Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Understanding how insurance works Insurance policies are a common form of risk reduction or risk transfer in which a third party assumes some or

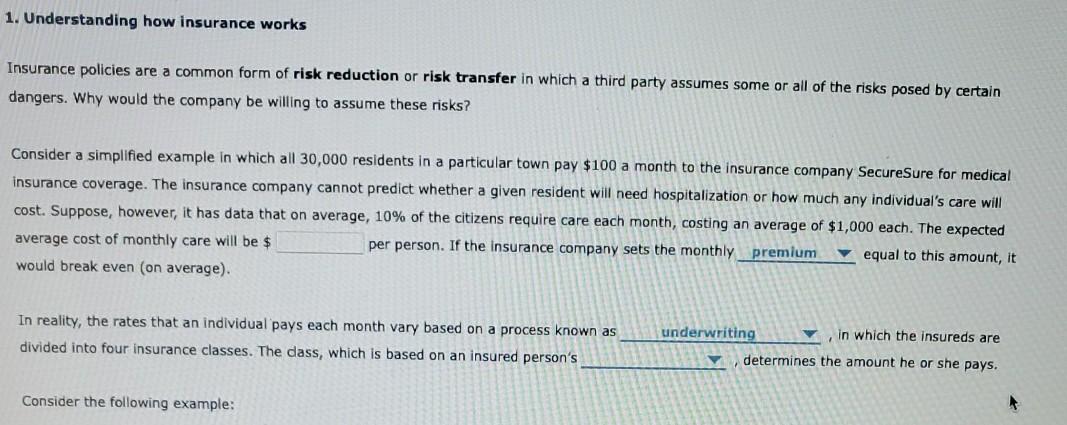

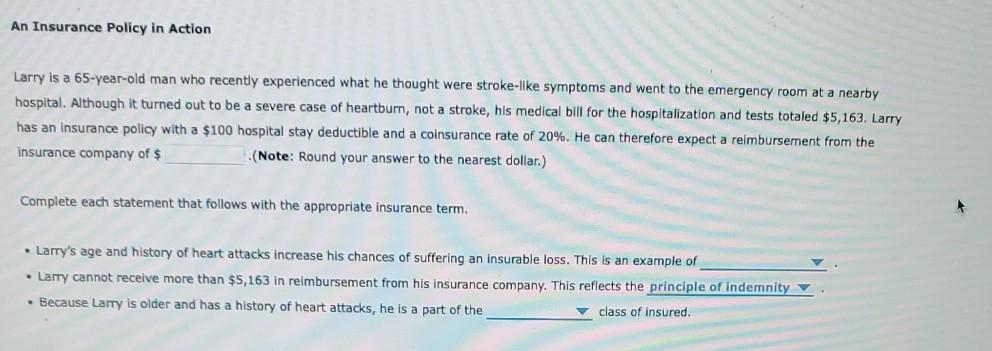

1. Understanding how insurance works Insurance policies are a common form of risk reduction or risk transfer in which a third party assumes some or all of the risks posed by certain dangers. Why would the company be willing to assume these risks? Consider a simplified example in which all 30,000 residents in a particular town pay $100 a month to the insurance company SecureSure for medical insurance coverage. The insurance company cannot predict whether a given resident will need hospitalization or how much any individual's care will cost. Suppose, however, it has data that on average, 10% of the citizens require care each month, costing an average of $1,000 each. The expected average cost of monthly care will be $ per person. If the insurance company sets the monthly premium equal to this amount, it would break even on average). In reality, the rates that an individual pays each month vary based on a process known as divided into four insurance classes. The dass, which is based on an insured person's underwriting in which the insureds are determines the amount he or she pays. Consider the following example: An Insurance policy in Action Larry is a 65-year-old man who recently experienced what he thought were stroke-like symptoms and went to the emergency room at a nearby hospital. Although it turned out to be a severe case of heartburn, not a stroke, his medical bill for the hospitalization and tests totaled $5,163. Larry has an insurance policy with a $100 hospital stay deductible and a coinsurance rate of 20%. He can therefore expect a reimbursement from the insurance company of $ (Note: Round your answer to the nearest dollar.) Complete each statement that follows with the appropriate insurance term. Larry's age and history of heart attacks increase his chances of suffering an insurable loss. This is an example of Larry cannot receive more than $5,163 in reimbursement from his insurance company. This reflects the principle of indemnity . Because Larry is older and has a history of heart attacks, he is a part of the class of insured, 1. Understanding how insurance works Insurance policies are a common form of risk reduction or risk transfer in which a third party assumes some or all of the risks posed by certain dangers. Why would the company be willing to assume these risks? Consider a simplified example in which all 30,000 residents in a particular town pay $100 a month to the insurance company SecureSure for medical insurance coverage. The insurance company cannot predict whether a given resident will need hospitalization or how much any individual's care will cost. Suppose, however, it has data that on average, 10% of the citizens require care each month, costing an average of $1,000 each. The expected average cost of monthly care will be $ per person. If the insurance company sets the monthly premium equal to this amount, it would break even on average). In reality, the rates that an individual pays each month vary based on a process known as divided into four insurance classes. The dass, which is based on an insured person's underwriting in which the insureds are determines the amount he or she pays. Consider the following example: An Insurance policy in Action Larry is a 65-year-old man who recently experienced what he thought were stroke-like symptoms and went to the emergency room at a nearby hospital. Although it turned out to be a severe case of heartburn, not a stroke, his medical bill for the hospitalization and tests totaled $5,163. Larry has an insurance policy with a $100 hospital stay deductible and a coinsurance rate of 20%. He can therefore expect a reimbursement from the insurance company of $ (Note: Round your answer to the nearest dollar.) Complete each statement that follows with the appropriate insurance term. Larry's age and history of heart attacks increase his chances of suffering an insurable loss. This is an example of Larry cannot receive more than $5,163 in reimbursement from his insurance company. This reflects the principle of indemnity . Because Larry is older and has a history of heart attacks, he is a part of the class of insured

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started