Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.) Under the facts given, what is the amount that Doug will inherit at Maxs death (assume only John predeceases Max)? $200,000 $100,000 $150,000 $50,000

1.) Under the facts given, what is the amount that Doug will inherit at Maxs death (assume only John predeceases Max)?

$200,000

$100,000

$150,000

$50,000

2.) Assuming only Max and John predecease Alicia and Alicia does not change her will, what is the amount that Tammy will inherit at Alicias death assuming Alicia dies with $3,000,000 in probate assets (ignoring the assets and values above)?

$1,500,000

$1,000,000

$3,000,000

$750,000

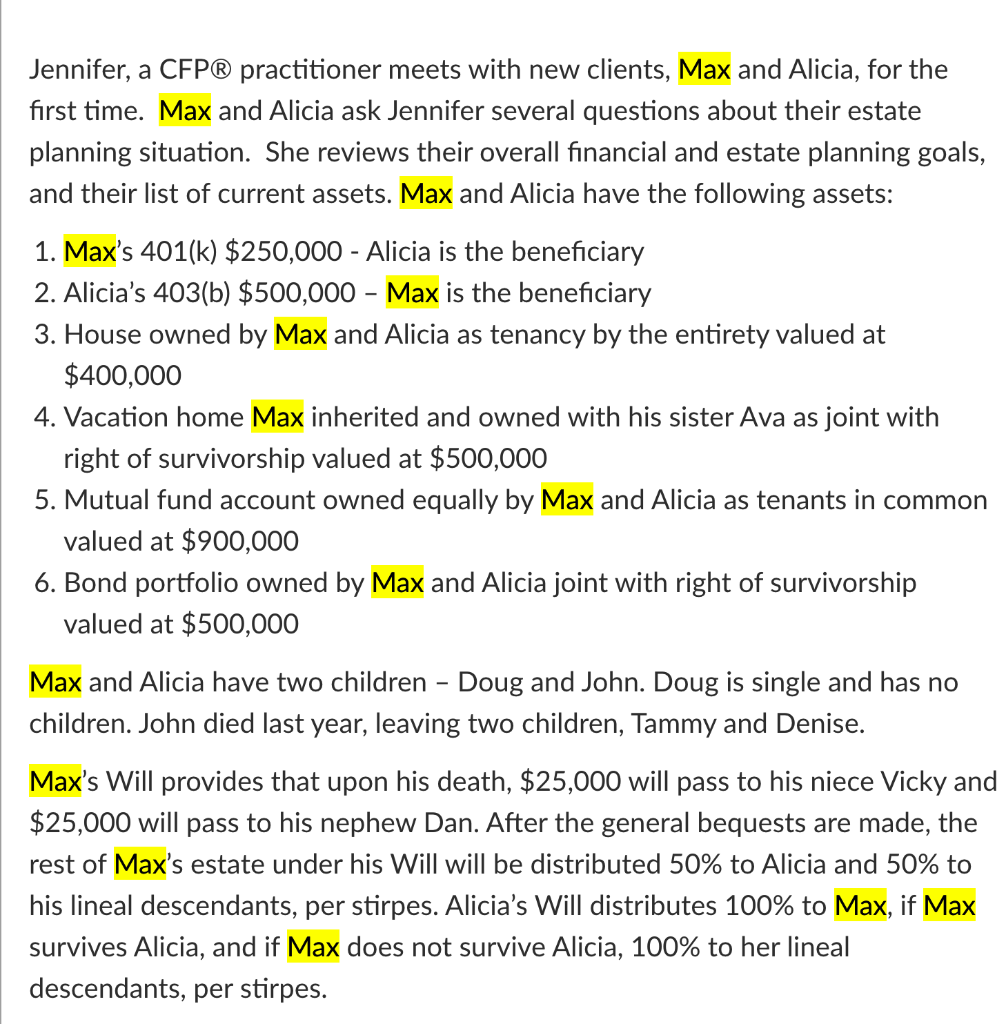

Jennifer, a CFP practitioner meets with new clients, Max and Alicia, for the first time. Max and Alicia ask Jennifer several questions about their estate planning situation. She reviews their overall financial and estate planning goals, and their list of current assets. Max and Alicia have the following assets: 1. Max's 401 (k) $250,000 - Alicia is the beneficiary 2. Alicia's 403(b) $500,000 - Max is the beneficiary 3. House owned by Max and Alicia as tenancy by the entirety valued at $400,000 4. Vacation home Max inherited and owned with his sister Ava as joint with right of survivorship valued at $500,000 5. Mutual fund account owned equally by Max and Alicia as tenants in common valued at $900,000 6. Bond portfolio owned by Max and Alicia joint with right of survivorship valued at $500,000 Max and Alicia have two children - Doug and John. Doug is single and has no children. John died last year, leaving two children, Tammy and Denise. Max's Will provides that upon his death, $25,000 will pass to his niece Vicky and $25,000 will pass to his nephew Dan. After the general bequests are made, the rest of Max's estate under his Will will be distributed 50% to Alicia and 50% to his lineal descendants, per stirpes. Alicia's Will distributes 100% to Max, if Max survives Alicia, and if Max does not survive Alicia, 100% to her lineal descendants, per stirpesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started