Question

1. Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs.

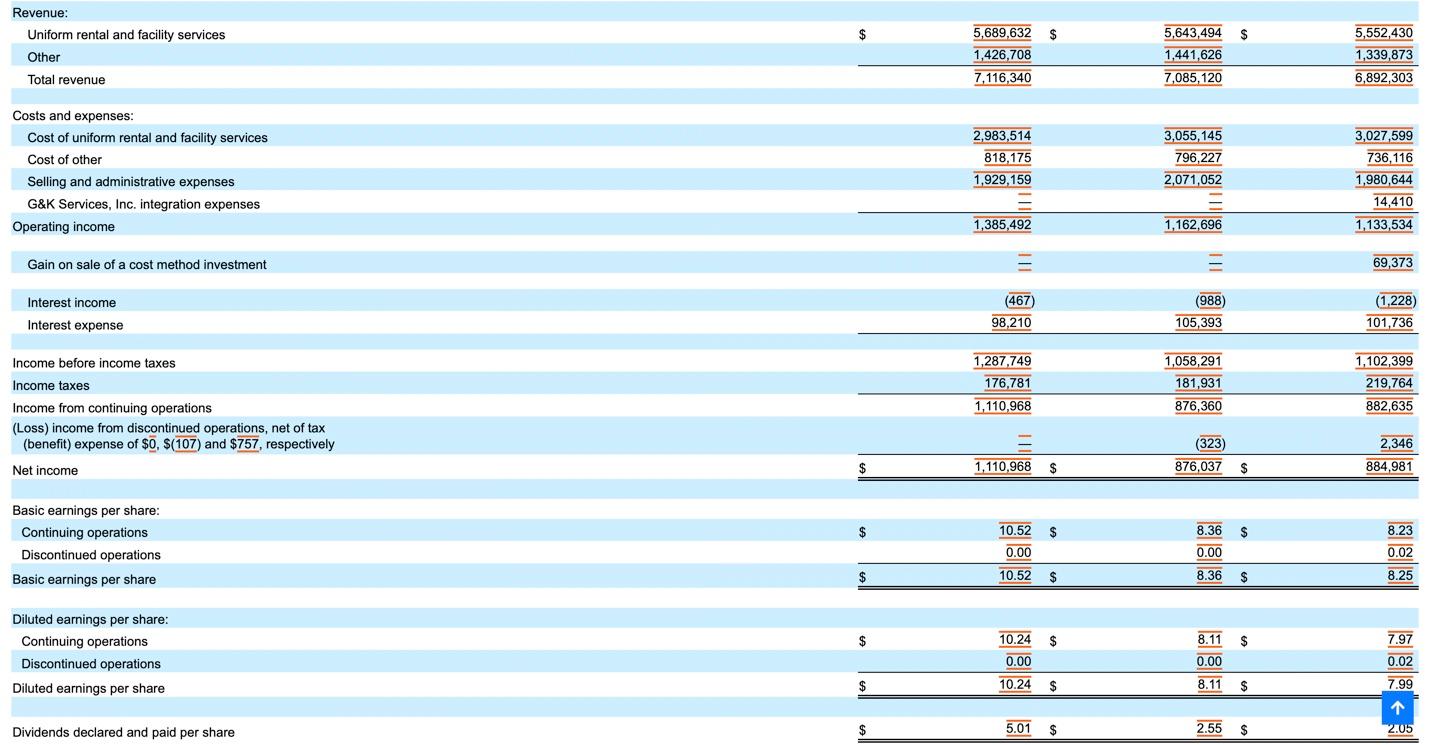

1. Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable. You should have 3 years of income statements, so pick the 2 years with the highest and lowest revenue to do the high-low analysis, and use total operating expenses from those same two years for the analysis.

1. Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable. You should have 3 years of income statements, so pick the 2 years with the highest and lowest revenue to do the high-low analysis, and use total operating expenses from those same two years for the analysis.

2. Based on your estimate of the portion of expenses that are variable, compute your companys contribution margin (described in Chapter 3) for the more recent year.

3. Based on this result, compute your companys operating leverage (also in Chapter 3) for that same year.

Revenue: Uniform rental and facility services Other $ $ $ 5,689,632 1,426,708 7,116,340 5,643,494 1,441,626 7,085,120 5,552,430 1,339,873 6,892,303 Total revenue Costs and expenses: Cost of uniform rental and facility services Cost of other Selling and administrative expenses G&K Services, Inc. integration expenses Operating income 2,983,514 818,175 1,929,159 3,055, 145 796,227 2,071,052 3,027,599 736,116 1,980,644 14,410 1,133,534 1,385,492 1,162,696 Gain on sale of a cost method investment 69,373 Interest income (467) 98,210 (988) 105,393 (1,228) 101,736 Interest expense Income before income taxes Income taxes Income from continuing operations (Loss) income from discontinued operations, net of tax (benefit) expense of $0, $(107) and $757, respectively 1,287,749 176,781 1,110,968 1,058,291 181,931 876,360 1,102,399 219,764 882,635 (323) 876,037 2,346 884,981 Net income $ 1,110,968 $ $ $ $ Basic earnings per share: Continuing operations Discontinued operations Basic earnings per share 10.52 0.00 10.52 8.36 0.00 8.36 8.23 0.02 $ $ $ 8.25 Diluted earnings per share: Continuing operations Discontinued operations $ $ $ 10.24 0.00 8.11 0.00 8.11 7.97 0.02 7.99 Diluted earnings per share $ 10.24 $ $ Dividends declared and paid per share $ 5.01 $ 2.55 $ 2.05 Revenue: Uniform rental and facility services Other $ $ $ 5,689,632 1,426,708 7,116,340 5,643,494 1,441,626 7,085,120 5,552,430 1,339,873 6,892,303 Total revenue Costs and expenses: Cost of uniform rental and facility services Cost of other Selling and administrative expenses G&K Services, Inc. integration expenses Operating income 2,983,514 818,175 1,929,159 3,055, 145 796,227 2,071,052 3,027,599 736,116 1,980,644 14,410 1,133,534 1,385,492 1,162,696 Gain on sale of a cost method investment 69,373 Interest income (467) 98,210 (988) 105,393 (1,228) 101,736 Interest expense Income before income taxes Income taxes Income from continuing operations (Loss) income from discontinued operations, net of tax (benefit) expense of $0, $(107) and $757, respectively 1,287,749 176,781 1,110,968 1,058,291 181,931 876,360 1,102,399 219,764 882,635 (323) 876,037 2,346 884,981 Net income $ 1,110,968 $ $ $ $ Basic earnings per share: Continuing operations Discontinued operations Basic earnings per share 10.52 0.00 10.52 8.36 0.00 8.36 8.23 0.02 $ $ $ 8.25 Diluted earnings per share: Continuing operations Discontinued operations $ $ $ 10.24 0.00 8.11 0.00 8.11 7.97 0.02 7.99 Diluted earnings per share $ 10.24 $ $ Dividends declared and paid per share $ 5.01 $ 2.55 $ 2.05Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started