Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. There are income limits for Roth IRA contributions, and deductibility limits for Traditional IRA contributions. Those rules are outside the scope of this

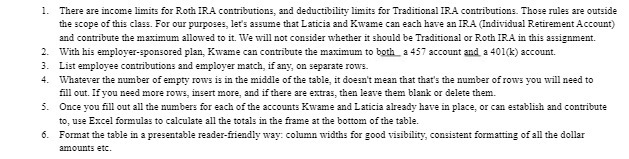

1. There are income limits for Roth IRA contributions, and deductibility limits for Traditional IRA contributions. Those rules are outside the scope of this class. For our purposes, let's assume that Laticia and Kwame can each have an IRA (Individual Retirement Account) and contribute the maximum allowed to it. We will not consider whether it should be Traditional or Roth IRA in this assignment. 2. With his employer-sponsored plan, Kwame can contribute the maximum to both a 457 account and a 401(k) account. 3. List employee contributions and employer match, if any, on separate rows. 4. Whatever the number of empty rows is in the middle of the table, it doesn't mean that that's the number of rows you will need to fill out. If you need more rows, insert more, and if there are extras, then leave them blank or delete them. 5. Once you fill out all the numbers for each of the accounts Kwame and Laticia already have in place, or can establish and contribute to, use Excel formulas to calculate all the totals in the frame at the bottom of the table. 6. Format the table in a presentable reader-friendly way: column widths for good visibility, consistent formatting of all the dollar amounts etc.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here is the completed retirement savings plan table for Kwame and Latic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started