Answered step by step

Verified Expert Solution

Question

1 Approved Answer

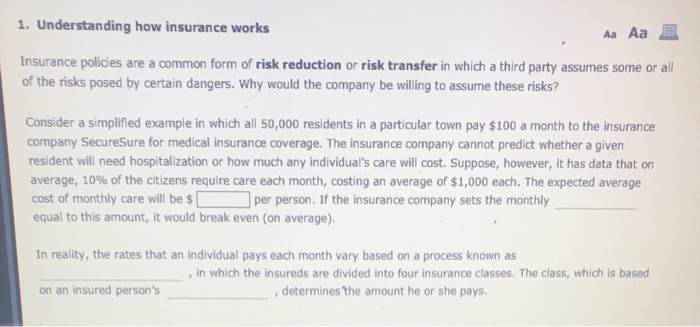

1. Understanding how insurance works Insurance policies are a common form of risk reduction or risk transfer in which a third party assumes some

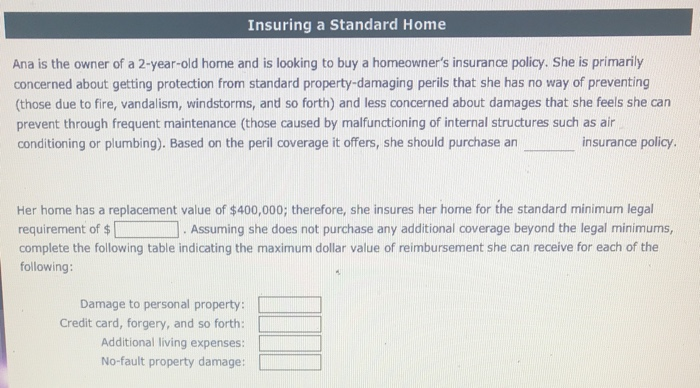

1. Understanding how insurance works Insurance policies are a common form of risk reduction or risk transfer in which a third party assumes some or all of the risks posed by certain dangers. Why would the company be willing to assume these risks? Aa Aa Consider a simplified example in which all 50,000 residents in a particular town pay $100 a month to the insurance company SecureSure for medical insurance coverage. The insurance company cannot predict whether a given resident will need hospitalization or how much any individual's care will cost. Suppose, however, it has data that on average, 10% of the citizens require care each month, costing an average of $1,000 each. The expected average cost of monthly care will be $ per person. If the insurance company sets the monthly equal to this amount, it would break even (on average). In reality, the rates that an individual pays each month vary based on a process known as on an insured person's F in which the insureds are divided into four insurance classes. The class, which is based determines the amount he or she pays. Insuring a Standard Home Ana is the owner of a 2-year-old home and is looking to buy a homeowner's insurance policy. She is primarily concerned about getting protection from standard property-damaging perils that she has no way of preventing (those due to fire, vandalism, windstorms, and so forth) and less concerned about damages that she feels she can prevent through frequent maintenance (those caused by malfunctioning of internal structures such as air conditioning or plumbing). Based on the peril coverage it offers, she should purchase an insurance policy. Her home has a replacement value of $400,000; therefore, she insures her home for the standard minimum legal requirement of $ . Assuming she does not purchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimbursement she can receive for each of the following: Damage to personal property: Credit card, forgery, and so forth: Additional living expenses: No-fault property damage:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the maximum dollar value of reimbursement Ana can receive for each category we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started