Answered step by step

Verified Expert Solution

Question

1 Approved Answer

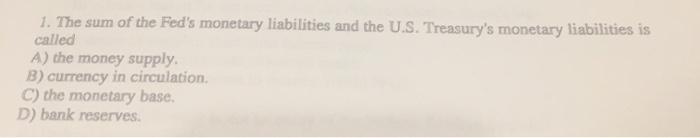

1. The sum of the Fed's monetary liabilities and the U.S. Treasury's monetary liabilities is called A) the money supply. B) currency in circulation.

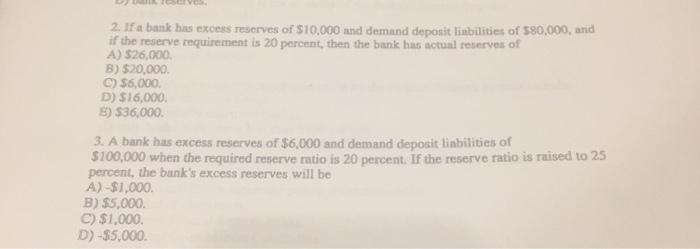

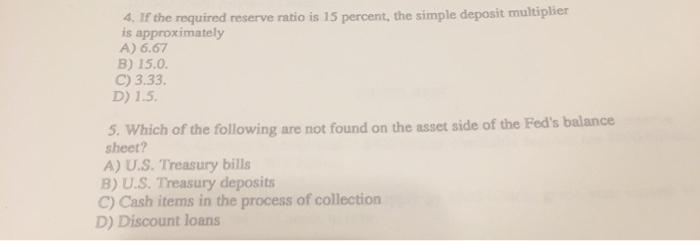

1. The sum of the Fed's monetary liabilities and the U.S. Treasury's monetary liabilities is called A) the money supply. B) currency in circulation. C) the monetary base. D) bank reserves. 2. If a bank has excess reserves of $10,000 and demand deposit linbilities of $80,000, and if the reserve renquirement is 20 percent, then the bank has actual reserves of A) $26,000, B) $20,000. C) $6,000. D) $16,000. E) $36,000. 3. A bank has excess reserves of $6,000 and demand deposit liabilities of $100,000 when the required reserve ratio is 20 percent. If the reserve ratio is raised to 25 percent, the bank's excess reserves will be A) -$1,000. B) $5,000. C) $1,000. D) -55,000. 4. If the required reserve ratio is 15 percent, the simple deposit multiplier is approximately A) 6.67 B) 15.0. C) 3.33. D) 1.5. 5. Which of the following are not found on the asset side of the Fed's balance sheet? A) U.S. Treasury bills B) U.S. Treasury deposits C) Cash items in the process of collection D) Discount loans

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

answer 1 Option C is correct Monetary base The monetary base also base money money base highpowered ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started