Answered step by step

Verified Expert Solution

Question

1 Approved Answer

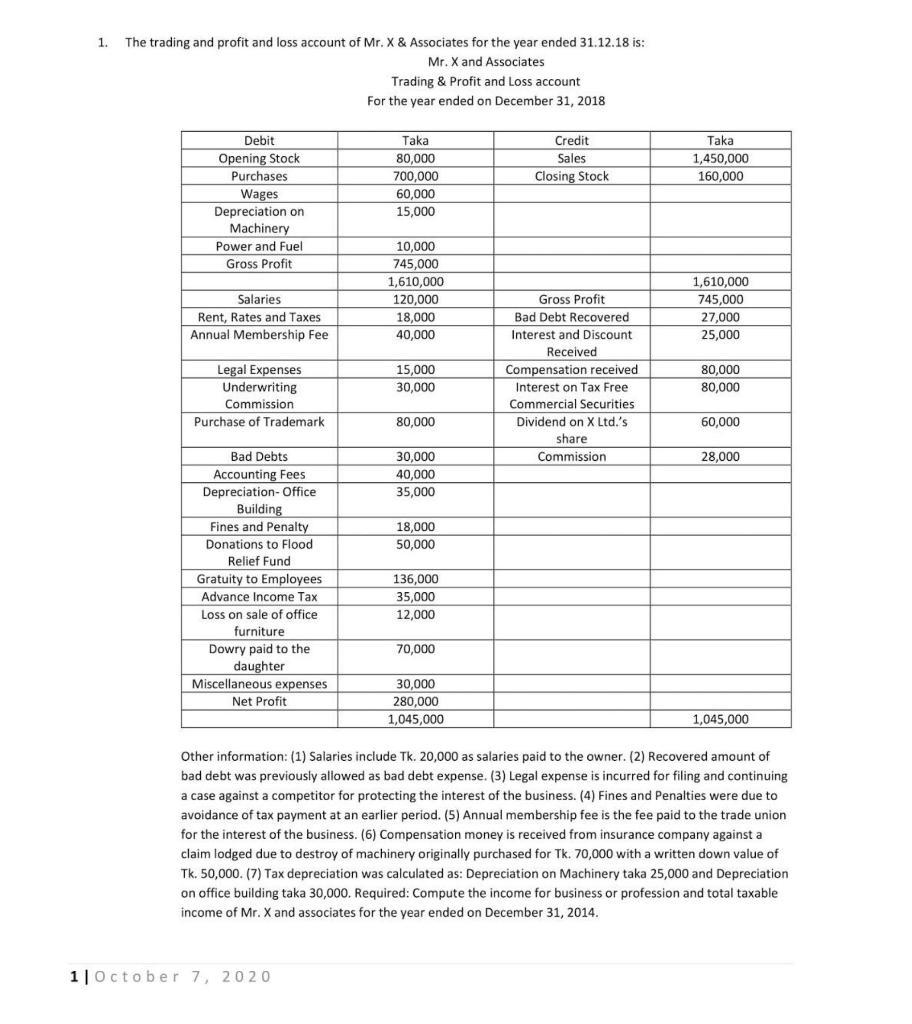

1. The trading and profit and loss account of Mr. X & Associates for the year ended 31.12.18 is: Mr. X and Associates Trading

1. The trading and profit and loss account of Mr. X & Associates for the year ended 31.12.18 is: Mr. X and Associates Trading & Profit and Loss account For the year ended on December 31, 2018 Credit Debit Opening Stock Taka 80,000 700,000 60,000 Taka 1,450,000 Sales Purchases Closing Stock 160,000 Wages Depreciation on Machinery 15,000 Power and Fuel Gross Profit 10,000 745,000 1,610,000 1,610,000 Salaries Gross Profit 745.000 120,000 18,000 40,000 Rent, Rates and Taxes Bad Debt Recovered 27,000 Annual Membership Fee Interest and Discount 25,000 Received Legal Expenses Underwriting Compensation received 15,000 30,000 80,000 80,000 Interest on Tax Free Commission Commercial Securities Purchase of Trademark 80,000 Dividend on X Ltd.'s 60,000 share Bad Debts 30,000 Commission 28,000 Accounting Fees Depreciation- Office Building 40,000 35,000 Fines and Penalty 18,000 50,000 Donations to Flood Relief Fund Gratuity to Employees Advance Income Tax 136,000 35,000 12,000 Loss on sale of office furniture Dowry paid to the daughter Miscellaneous expenses Net Profit 70,000 30,000 280,000 1,045,000 1,045,000 Other information: (1) Salaries include Tk. 20,000 as salaries paid to the owner. (2) Recovered amount of bad debt was previously allowed as bad debt expense. (3) Legal expense is incurred for filing and continuing a case against a competitor for protecting the interest of the business. (4) Fines and Penalties were due to avoidance of tax payment at an earlier period. (5) Annual membership fee is the fee paid to the trade union for the interest of the business. (6) Compensation money is received from insurance company against a claim lodged due to destroy of machinery originally purchased for Tk. 70,000 with a written down value of Tk. 50,000. (7) Tax depreciation was calculated as: Depreciation on Machinery taka 25,000 and Depreciation on office building taka 30,000. Required: Compute the income for business or profession and total taxable income of Mr. X and associates for the year ended on December 31, 2014. 1|october 7, 2020

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Income from Business for the year ended December 31 2014 Particulars Note Taka Taka Net profit as perp L Ac 280000 Add Expenses claimed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started