Answered step by step

Verified Expert Solution

Question

1 Approved Answer

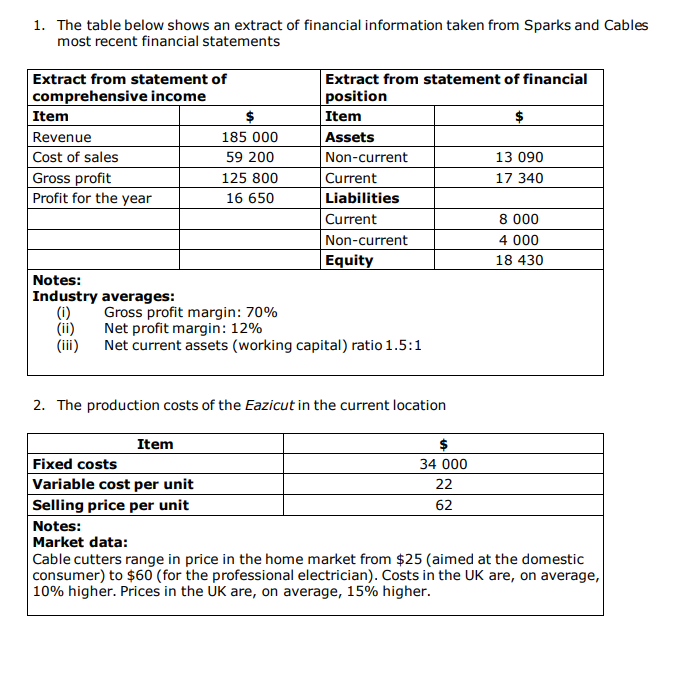

1. The table below shows an extract of financial information taken from Sparks and Cables most recent financial statements Notes: Industry averages: (i) Gross profit

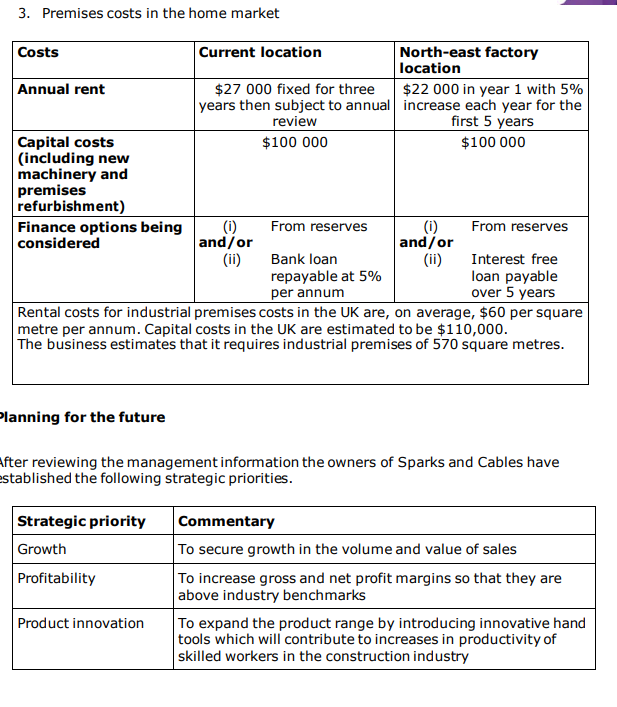

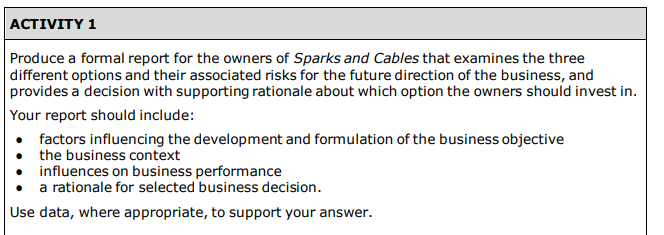

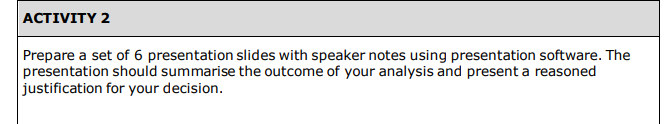

1. The table below shows an extract of financial information taken from Sparks and Cables most recent financial statements Notes: Industry averages: (i) Gross profit margin: 70% (ii) Net profit margin: 12% (iii) Net current assets (working capital) ratio 1.5:1 2. The production costs of the Eazicut in the current location 3. Premises costs in the home market metre per annum. Capital costs in the UK are estimated to be $110,000. The business estimates that it requires industrial premises of 570 square metres. lanning for the future fter reviewing the management information the owners of Sparks and Cables have stablished the following strategic priorities. Produce a formal report for the owners of Sparks and Cables that examines the three different options and their associated risks for the future direction of the business, and provides a decision with supporting rationale about which option the owners should invest in. Your report should include: - factors influencing the development and formulation of the business objective - the business context - influences on business performance - a rationale for selected business decision. Use data, where appropriate, to support your answer. Prepare a set of 6 presentation slides with speaker notes using presentation software. The presentation should summarise the outcome of your analysis and present a reasoned justification for your decision

1. The table below shows an extract of financial information taken from Sparks and Cables most recent financial statements Notes: Industry averages: (i) Gross profit margin: 70% (ii) Net profit margin: 12% (iii) Net current assets (working capital) ratio 1.5:1 2. The production costs of the Eazicut in the current location 3. Premises costs in the home market metre per annum. Capital costs in the UK are estimated to be $110,000. The business estimates that it requires industrial premises of 570 square metres. lanning for the future fter reviewing the management information the owners of Sparks and Cables have stablished the following strategic priorities. Produce a formal report for the owners of Sparks and Cables that examines the three different options and their associated risks for the future direction of the business, and provides a decision with supporting rationale about which option the owners should invest in. Your report should include: - factors influencing the development and formulation of the business objective - the business context - influences on business performance - a rationale for selected business decision. Use data, where appropriate, to support your answer. Prepare a set of 6 presentation slides with speaker notes using presentation software. The presentation should summarise the outcome of your analysis and present a reasoned justification for your decision Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started