Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The total construction cost of a refinery with a production capacity of 100,000 bbl/day in Caracas, Venezuela, completed in 1977 was $40 million.

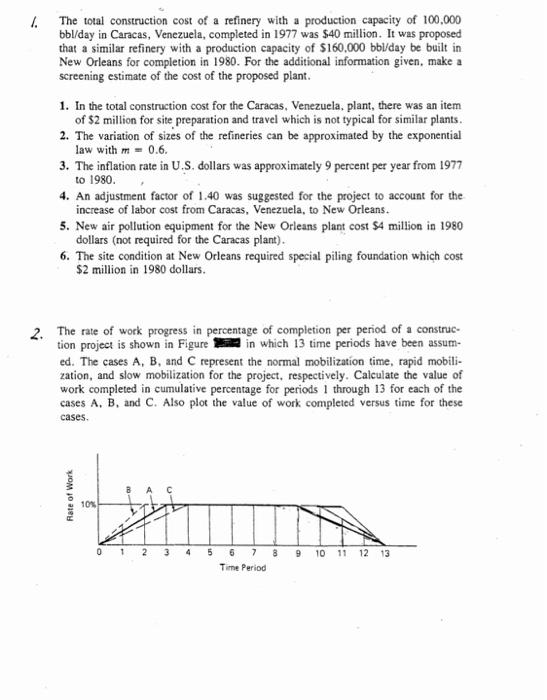

1. The total construction cost of a refinery with a production capacity of 100,000 bbl/day in Caracas, Venezuela, completed in 1977 was $40 million. It was proposed that a similar refinery with a production capacity of $160,000 bbl/day be built in New Orleans for completion in 1980. For the additional information given, make a screening estimate of the cost of the proposed plant. 1. In the total construction cost for the Caracas, Venezuela, plant, there was an item of $2 million for site preparation and travel which is not typical for similar plants. 2. The variation of sizes of the refineries can be approximated by the exponential law with m = 0.6. 3. The inflation rate in U.S. dollars was approximately 9 percent per year from 1977 to 1980. 4. An adjustment factor of 1.40 was suggested for the project to account for the increase of labor cost from Caracas, Venezuela, to New Orleans. 5. New air pollution equipment for the New Orleans plant cost $4 million in 1980 dollars (not required for the Caracas plant). 6. The site condition at New Orleans required special piling foundation which cost $2 million in 1980 dollars. 2. The rate of work progress in percentage of completion per period of a construc- tion project is shown in Figure in which 13 time periods have been assum- ed. The cases A, B, and C represent the normal mobilization time, rapid mobili- zation, and slow mobilization for the project, respectively. Calculate the value of work completed in cumulative percentage for periods 1 through 13 for each of the cases A, B, and C. Also plot the value of work completed versus time for these cases. Rate of Work 10% 0 2 3 4 5 6 7 8 9 10 11 12 13 Time Period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started