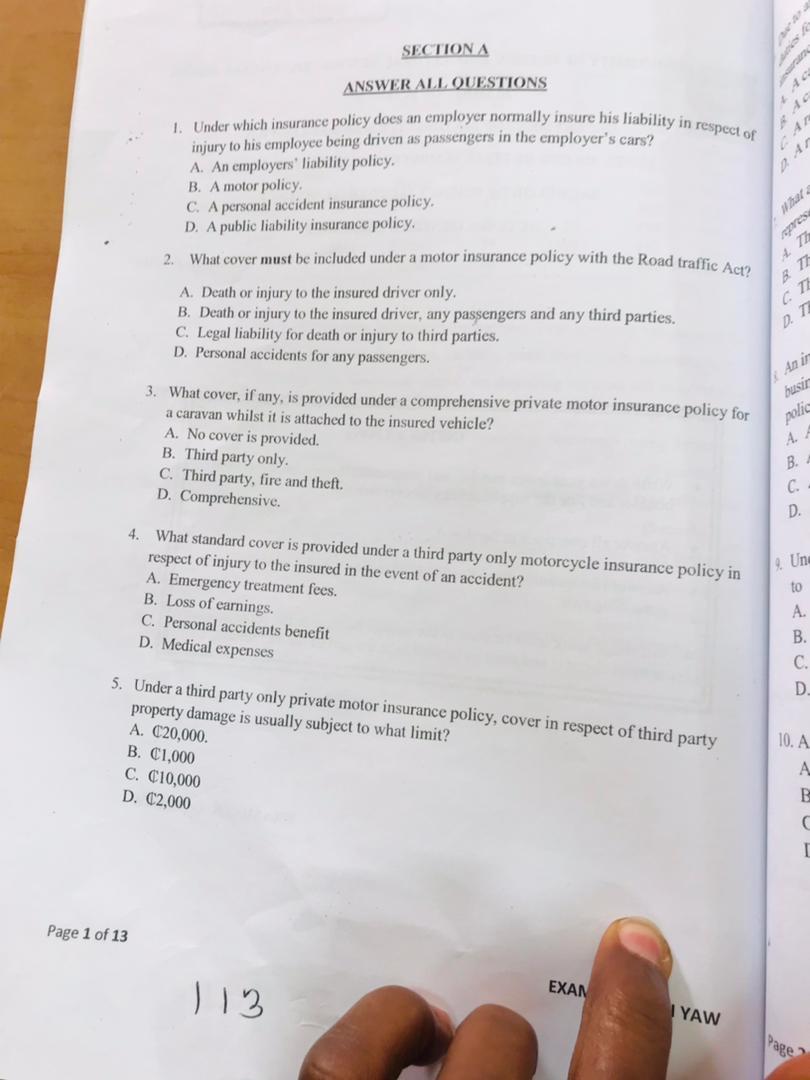

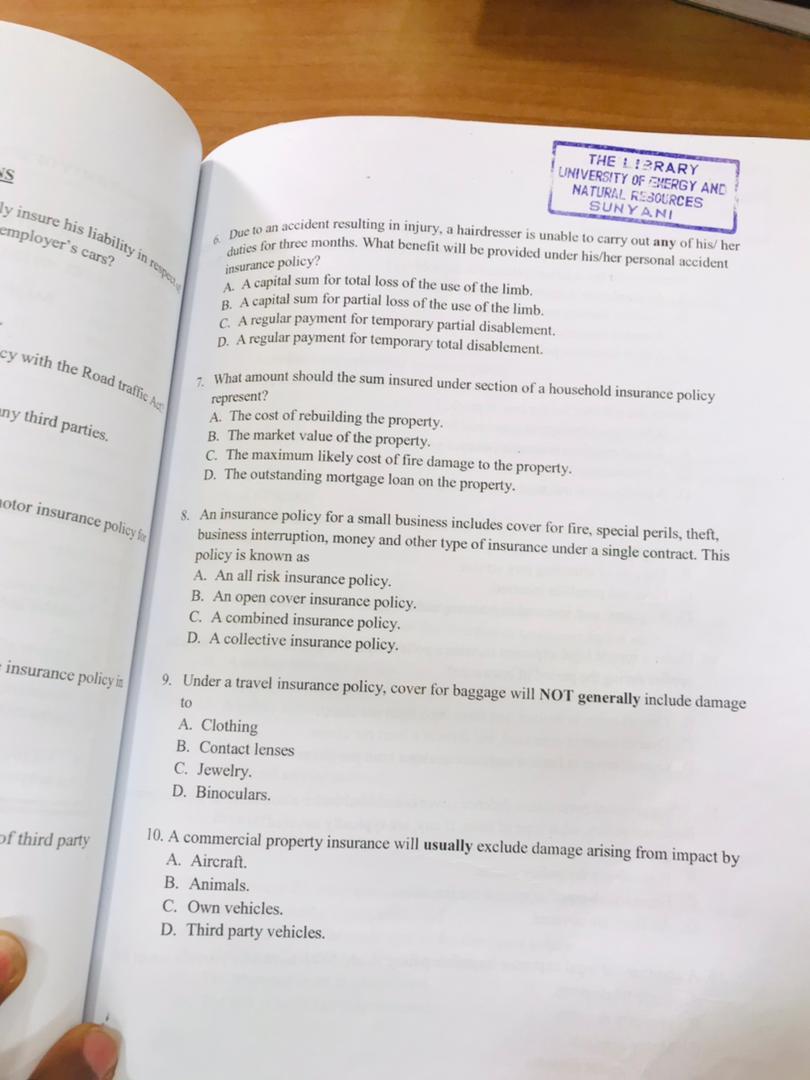

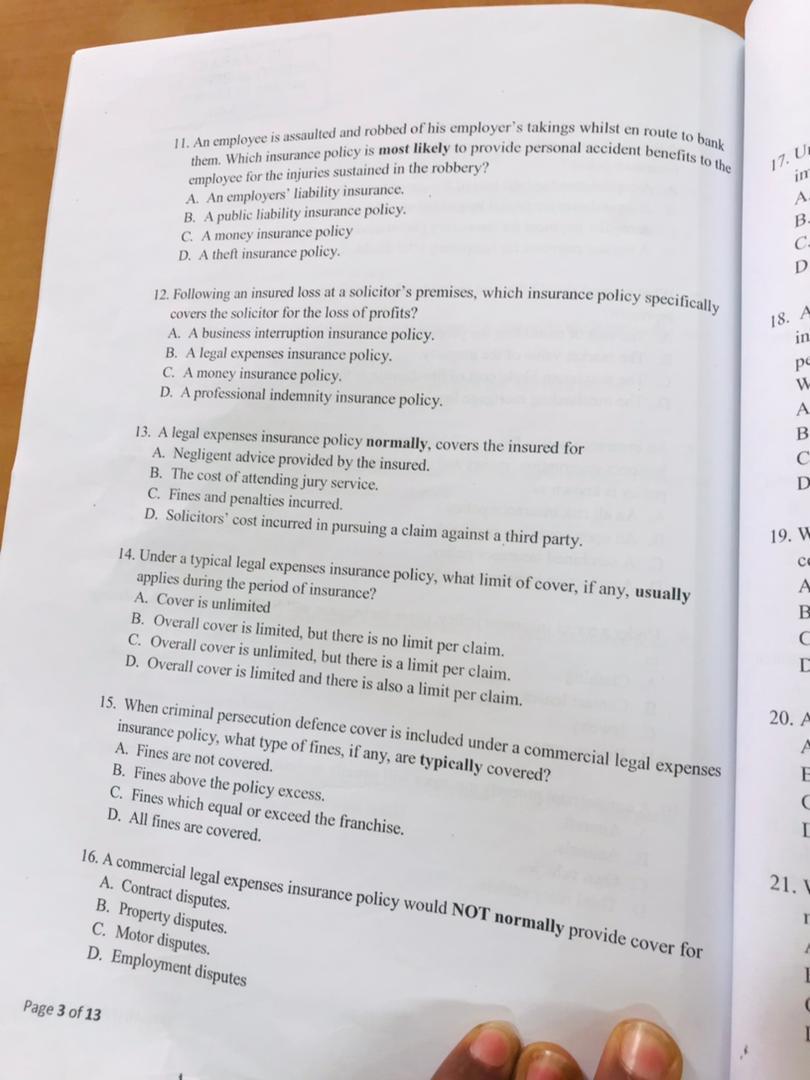

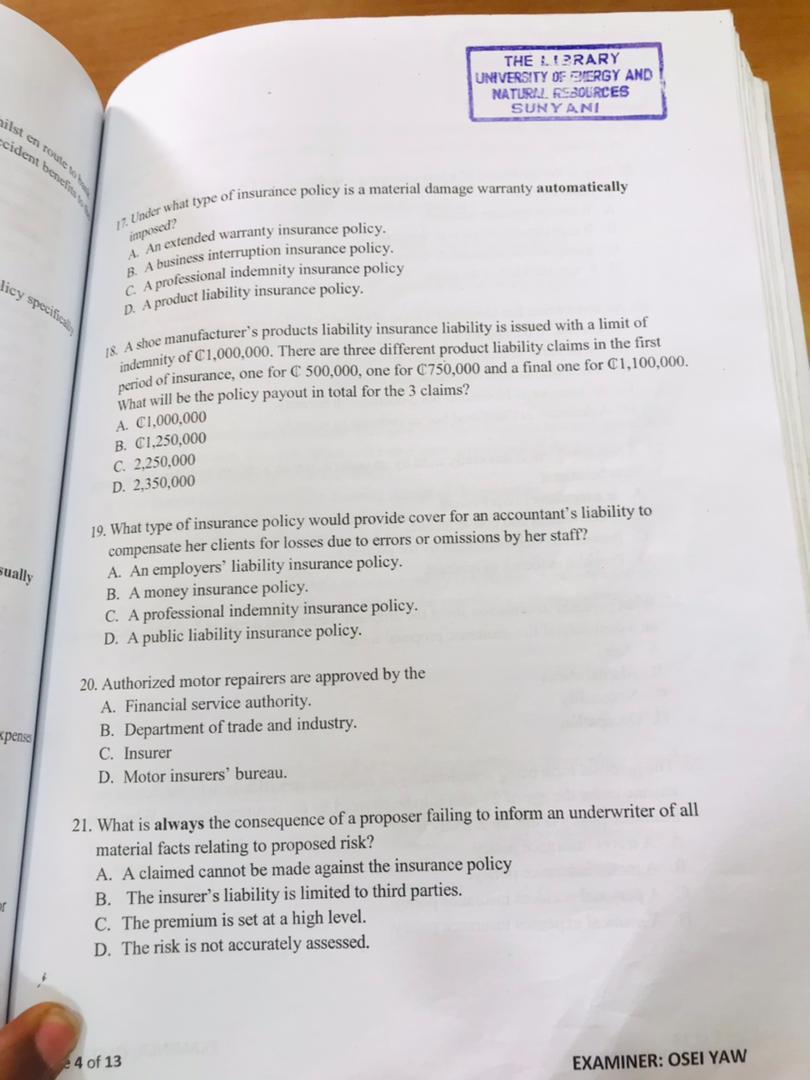

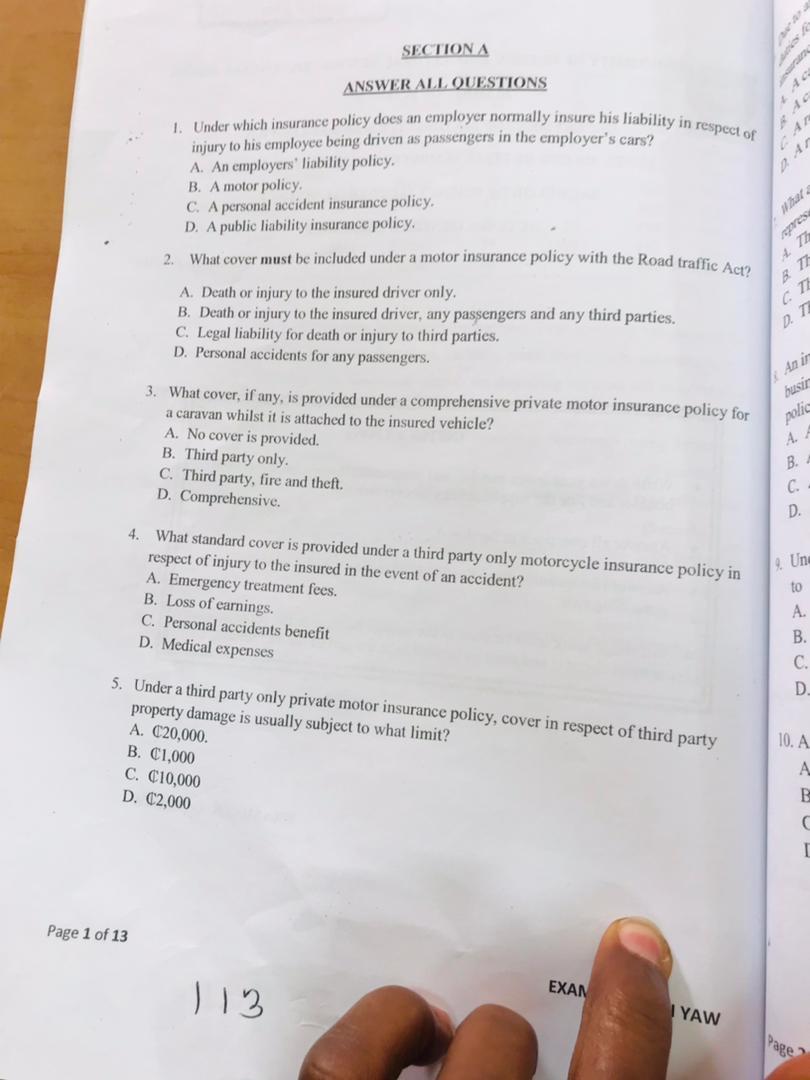

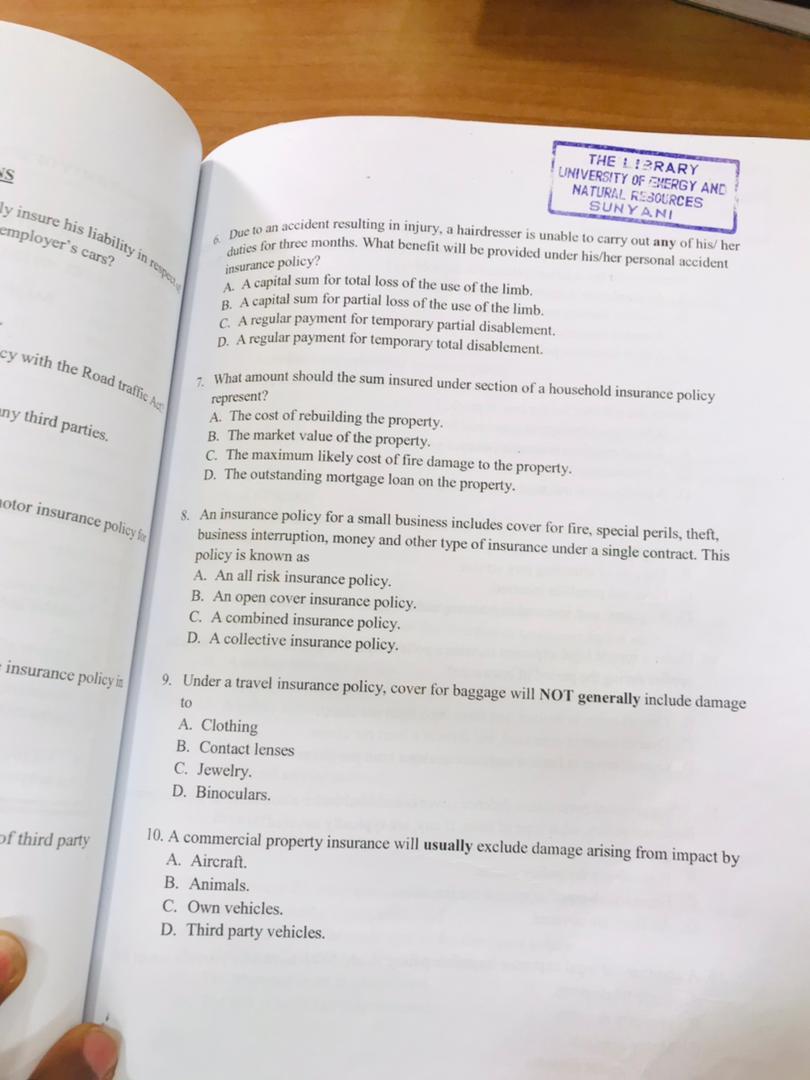

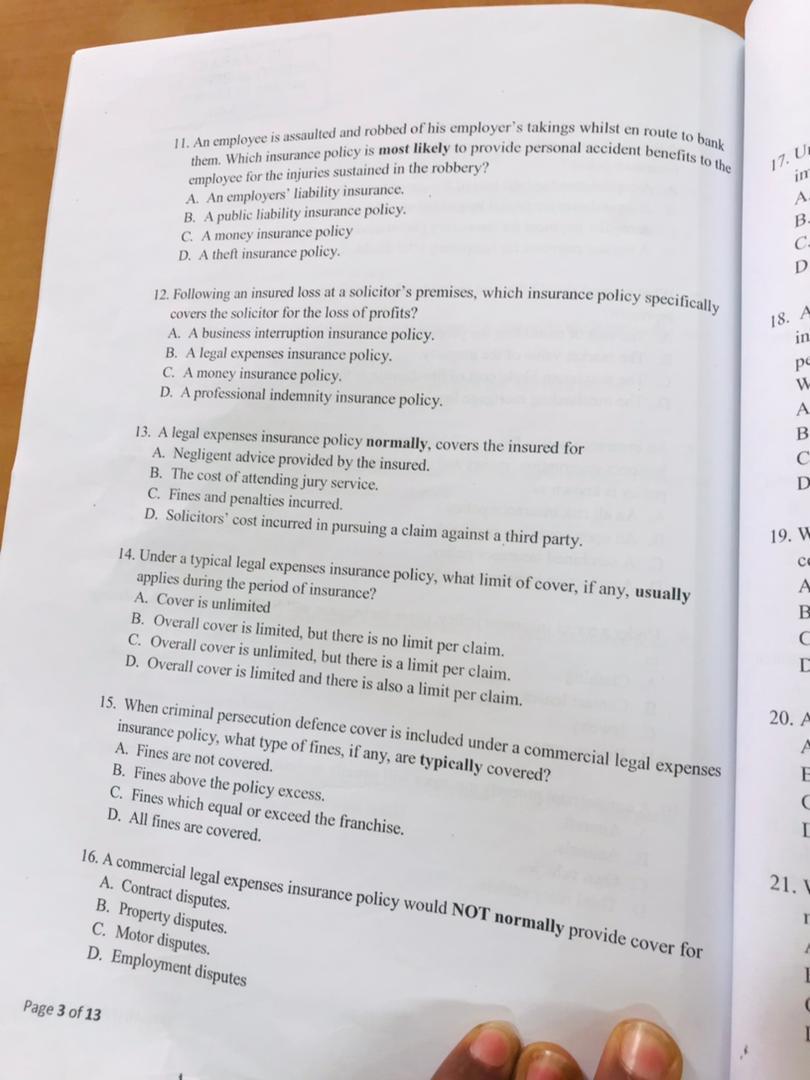

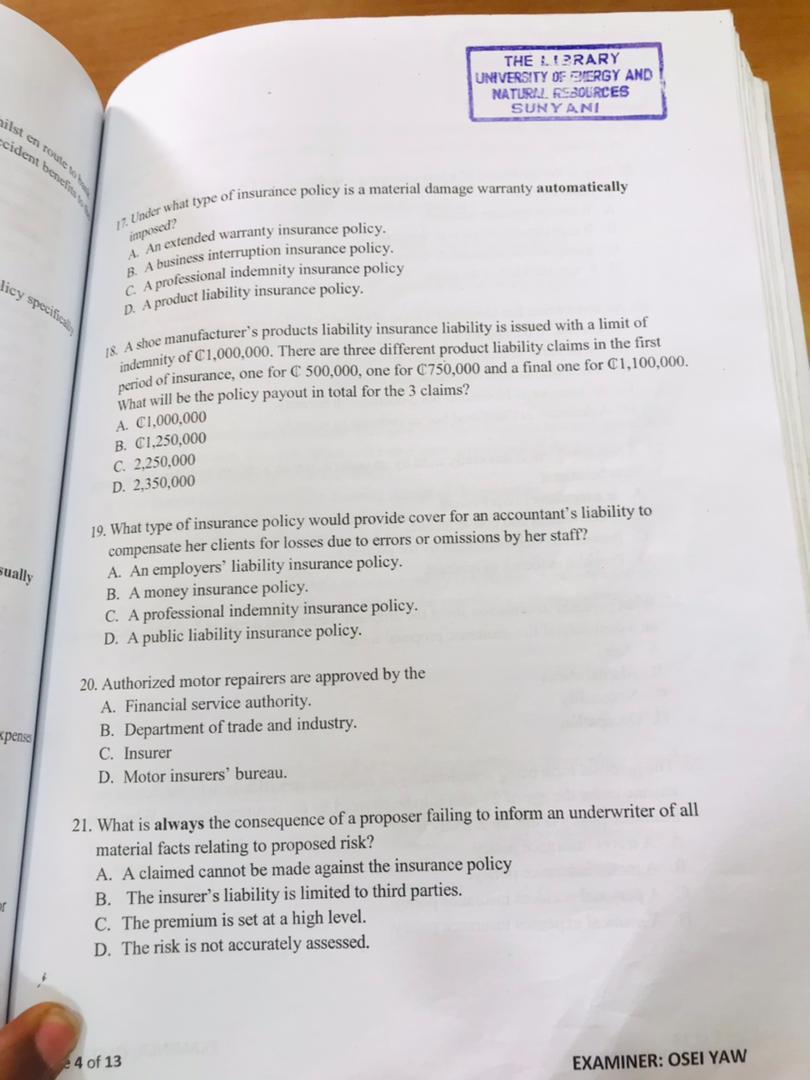

1. Under which insurance policy does an employer normally insure his liability in respect of injury to his employee being driven as passengers in the employer's cars? A. An employers' liability policy. B. A motor policy. C. A personal accident insurance policy. D. A public liability insurance policy. 2. What cover must be included under a motor insurance policy with the Road traffic Act? A. Death or injury to the insured driver only. B. Death or injury to the insured driver, any passengers and any third parties. C. Legal liability for death or injury to third parties. D. Personal accidents for any passengers. 