Answered step by step

Verified Expert Solution

Question

1 Approved Answer

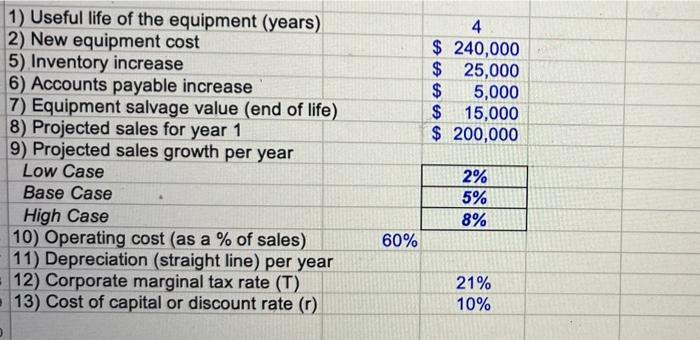

1) Useful life of the equipment (years) 2) New equipment cost 5) Inventory increase 6) Accounts payable increase 7) Equipment salvage value (end of

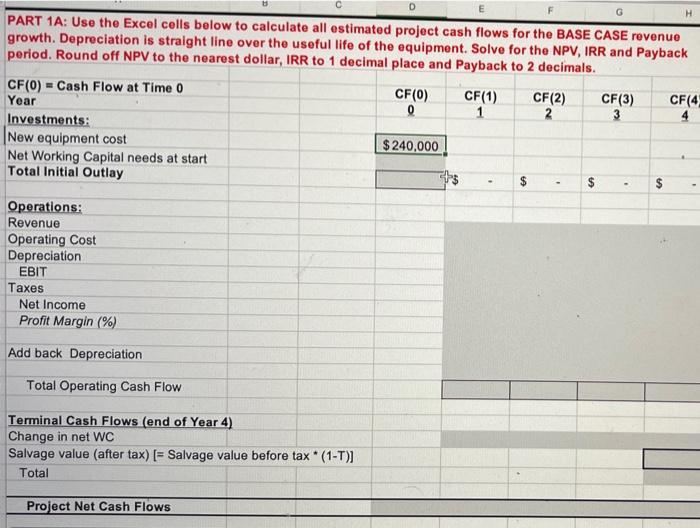

1) Useful life of the equipment (years) 2) New equipment cost 5) Inventory increase 6) Accounts payable increase 7) Equipment salvage value (end of life) 8) Projected sales for year 1 9) Projected sales growth per year Low Case Base Case High Case 10) Operating cost (as a % of sales) 11) Depreciation (straight line) per year 12) Corporate marginal tax rate (T) 13) Cost of capital or discount rate (r) 60% 4 $ 240,000 $ 25,000 $ 5,000 $ 15,000 $ 200,000 2% 5% 8% 21% 10% E PART 1A: Use the Excel cells below to calculate all estimated project cash flows for the BASE CASE revenue growth. Depreciation is straight line over the useful life of the equipment. Solve for the NPV, IRR and Payback period. Round off NPV to the nearest dollar, IRR to 1 decimal place and Payback to 2 decimals. CF(0) Cash Flow at Time 0 Year Investments: New equipment cost Net Working Capital needs at start Total Initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Profit Margin (%) Add back Depreciation Total Operating Cash Flow Terminal Cash Flows (end of Year 4) Change in net WC Salvage value (after tax) [= Salvage value before tax*(1-T)] Total Project Net Cash Flows D CF(0) 0 $240,000 CF(1) 1 CF(2) 2 LA CF(3) 3 SA H CF(4)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Useful life of the equipment years 2 New equipment cost 5 Inventory increase 6 Accounts payable i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started