Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The Oakland Bombers professional basketball team just missed making the playoffs last sea- son and believes it needs to sign only one very

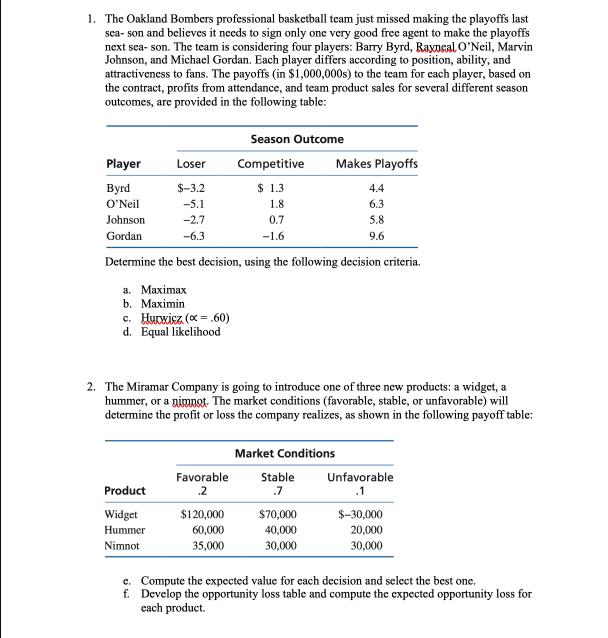

1. The Oakland Bombers professional basketball team just missed making the playoffs last sea- son and believes it needs to sign only one very good free agent to make the playoffs next season. The team is considering four players: Barry Byrd, Raxocal O'Neil, Marvin Johnson, and Michael Gordan. Each player differs according to position, ability, and attractiveness to fans. The payoffs (in $1,000,000s) to the team for each player, based on the contract, profits from attendance, and team product sales for several different season outcomes, are provided in the following table: Season Outcome Player Loser Competitive Byrd $-3.2 $ 1.3 O'Neil -5.1 1.8 Johnson -2.7 0.7 Gordan -6.3 -1.6 Makes Playoffs 4.4 6.3 5.8 9.6 Determine the best decision, using the following decision criteria. a. Maximax b. Maximin c. Hurwicz (x = .60) d. Equal likelihood 2. The Miramar Company is going to introduce one of three new products: a widget, a hummer, or a nimnot. The market conditions (favorable, stable, or unfavorable) will determine the profit or loss the company realizes, as shown in the following payoff table: Market Conditions Favorable Product .2 Stable .7 Unfavorable .1 Widget Hummer $120,000 $70,000 $-30,000 60,000 40,000 20,000 Nimnot 35,000 30,000 30,000 e. Compute the expected value for each decision and select the best one. f. Develop the opportunity loss table and compute the expected opportunity loss for each product. g. Determine how much the firm would be willing to pay to a market research firm to gain better information about future market conditions. 3. The Miramar Company in Problem 2 is considering contracting with a market research firm to do a survey to determine future market conditions. The results of the survey will indicate either positive or negative market conditions. There is a .60 probability of a positive report, given favorable conditions; a .30 probability of a positive report, given stable conditions; and a .10 probability of a positive report, given unfavorable conditions. There is a .90 probability of a negative report, given unfavorable conditions; a .70 probability, given stable conditions; and a .40 probability, given favorable conditions. Using decision tree analysis and posterior probability tables, determine the decision strategy the company should follow, the expected value of the strategy, and the maximum amount the company should pay the market research firm for the survey results. 4. Labran Jones has played for the Cleveland professional basketball team for the past eight seasons and has established himself as one of the top players in the league. He has recently become a free agent, meaning he can sign a new contract with Cleveland or sign a contract with any other team in the league. Cleveland has never seriously contended for a championship, and Labran is strongly considering moving to Miami, where he would have a better chance at a championship, or to New York, which is a bigger media market and would give him more financial opportunities and endorsements. All three teams are offering Labran a 6-year contract, but because of a salary cap rule, Miami can only offer Labran $110 million, while New York is offering $120 million and Cleveland $125 million. Odds makers give Miami a 70% chance of winning the champion- ship with Labran, while they give Cleveland a 40% chance and New York only a 10% chance. If Labran wins a championship, he will almost certainly finish his career with the team he wins it with. If that team is New York, he will sign a new contract after 6 years that with endorsements and financial deals is estimated to be worth around $500 million by the end of his career. However, if New York doesn't win a championship during his 6 years, he will either stay with New York for a career total of $200 million, or sign a new 4-year contract with a new team. If he signs with a new team, he assumes he will sign with a team good enough to give him a 50-50 chance of winning a championship but, because of his likely diminished abilities, he will have eventual earnings of only around $120 million if he wins a championship with his new team. However, if he doesn't win a championship, his eventual earnings would only be about $65 mil- lion. If he signs with Miami and Miami wins the championship, he will stay with the team and have eventual long-term earnings of $375 million, but if Miami doesn't win a championship, he will either stay with Miami for earnings of about $90 million or sign with a new team, with the same expected outcomes if he signs with a new team after playing in New York. If he re-signs with Cleveland and Cleveland wins a championship, his eventual earnings are expected to be $300 million by the end of his playing career, but if Cleveland doesn't win, he can stay with the team and expect eventual possible earnings of around $145 million or sign with a new team with the same expected outcomes if he signs with a new team after playing in New York and Miami. Using decision tree analysis, determine which team Labran should sign a new contract with and the expected value of his decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started