Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Totem group is planning to purchase a new printing machine to replace a current machine. The cost of the new machine Konica Minolta

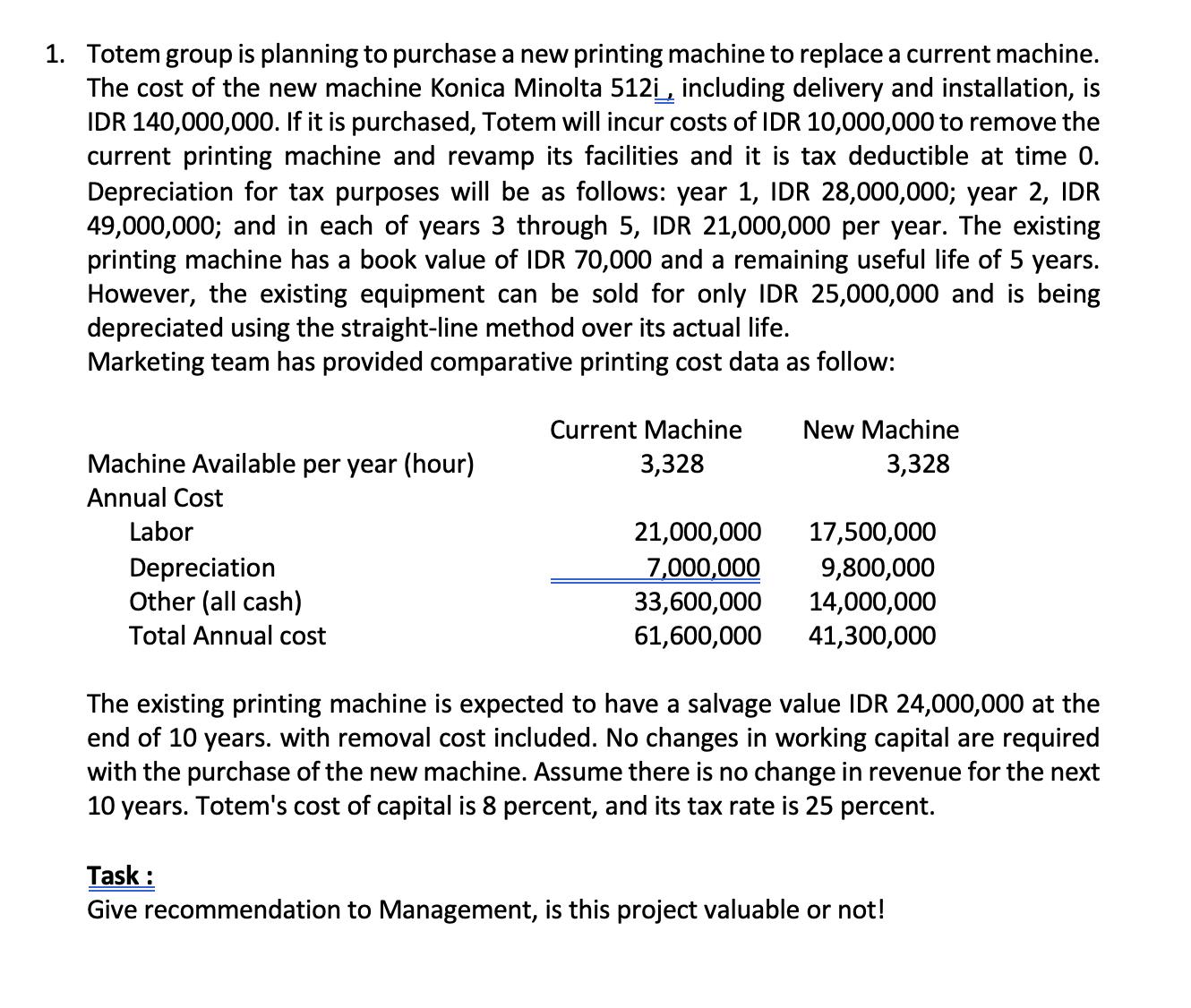

1. Totem group is planning to purchase a new printing machine to replace a current machine. The cost of the new machine Konica Minolta 512i, including delivery and installation, is IDR 140,000,000. If it is purchased, Totem will incur costs of IDR 10,000,000 to remove the current printing machine and revamp its facilities and it is tax deductible at time 0. Depreciation for tax purposes will be as follows: year 1, IDR 28,000,000; year 2, IDR 49,000,000; and in each of years 3 through 5, IDR 21,000,000 per year. The existing printing machine has a book value of IDR 70,000 and a remaining useful life of 5 years. However, the existing equipment can be sold for only IDR 25,000,000 and is being depreciated using the straight-line method over its actual life. Marketing team has provided comparative printing cost data as follow: Machine Available per year (hour) Annual Cost Labor Depreciation Other (all cash) Total Annual cost Current Machine 3,328 New Machine 3,328 21,000,000 17,500,000 7,000,000 9,800,000 33,600,000 14,000,000 61,600,000 41,300,000 The existing printing machine is expected to have a salvage value IDR 24,000,000 at the end of 10 years. with removal cost included. No changes in working capital are required with the purchase of the new machine. Assume there is no change in revenue for the next 10 years. Totem's cost of capital is 8 percent, and its tax rate is 25 percent. Task : Give recommendation to Management, is this project valuable or not! Clues: Calculate all cost and depreciation Consider tax benefit Calculate Cash Flow of implementation of the new printing machine

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine if the project of purchasing the new printing machine is valuable we need to calculate the Net Present Value NPV of the project We ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started