Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The use of WACC based on a firm's own stock price to select new projects or investments is acceptable when the: A) Projects

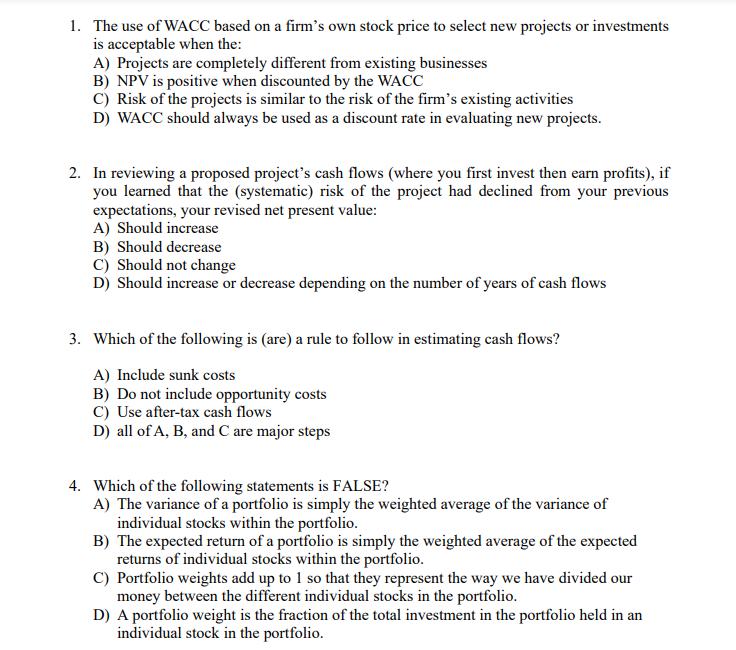

1. The use of WACC based on a firm's own stock price to select new projects or investments is acceptable when the: A) Projects are completely different from existing businesses B) NPV is positive when discounted by the WACC C) Risk of the projects is similar to the risk of the firm's existing activities D) WACC should always be used as a discount rate in evaluating new projects. 2. In reviewing a proposed project's cash flows (where you first invest then earn profits), if you learned that the (systematic) risk of the project had declined from your previous expectations, your revised net present value: A) Should increase B) Should decrease C) Should not change D) Should increase or decrease depending on the number of years of cash flows 3. Which of the following is (are) a rule to follow in estimating cash flows? A) Include sunk costs B) Do not include opportunity costs C) Use after-tax cash flows D) all of A, B, and C are major steps 4. Which of the following statements is FALSE? A) The variance of a portfolio is simply the weighted average of the variance of individual stocks within the portfolio. B) The expected return of a portfolio is simply the weighted average of the expected returns of individual stocks within the portfolio. C) Portfolio weights add up to 1 so that they represent the way we have divided our money between the different individual stocks in the portfolio. D) A portfolio weight is the fraction of the total investment in the portfolio held in an individual stock in the portfolio.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The use of WACC based on a firms own stock price to select new projects or investments is acceptable when the C Risk of the projects is s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started