Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The Philippine Government imposed a new regulation on the use of E- Bicycles on main roads, where an individual ages 21 years old

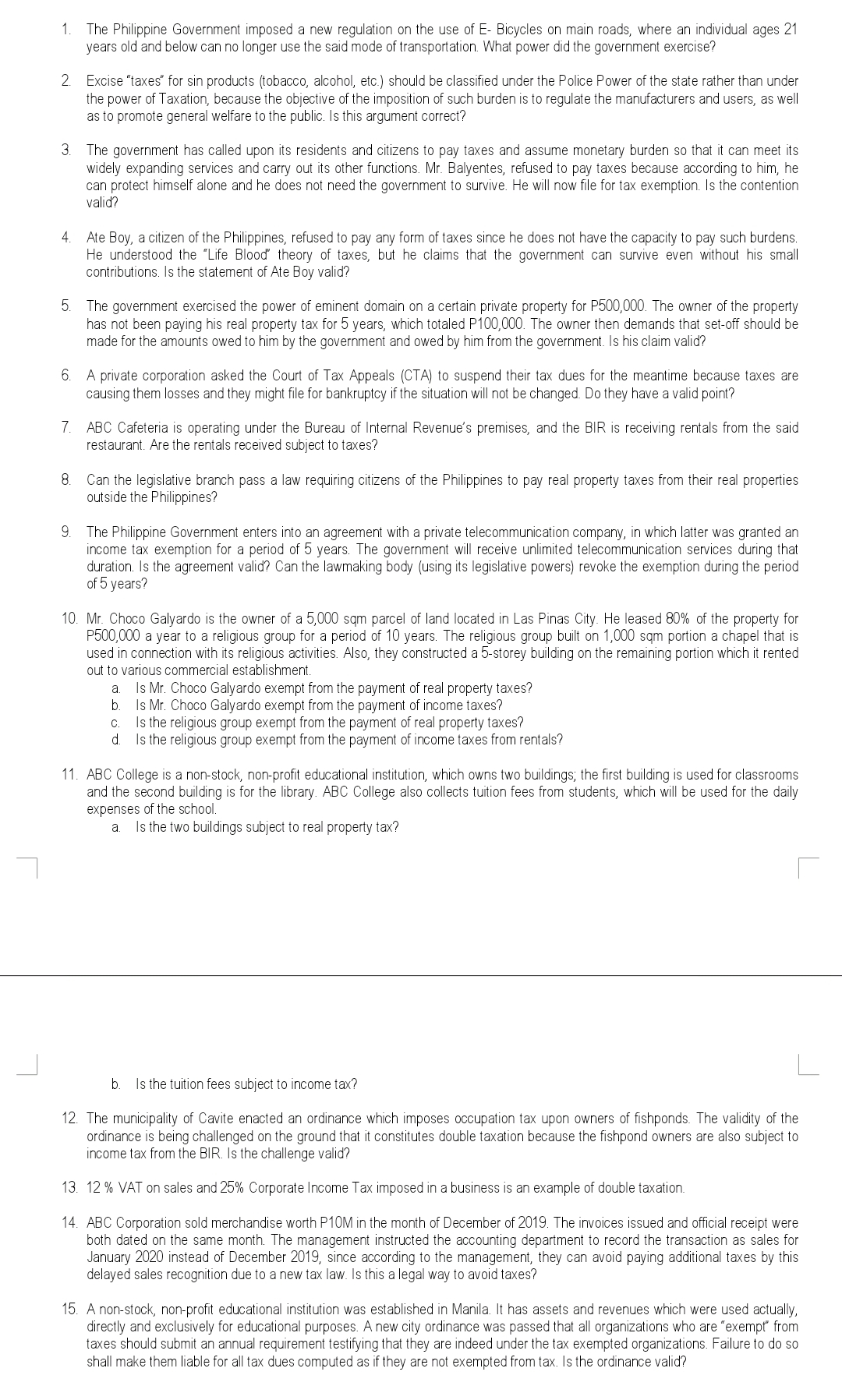

1. The Philippine Government imposed a new regulation on the use of E- Bicycles on main roads, where an individual ages 21 years old and below can no longer use the said mode of transportation. What power did the government exercise? 2. Excise "taxes" for sin products (tobacco, alcohol, etc.) should be classified under the Police Power of the state rather than under the power of Taxation, because the objective of the imposition of such burden is to regulate the manufacturers and users, as well as to promote general welfare to the public. Is this argument correct? 3. The government has called upon its residents and citizens to pay taxes and assume monetary burden so that it can meet its widely expanding services and carry out its other functions. Mr. Balyentes, refused to pay taxes because according to him, he can protect himself alone and he does not need the government to survive. He will now file for tax exemption. Is the contention valid? 4. Ate Boy, a citizen of the Philippines, refused to pay any form of taxes since he does not have the capacity to pay such burdens. He understood the "Life Blood" theory of taxes, but he claims that the government can survive even without his small contributions. Is the statement of Ate Boy valid? 5. The government exercised the power of eminent domain on a certain private property for P500,000. The owner of the property. has not been paying his real property tax for 5 years, which totaled P100,000. The owner then demands that set-off should be made for the amounts owed to him by the government and owed by him from the government. Is his claim valid? 6. A private corporation asked the Court of Tax Appeals (CTA) to suspend their tax dues for the meantime because taxes are causing them losses and they might file for bankruptcy if the situation will not be changed. Do they have a valid point? 7. ABC Cafeteria is operating under the Bureau of Internal Revenue's premises, and the BIR is receiving rentals from the said restaurant. Are the rentals received subject to taxes? 8. 9. Can the legislative branch pass a law requiring citizens of the Philippines to pay real property taxes from their real properties outside the Philippines? The Philippine Government enters into an agreement with a private telecommunication company, in which latter was granted an income tax exemption for a period of 5 years. The government will receive unlimited telecommunication services during that duration. Is the agreement valid? Can the lawmaking body (using its legislative powers) revoke the exemption during the period of 5 years? 