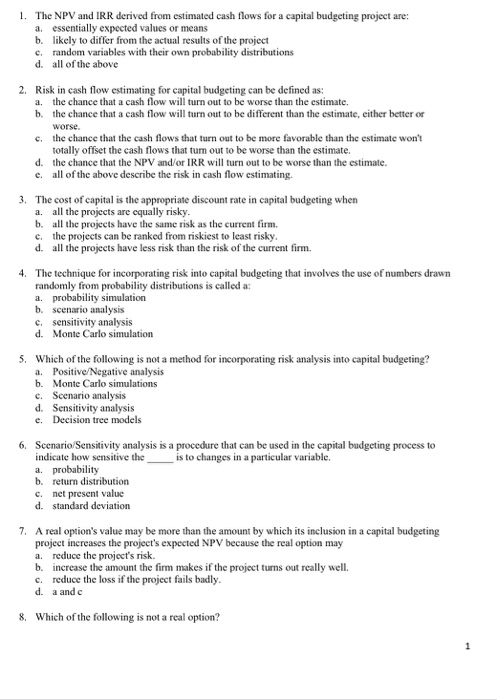

1. The NPV and IRR derived from estimated cash flows for a capital budgeting project are: a. essentially expected values or means b. likely to differ from the actual results of the project c. random variables with their own probability distributions d. all of the above 2. Risk in cash flow estimating for capital budgeting can be defined as: a. the chance that a cash flow will turn out to be worse than the estimate. b. the chance that a cash flow will turn out to be different than the estimate, either better or worse c. the chance that the cash flows that turn out to be more favorable than the estimate won't totally offset the cash flows that turn out to be worse than the estimate. d. the chance that the NPV and/or IRR will turn out to be worse than the estimate. c. all of the above describe the risk in cash flow estimating. 3. The cost of capital is the appropriate discount rate in capital budgeting when a. all the projects are equally risky. b. all the projects have the same risk as the current firm. c. the projects can be ranked from riskiest to least risky. d. all the projects have less risk than the risk of the current firm. 4. The technique for incorporating risk into capital budgeting that involves the use of numbers drawn randomly from probability distributions is called a a probability simulation b. scenario analysis c. sensitivity analysis d. Monte Carlo simulation 5. Which of the following is not a method for incorporating risk analysis into capital budgeting? a Positive/Negative analysis b. Monte Carlo simulations c. Scenario analysis d. Sensitivity analysis e Decision tree models 6. Scenario/Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the is to changes in a particular variable. a probability b. return distribution c.net present value d. standard deviation 7. A real option's value may be more than the amount by which its inclusion in a capital budgeting project increases the project's expected NPV because the real option may a. reduce the project's risk. b. increase the amount the firm makes if the project turns out really well. C. reduce the loss if the project fails badly. d. a and 8. Which of the following is not a real option