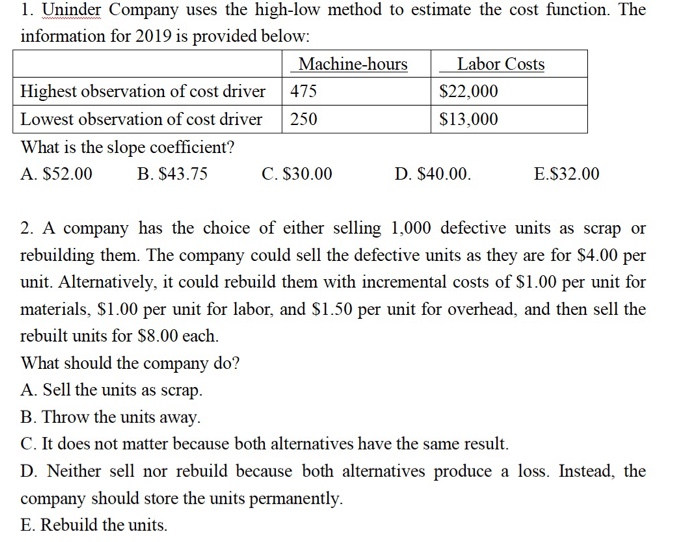

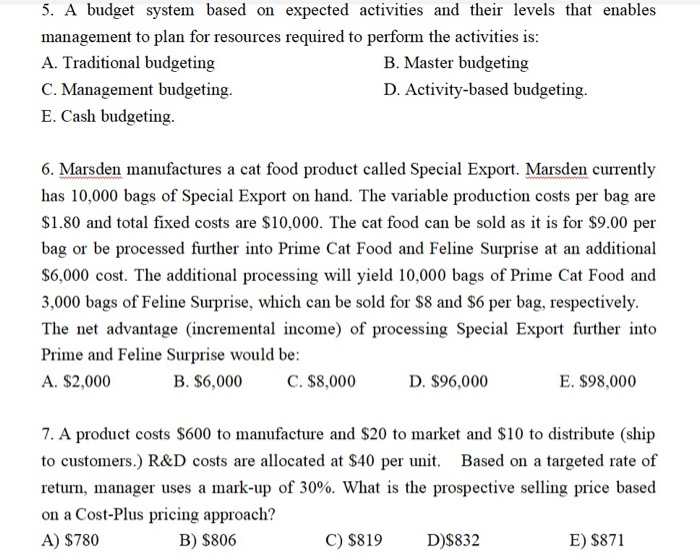

1. Uninder Company uses the high-low method to estimate the cost function. The information for 2019 is provided below: Machine-hours Labor Costs Highest observation of cost driver 475 $22,000 Lowest observation of cost driver 250 $13,000 What is the slope coefficient? A. $52.00 B. $43.75 C. $30.00 D. $40.00 E.$32.00 2. A company has the choice of either selling 1,000 defective units as scrap or rebuilding them. The company could sell the defective units as they are for $4.00 per unit. Alternatively, it could rebuild them with incremental costs of $1.00 per unit for materials, $1.00 per unit for labor, and $1.50 per unit for overhead, and then sell the rebuilt units for $8.00 each. What should the company do? A. Sell the units as scrap. B. Throw the units away. C. It does not matter because both alternatives have the same result. D. Neither sell nor rebuild because both alternatives produce a loss. Instead, the company should store the units permanently. E. Rebuild the units. 5. A budget system based on expected activities and their levels that enables management to plan for resources required to perform the activities is: A. Traditional budgeting B. Master budgeting C. Management budgeting. D. Activity-based budgeting. E. Cash budgeting. 6. Marsden manufactures a cat food product called Special Export. Marsden currently has 10,000 bags of Special Export on hand. The variable production costs per bag are $1.80 and total fixed costs are $10,000. The cat food can be sold as it is for $9.00 per bag or be processed further into Prime Cat Food and Feline Surprise at an additional $6,000 cost. The additional processing will yield 10,000 bags of Prime Cat Food and 3,000 bags of Feline Surprise, which can be sold for $8 and $6 per bag, respectively. The net advantage (incremental income) of processing Special Export further into Prime and Feline Surprise would be: A. $2,000 B. $6,000 C. $8,000 D. $96,000 E. $98,000 7. A product costs $600 to manufacture and $20 to market and $10 to distribute (ship to customers.) R&D costs are allocated at $40 per unit. Based on a targeted rate of return, manager uses a mark-up of 30%. What is the prospective selling price based on a Cost-Plus pricing approach? A) $780 B) $806 C) $819 D)$832 E) $871