3. What cover, if any, is provided under a comprehensive private motor insurance policy for a caravan whilst it is attached to the insured vehicle? A. No cover is provided. B. Third party only. C. Third party, fire and theft. D. Comprehensive. 4. What standard cover is provided under a third party only motorcycle insurance policy in A A Espect of injury to the insured in the event of an accident? B. Loss of earnings. C. Personal accidents benefit D. Medical expenses 5. Under a third party only private motor insurance policy, cover in respect of third party property damage is usually subject to what limit? B. C1,000 C. C10,000 D. C2,000 6. Due to an accident resulting in injury, a hairdresser is unable to carry out any of his/her duties for three months. What benefit will be provided under his/her personal accident insurance policy? A. A capital sum for total loss of the use of the limb. B. A capital sum for partial loss of the use of the limb. C. A regular payment for temporary partial disablement. D. A regular payment for temporary total disablement. 7. What amount should the sum insured under section of a household insurance policy. represent? A. The cost of rebuilding the property. B. The market value of the property. C. The maximum likely cost of fire damage to the property. D. The outstanding mortgage loan on the property. 8. An insurance policy for a small business includes cover for fire, special perils, theft, business interruption, money and other type of insurance under a single contract. This policy is known as A. An all risk insurance policy. B. An open cover insurance policy. C. A combined insurance policy. D. A collective insurance policy. 