Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 The net effect of issuing bonds at a discount is to increase the periodic interest expense over the life of the bonds through

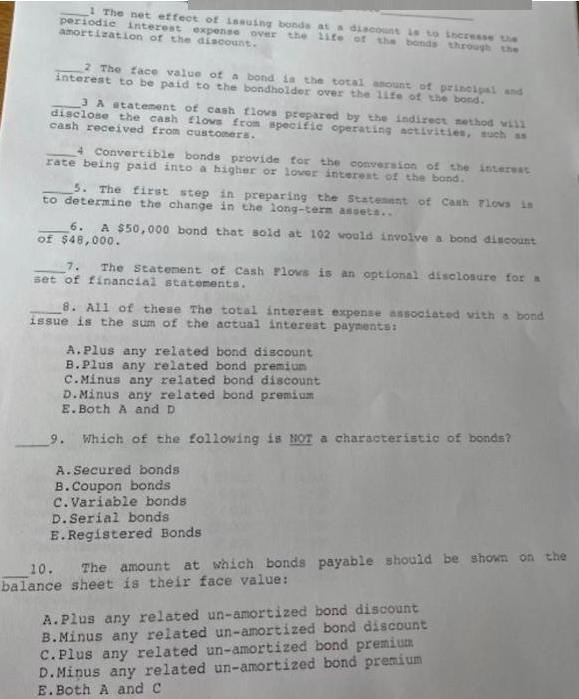

1 The net effect of issuing bonds at a discount is to increase the periodic interest expense over the life of the bonds through the amortization of the discount. 2 The face value of a bond is the total amount of principal and interest to be paid to the bondholder over the life of the bond. 3A statement of cash flows prepared by the indirect method will disclose the cash flows from specific operating activities, such as cash received from customers. 4 Convertible bonds provide for the conversion of the interest rate being paid into a higher or lover interest of the bond. 5. The first step in preparing the Statement of Cash Flows in to determine the change in the long-term assets.. 6. A $50,000 bond that sold at 102 would involve a bond discount of $48,000. The Statement of Cash Flows is an optional disclosure for a set of financial statements. 8. All of these The total interest expense associated with a bond issue is the sum of the actual interest payments: A. Plus any related bond discount B. Plus any related bond premium C.Minus any related bond discount D.Minus any related bond premium E. Both A and D 9. Which of the following is NOT a characteristic of bonds? A. Secured bonds B.Coupon bonds C. Variable bonds D. Serial bonds E. Registered Bonds 10. The amount at which bonds payable should be shown on the balance sheet is their face value: A.Plus any related un-amortized bond discount B.Minus any related un-amortized bond discount C. Plus any related un-amortized bond premium D.Minus any related un-amortized bond premium E. Both A and C

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer True Explanation The amount of Bond discount amortized to interest expense over the life of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started