10. Mr. Choco Galyardo is the owner of a 5,000 sqm parcel of land located in Las Pinas City. He leased 80% of the property for P500,000 a year to a religious group for a period of 10 years. The religious group built on 1,000 sqm portion a chapel that is used in connection with its religious activities. Also, they constructed a 5-storey building on the remaining portion which it rented out to various commercial establishment. a. Is Mr. Choco Galyardo exempt from the payment of real property taxes? b. Is Mr. Choco Galyardo exempt from the payment of income taxes? C Is the religious group exempt from the payment of real property taxes? d. Is the religious group exempt from the payment of income taxes from rentals? 11. ABC College is a non-stock, non-profit educational institution, which owns two buildings; the first building is used for classrooms and the second building is for the library. ABC College also collects tuition fees from students, which will be used for the daily expenses of the school. a. Is the two buildings subject to real property tax? b. Is the tuition fees subject to income tax? 12. The municipality of Cavite enacted an ordinance which imposes occupation tax upon owners of fishponds. The validity of the ordinance is being challenged on the ground that it constitutes double taxation because the fishpond owners are also subject to income tax from the BIR. Is the challenge valid? 13. 12% VAT on sales and 25% Corporate Income Tax imposed in a business is an example of double taxation. 14. ABC Corporation sold merchandise worth P10M in the month of December of 2019. The invoices issued and official receipt were both dated on the same month. The management instructed the accounting department to record the transaction as sales for January 2020 instead of December 2019, since according to the management, they can avoid paying additional taxes by this delayed sales recognition due to a new tax law. Is this a legal way to avoid taxes? 15. A non-stock, non-profit educational institution was established in Manila. It has assets and revenues which were used actually, directly and exclusively for educational purposes. A new city ordinance was passed that all organizations who are "exempt" from taxes should submit an annual requirement testifying that they are indeed under the tax exempted organizations. Failure to do so shall make them liable for all tax dues computed as if they are not exempted from tax. Is the ordinance valid?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 The government exercised its Police Power by imposing a regulation restricting the use of EBicycles on main roads for individuals aged 21 years old and below Police Power allows the governmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started