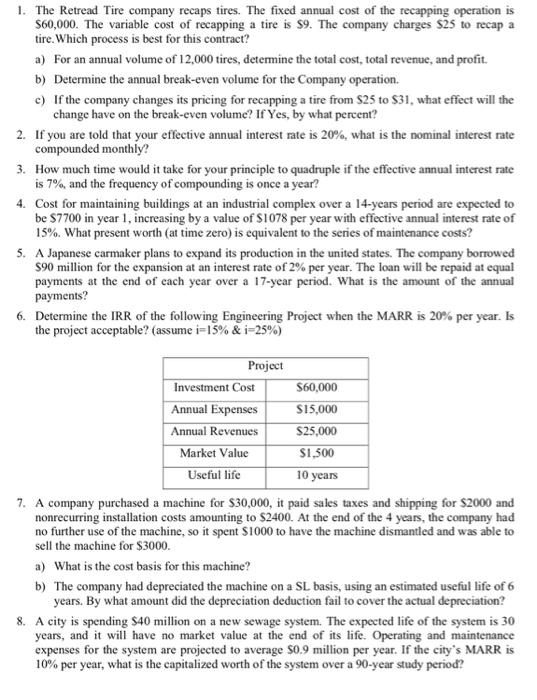

1. The Retread Tire company recaps tires. The fixed annual cost of the recapping operation is $60,000. The variable cost of recapping a tire is $9. The company charges s25 to recap a tire. Which process is best for this contract? a) For an annual volume of 12,000 tires, determine the total cost, total revenue, and profit. b) Determine the annual break-even volume for the Company operation. c) If the company changes its pricing for recapping a tire from $25 to $31, what effect will the change have on the break-even volume? If Yes, by what percent? 2. If you are told that your effective annual interest rate is 20%, what is the nominal interest rate compounded monthly? 3. How much time would it take for your principle to quadruple if the effective annual interest rate is 7%, and the frequency of compounding is once a year? 4. Cost for maintaining buildings at an industrial complex over a 14-years period are expected to be $7700 in year 1, increasing by a value of S1078 per year with effective annual interest rate of 15%. What present worth (at time zero) is equivalent to the series of maintenance costs? 5. A Japanese carmaker plans to expand its production in the united states. The company borrowed $90 million for the expansion at an interest rate of 2% per year. The loan will be repaid at equal payments at the end of each year over a 17-year period. What is the amount of the annual payments? 6. Determine the IRR of the following Engineering Project when the MARR is 20% per year. Is the project acceptable? (assume i=15% & i=25%) Project Investment Cost $60,000 Annual Expenses $15,000 Annual Revenues $25,000 Market Value $1,500 Useful life 10 years 7. A company purchased a machine for $30,000, it paid sales taxes and shipping for $2000 and nonrecurring installation costs amounting to $2400. At the end of the 4 years, the company had no further use of the machine, so it spent $1000 to have the machine dismantled and was able to sell the machine for $3000. a) What is the cost basis for this machine? b) The company had depreciated the machine on a SL basis, using an estimated useful life of 6 years. By what amount did the depreciation deduction fail to cover the actual depreciation? 8. A city is spending 540 million on a new sewage system. The expected life of the system is 30 years, and it will have no market value at the end of its life. Operating and maintenance expenses for the system are projected to average 80.9 million per year. If the city's MARR is 10% per year, what is the capitalized worth of the system over a 90-year study period