Question

Axim limited is an international oil and gas company. The management decided to purchase sub-sea equipment which cost Ghe 60 billion and would save

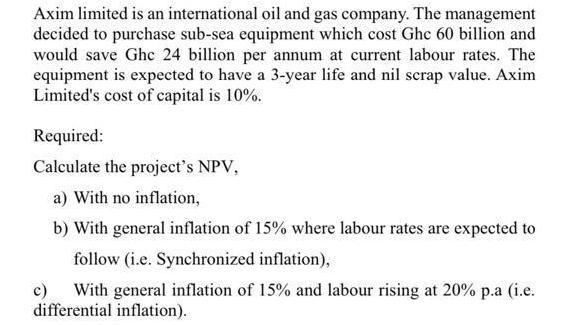

Axim limited is an international oil and gas company. The management decided to purchase sub-sea equipment which cost Ghe 60 billion and would save Ghc 24 billion per annum at current labour rates. The equipment is expected to have a 3-year life and nil scrap value. Axim Limited's cost of capital is 10%. Required: Calculate the project's NPV, a) With no inflation, b) With general inflation of 15% where labour rates are expected to follow (i.e. Synchronized inflation), c) With general inflation of 15% and labour rising at 20% p.a (i.e. differential inflation).

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a NPV no inflation 60 billion 24 billion1103 60 billion 24 billion1331 60 billi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann L. Johnston, Peter R. Norwood

10th Canadian edition Volume 1

978-0134213101, 134213106, 133855376, 978-0133855371

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App