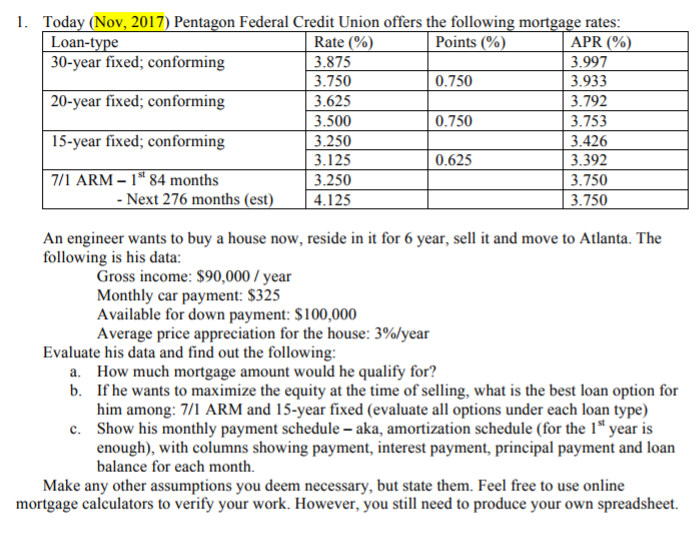

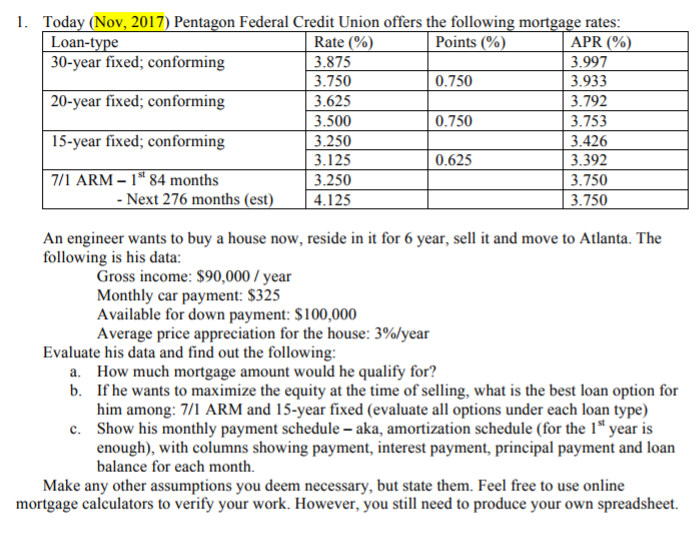

1. Today (Nov, 2017) Pentagon Federal Credit Union offers the following mortgage rates Rate(%) 3.875 3.750 3.625 3.500 3.250 3.125 3.250 4.125 Points (%) 0.750 0.750 0.625 APR (%) 3.997 3.933 3.792 3.753 3.426 3.392 3.750 3.750 Loan-t 30-year fixed, conforming 20-year fixed, conforming 15-year fixed, conforming 7/1 ARM-184 months Next 276 months (est An engineer wants to buy a house now, reside in it for 6 year, sell it and move to Atlanta. The following is his data Gross income: $90,000/year Monthly car payment: $325 Available for down payment: S100,000 Average price appreciation for the house: 3%/year Evaluate his data and find out the following How much mortgage amount would he qualify for? If he wants to maximize the equity at the time of selling, what is the best loan option for him among: 7/1 ARM and 15-year fixed (evaluate all options under each loan type) a. b. c. Show his monthly payment schedule aka, amortization schedule (for the 1s* year is enough), with columns showing payment, interest payment, principal payment and loan balance for each month. Make any other assumptions you deem necessary, but state them. Feel free to use online mortgage calculators to verify your work. However, you still need to produce your own spreadsheet. 1. Today (Nov, 2017) Pentagon Federal Credit Union offers the following mortgage rates Rate(%) 3.875 3.750 3.625 3.500 3.250 3.125 3.250 4.125 Points (%) 0.750 0.750 0.625 APR (%) 3.997 3.933 3.792 3.753 3.426 3.392 3.750 3.750 Loan-t 30-year fixed, conforming 20-year fixed, conforming 15-year fixed, conforming 7/1 ARM-184 months Next 276 months (est An engineer wants to buy a house now, reside in it for 6 year, sell it and move to Atlanta. The following is his data Gross income: $90,000/year Monthly car payment: $325 Available for down payment: S100,000 Average price appreciation for the house: 3%/year Evaluate his data and find out the following How much mortgage amount would he qualify for? If he wants to maximize the equity at the time of selling, what is the best loan option for him among: 7/1 ARM and 15-year fixed (evaluate all options under each loan type) a. b. c. Show his monthly payment schedule aka, amortization schedule (for the 1s* year is enough), with columns showing payment, interest payment, principal payment and loan balance for each month. Make any other assumptions you deem necessary, but state them. Feel free to use online mortgage calculators to verify your work. However, you still need to produce your own spreadsheet