Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tiff Macklem began his current part-time job as Governor of the Bank of Canada in 2020, immediately implementing a monetary policy which reduced

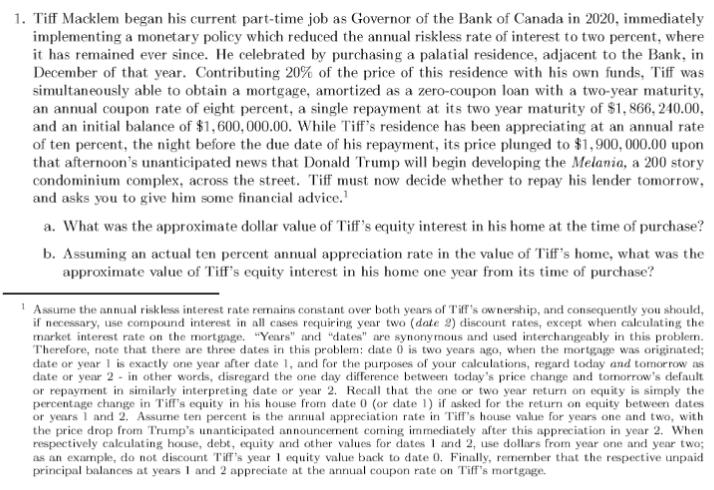

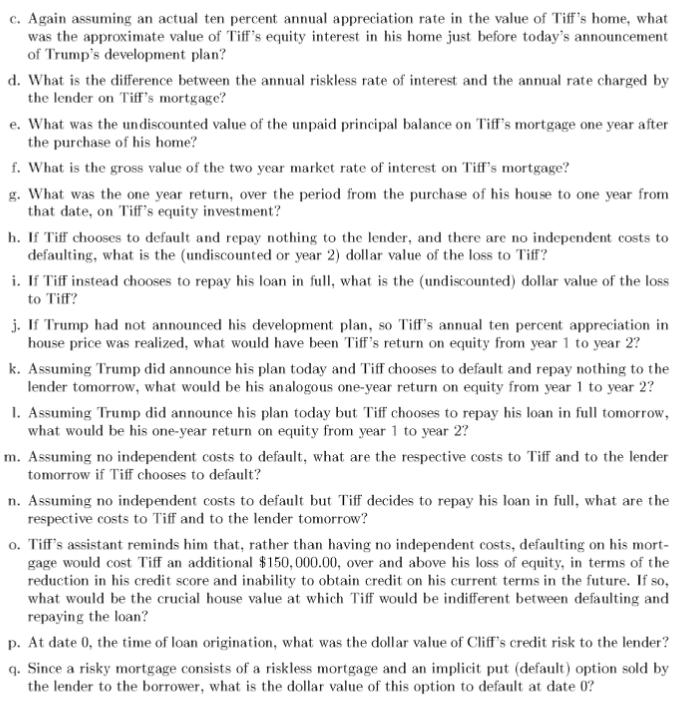

1. Tiff Macklem began his current part-time job as Governor of the Bank of Canada in 2020, immediately implementing a monetary policy which reduced the annual riskless rate of interest to two percent, where it has remained ever since. He celebrated by purchasing a palatial residence, adjacent to the Bank, in December of that year. Contributing 20% of the price of this residence with his own funds, Tiff was simultaneously able to obtain a mortgage, amortized as a zero-coupon loan with a two-year maturity, an annual coupon rate of eight percent, a single repayment at its two year maturity of $1,866, 240.00, and an initial balance of $1,600,000.00. While Tiff's residence has been appreciating at an annual rate of ten percent, the night before the due date of his repayment, its price plunged to $1,900,000.00 upon that afternoon's unanticipated news that Donald Trump will begin developing the Melania, a 200 story condominium complex, across the street. Tiff must now decide whether to repay his lender tomorrow, and asks you to give him some financial advice. a. What was the approximate dollar value of Tiff's equity interest in his home at the time of purchase? b. Assuming an actual ten percent annual appreciation rate in the value of Tiff's home, what was the approximate value of Tiff's equity interest in his home one year from its time of purchase? Assume the annual riskless interest rate remains constant over both years of Tiff's ownership, and consequently you should, if necessary, use compound interest in all cases requiring year two (date 2) discount rates, except when calculating the market interest rate on the mortgage. "Years" and "dates" are synonymous and used interchangeably in this problem. Therefore, note that there are three dates in this problem: date 0 is two years ago, when the mortgage was originated; date or year 1 is exactly one year after date 1, and for the purposes of your calculations, regard today and tomorrow as date or year 2- in other words, disregard the one day difference between today's price change and tomorrow's default. or repayment in similarly interpreting date or year 2. Recall that the one or two year return on equity is simply the percentage change in Tiff's equity in his house from date 0 (or date 1) if asked for the return on equity between dates or years 1 and 2. Assume ten percent is the annual appreciation rate in Tiff's house value for years one and two, with the price drop from Trump's unanticipated announcement coming immediately after this appreciation in year 2. When respectively calculating house, debt, equity and other values for dates 1 and 2, use dollars from year one and year two; as an example, do not discount Tiff's year 1 equity value back to date 0. Finally, remember that the respective unpaid principal balances at years 1 and 2 appreciate at the annual coupon rate on Tiff's mortgage. c. Again assuming an actual ten percent annual appreciation rate in the value of Tiff's home, what was the approximate value of Tiff's equity interest in his home just before today's announcement of Trump's development plan? d. What is the difference between the annual riskless rate of interest and the annual rate charged by the lender on Tiff's mortgage? e. What was the undiscounted value of the unpaid principal balance on Tiff's mortgage one year after the purchase of his home? f. What is the gross value of the two year market rate of interest on Tiff's mortgage? g. What was the one year return, over the period from the purchase of his house to one year from that date, on Tiff's equity investment? h. If Tiff chooses to default and repay nothing to the lender, and there are no independent costs to defaulting, what is the (undiscounted or year 2) dollar value of the loss to Tiff? i. If Tiff instead chooses to repay his loan in full, what is the (undiscounted) dollar value of the loss to Tiff? j. If Trump had not announced his development plan, so Tiff's annual ten percent appreciation in house price was realized, what would have been Tiff's return on equity from year 1 to year 2? k. Assuming Trump did announce his plan today and Tiff chooses to default and repay nothing to the lender tomorrow, what would be his analogous one-year return on equity from year 1 to year 2? 1. Assuming Trump did announce his plan today but Tiff chooses to repay his loan in full tomorrow, what would be his one-year return on equity from year 1 to year 2? m. Assuming no independent costs to default, what are the respective costs to Tiff and to the lender tomorrow if Tiff chooses to default? n. Assuming no independent costs to default but Tiff decides to repay his loan in full, what are the respective costs to Tiff and to the lender tomorrow? o. Tiff's assistant reminds him that, rather than having no independent costs, defaulting on his mort- gage would cost Tiff an additional $150,000.00, over and above his loss of equity, in terms of the reduction in his credit score and inability to obtain credit on his current terms in the future. If so, what would be the crucial house value at which Tiff would be indifferent between defaulting and repaying the loan? p. At date 0, the time of loan origination, what was the dollar value of Cliff's credit risk to the lender? q. Since a risky mortgage consists of a riskless mortgage and an implicit put (default) option sold by the lender to the borrower, what is the dollar value of this option to default at date 0?

Step by Step Solution

★★★★★

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started