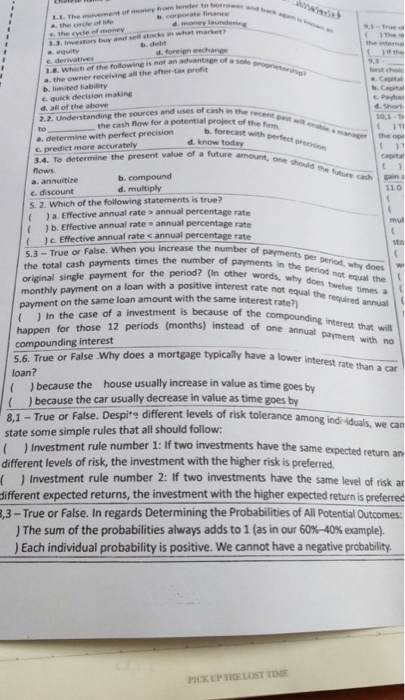

1... The movement of money from lender to b corporate finance 9.3-Tre 1.3. Irvestors buy and sell stocks an what b. debt a equity d, foreign exchange 1.8. Which of the following is not an advantage of a so a. the owner receiving all the after-tax profit a Capital b, Capita b. limited Rability quick decision making d, all od the above f 2.2. Understanding the sources and uses of cash in the 10,1-T the cash fnow for a potential project of the IT the to b. forecast with perfece .. a. determine with perfect precision d. know today c. predict more accurately amount, one shol capital 3.4. To determine the present value of a future cash ain 11.0 a. annuitize d. multiply c. discount S. 2. Which of the following statements is true? ge rate a. Effective annual rate > annual percenta mul ( )b. Effective annual rate annual percentage rate ( rate ) C. Effective annual rates annual percentage 5.3- True or False. When you increase the number f ets in the period the total cash payments times the number of original single payment for the period? (In other monthly payment on a loan with a positive interest rate payment on the same loan amount with the period, why does\ words, why does twebve times a payments in the period not equal the interest rate not equal the required annual is because of the compounding interest that wil ( J in the case of a investment is because of thest rate) ods (months) instead of one annual payment with no compounding interest 5.6. True or False .Why does a mortgage typically have a lower loan? interest rate than a ) because the house usually increase in value as time goes by ) because the car usually decrease in value I Investment rule number 1: If two investments have the same expected return an Investment rule number 2: If two investments have the same level of risk ar ( as time goes different levels of risk tolerance among indi-iduals, we can 8,1-True or False. Despite state some simple rules that all should follow different levels of risk, the investment with the higher risk is preferred. different expected returns, the investment with the higher expected return is preferred ,3-True or False. In regards Determining the Probabilities of All Potential Outcomes ) The sum of the probabilities always adds to 1 (as in our 60%-40% example). Each individual probability is positive. We cannot have a negative probability PICK UP THE LOST TIME