9. Under a travel insurance policy, cover for baggage will NOT generally include damage to A. Clothing B. Contact lenses C. Jewelry. D. Binoculars. 10. A commercial property insurance will usually exclude damage arising from impact by A. Aircraft. B. Animals. C. Own vehicles. D. Third party vehicles. 11. An employee is assaulted and robbed of his employer's takings whilst en route to bank them. Which insurance policy is most likely to provide personal aceident benefits to the employee for the injuries sustained in the robbery? A. An employers' liability insurance. B. A public liability insurance policy. C. A money insurance policy D. A theft insurance policy. 12. Following an insured loss at a solicitor's premises, which insurance policy specifically covers the solicitor for the loss of profits? A. A business interruption insurance policy. B. A legal expenses insurance policy. C. A money insurance policy. D. A professional indemnity insurance policy. 13. A legal expenses insurance policy normally, covers the insured for A. Negligent advice provided by the insured. B. The cost of attending jury service. C. Fines and penalties incurred. D. Solicitors' cost incurred in pursuing a claim against a third party. 14. Under a typical legal expenses insurance policy, what limit of cover, if any, usually applies during the period of insurance? A. Cover is unlimited B. Overall cover is limited, but there is no limit per claim. C. Overall cover is unlimited, but there is a limit per claim. D. Overall cover is limited and there is also a limit per claim. 