Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Transactions treated as sales due to the absence of actual exchanges are subject to value added tax. 2. The Output value-added tax is

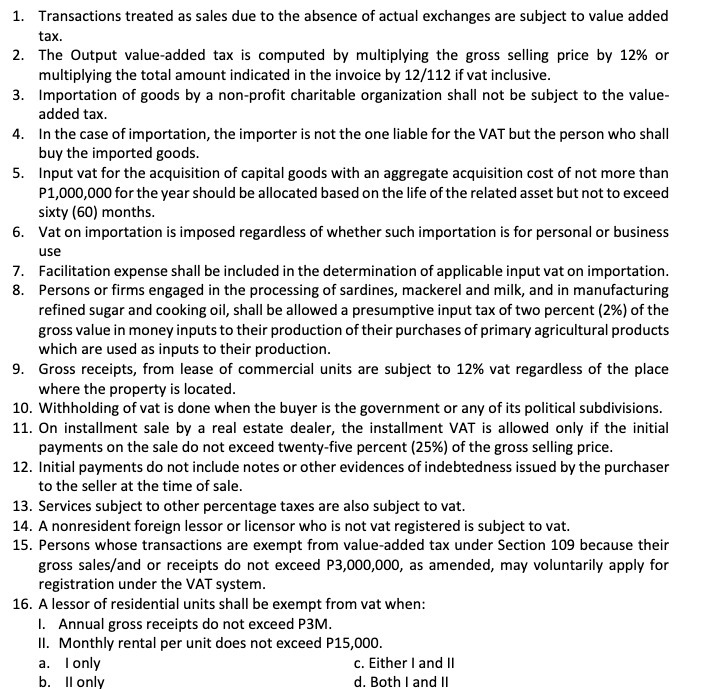

1. Transactions treated as sales due to the absence of actual exchanges are subject to value added tax. 2. The Output value-added tax is computed by multiplying the gross selling price by 12% or multiplying the total amount indicated in the invoice by 12/112 if vat inclusive. 3. Importation of goods by a non-profit charitable organization shall not be subject to the value- added tax. 4. In the case of importation, the importer is not the one liable for the VAT but the person who shall buy the imported goods. 5. Input vat for the acquisition of capital goods with an aggregate acquisition cost of not more than P1,000,000 for the year should be allocated based on the life of the related asset but not to exceed sixty (60) months. 6. Vat on importation is imposed regardless of whether such importation is for personal or business use 7. Facilitation expense shall be included in the determination of applicable input vat on importation. 8. Persons or firms engaged in the processing of sardines, mackerel and milk, and in manufacturing refined sugar and cooking oil, shall be allowed a presumptive input tax of two percent (2%) of the gross value in money inputs to their production of their purchases of primary agricultural products which are used as inputs to their production. 9. Gross receipts, from lease of commercial units are subject to 12% vat regardless of the place where the property is located. 10. Withholding of vat is done when the buyer is the government or any of its political subdivisions. 11. On installment sale by a real estate dealer, the installment VAT is allowed only if the initial payments on the sale do not exceed twenty-five percent (25%) of the gross selling price. 12. Initial payments do not include notes or other evidences of indebtedness issued by the purchaser to the seller at the time of sale. 13. Services subject to other percentage taxes are also subject to vat. 14. A nonresident foreign lessor or licensor who is not vat registered is subject to vat. 15. Persons whose transactions are exempt from value-added tax under Section 109 because their gross sales/and or receipts do not exceed P3,000,000, as amended, may voluntarily apply for registration under the VAT system. 16. A lessor of residential units shall be exempt from vat when: I. Annual gross receipts do not exceed P3M. II. Monthly rental per unit does not exceed P15,000. a. I only b. ll only c. Either I and II d. Both I and II

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is c Either I and II ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started