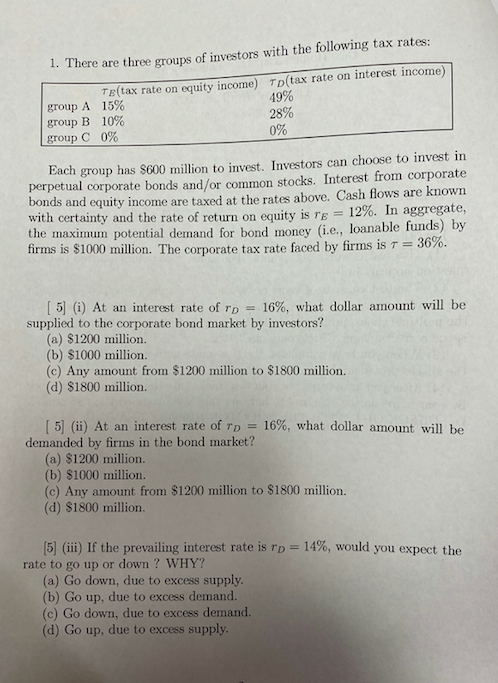

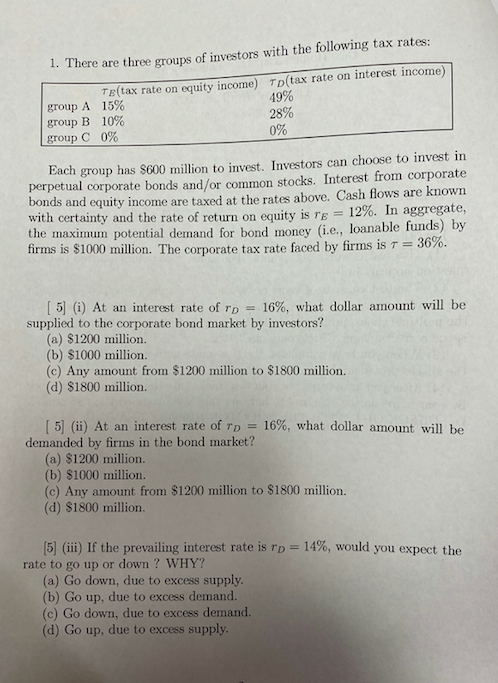

1. There are three groups of investors with the following tax rates: TE(tax rate on equity income) Tp(tax rate on interest income) group A 15% 49% group B 10% 28% group C 0% 0% Each group has $600 million to invest. Investors can choose to invest in perpetual corporate bonds and/or common stocks. Interest from corporate bonds and equity income are taxed at the rates above. Cash flows are known with certainty and the rate of return on equity is re = 12%. In aggregate, the maximum potential demand for bond money (i.e., loanable funds) by firms is $1000 million. The corporate tax rate faced by firms is t = 36%. [5] (i) At an interest rate of rp = 16%, what dollar amount will be supplied to the corporate bond market by investors? (a) $1200 million. (b) $1000 million (c) Any amount from $1200 million to $1800 million. (d) $1800 million [5] (ii) At an interest rate of TD 16%, what dollar amount will be demanded by firms in the bond market? (a) $1200 million (b) $1000 million (c) Any amount from $1200 million to $1800 million. (d) $1800 million (5) (ii) If the prevailing interest rate is ro = 14%, would you expect the rate to go up or down ? WHY? (a) Go down, due to excess supply. (b) Go up, due to excess demand. (c) Go down, due to excess demand. (d) Go up, due to excess supply. 1. There are three groups of investors with the following tax rates: TE(tax rate on equity income) Tp(tax rate on interest income) group A 15% 49% group B 10% 28% group C 0% 0% Each group has $600 million to invest. Investors can choose to invest in perpetual corporate bonds and/or common stocks. Interest from corporate bonds and equity income are taxed at the rates above. Cash flows are known with certainty and the rate of return on equity is re = 12%. In aggregate, the maximum potential demand for bond money (i.e., loanable funds) by firms is $1000 million. The corporate tax rate faced by firms is t = 36%. [5] (i) At an interest rate of rp = 16%, what dollar amount will be supplied to the corporate bond market by investors? (a) $1200 million. (b) $1000 million (c) Any amount from $1200 million to $1800 million. (d) $1800 million [5] (ii) At an interest rate of TD 16%, what dollar amount will be demanded by firms in the bond market? (a) $1200 million (b) $1000 million (c) Any amount from $1200 million to $1800 million. (d) $1800 million (5) (ii) If the prevailing interest rate is ro = 14%, would you expect the rate to go up or down ? WHY? (a) Go down, due to excess supply. (b) Go up, due to excess demand. (c) Go down, due to excess demand. (d) Go up, due to excess supply