15. When criminal persecution defence cover is included under a commercial legal expenses insurance policy, what type of fines, if any, are typically covered? A. Fines are not covered. B. Fines above the policy excess. C. Fines which equal or exceed the franchise. D. All fines are covered. 16. A commercial legal e A. Contract disputes. B. Property disputes. D. Employment disputes 17. Uader what type of insurance policy is a material damage warranty automatically 4. An extended warranty insurance policy. B. A business interruption insurance policy. C. A professional indemnity insurance policy D. A product liability insurance policy. 18. A shoe manufacturer's products liability insurance liability is issued with a limit of indemnity of C1,000,000. There are three different product liability claims in the first period of insurance, one for C500,000, one for C750,000 and a final one for C1,100,000. What will be the policy payout in total for the 3 claims? A. Cl,000,000 B. Cl,250,000 C. 2,250,000 D. 2,350,000 19. What type of insurance policy would provide cover for an accountant's liability to compensate her clients for losses due to errors or omissions by her staff? A. An employers' liability insurance policy. B. A money insurance policy. C. A professional indemnity insurance policy. D. A public liability insurance policy. 20. Authorized motor repairers are approved by the A. Financial service authority. B. Department of trade and industry. C. Insurer D. Motor insurers' bureau. 21. What is always the consequence of a proposer failing to inform an underwriter of all material facts relating to proposed risk? A. A claimed cannot be made against the insurance policy B. The insurer's liability is limited to third parties. C. The premium is set at a high level. D. The risk is not accurately assessed