Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 The Robo Division, a decentralized division of GMT Industries, has been approached to submit a bid for a potential project for the RSP

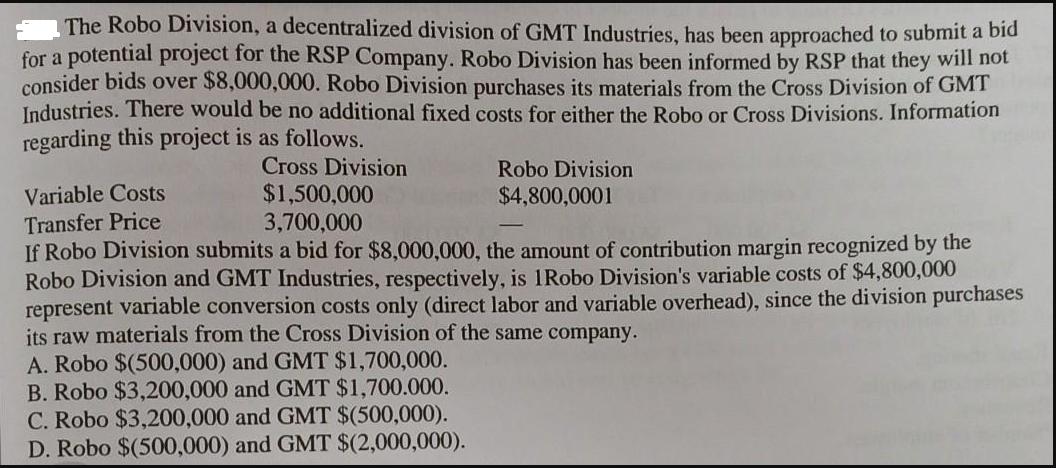

1 The Robo Division, a decentralized division of GMT Industries, has been approached to submit a bid for a potential project for the RSP Company. Robo Division has been informed by RSP that they will not consider bids over $8,000,000. Robo Division purchases its materials from the Cross Division of GMT Industries. There would be no additional fixed costs for either the Robo or Cross Divisions. Information regarding this project is as follows. Cross Division $1,500,000 Variable Costs Transfer Price 3,700,000 If Robo Division submits a bid for $8,000,000, the amount of contribution margin recognized by the Robo Division and GMT Industries, respectively, is 1 Robo Division's variable costs of $4,800,000 represent variable conversion costs only (direct labor and variable overhead), since the division purchases its raw materials from the Cross Division of the same company. A. Robo $(500,000) and GMT $1,700,000. B. Robo $3,200,000 and GMT $1,700.000. C. Robo $3,200,000 and GMT $(500,000). D. Robo $(500,000) and GMT $(2,000,000). Robo Division $4,800,0001 1 The Robo Division, a decentralized division of GMT Industries, has been approached to submit a bid for a potential project for the RSP Company. Robo Division has been informed by RSP that they will not consider bids over $8,000,000. Robo Division purchases its materials from the Cross Division of GMT Industries. There would be no additional fixed costs for either the Robo or Cross Divisions. Information regarding this project is as follows. Cross Division $1,500,000 Variable Costs Transfer Price 3,700,000 If Robo Division submits a bid for $8,000,000, the amount of contribution margin recognized by the Robo Division and GMT Industries, respectively, is 1 Robo Division's variable costs of $4,800,000 represent variable conversion costs only (direct labor and variable overhead), since the division purchases its raw materials from the Cross Division of the same company. A. Robo $(500,000) and GMT $1,700,000. B. Robo $3,200,000 and GMT $1,700.000. C. Robo $3,200,000 and GMT $(500,000). D. Robo $(500,000) and GMT $(2,000,000). Robo Division $4,800,0001

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the contribution margin we need to consider the selling price variable costs and trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started