Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using good form, prepare the companys 4 basic financial statements for the year ended 12/31/2019. finish the requirements and the information is complete! Graded

1. Using good form, prepare the companys 4 basic financial statements for the year ended 12/31/2019.

1. Using good form, prepare the companys 4 basic financial statements for the year ended 12/31/2019.

finish the requirements and the information is complete!

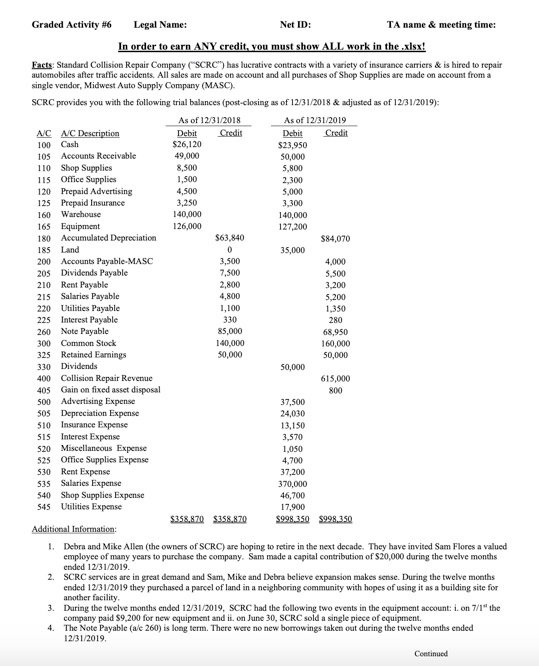

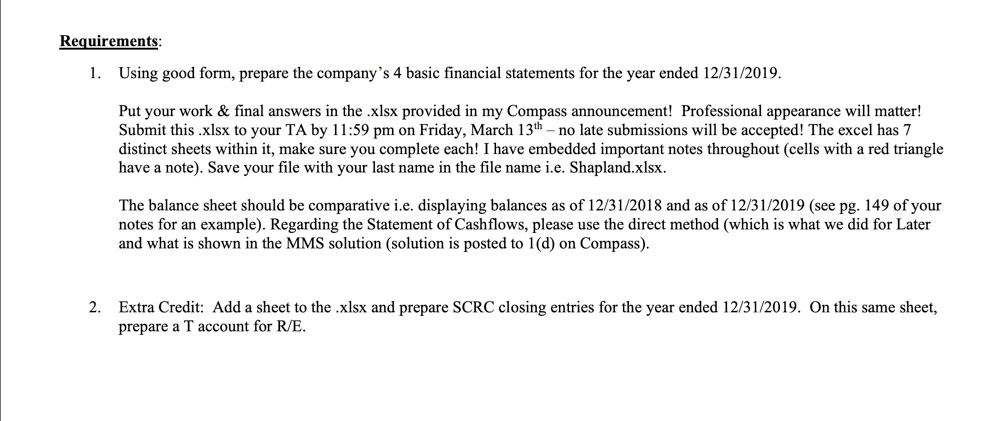

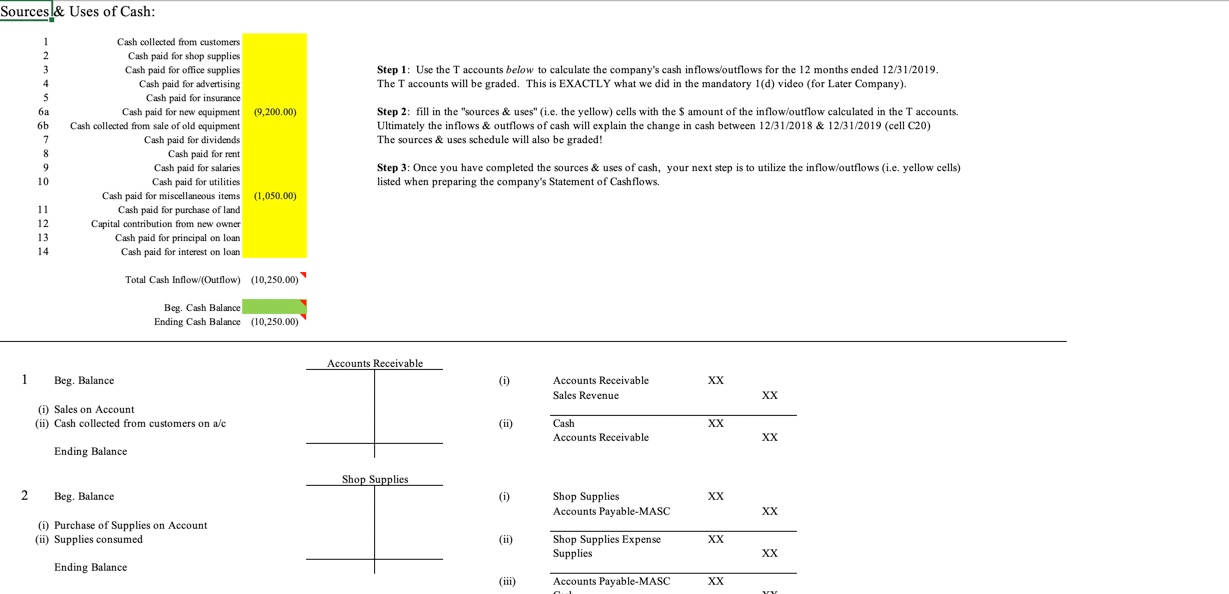

Graded Activity #6 Legal Name: Net ID: TA name & meeting time: In order to earn ANY credit, you must show ALL work in the .xlsx! Eacts Standard Collision Repair Company ("SCRC) has lucrative contracts with a variety of insurance carriers & is hired to repair automobiles after traffic accidents. All sales are made on account and all purchases of Shop Supplies are made on account from a single vender, Midwest Auto Supply Company (MASC) SCRC provides you with the following trial balances (post-closing as of 12/31/2018 & adjusted as of 12/31/2019): As of 12/31/2018 As of 12/31/2019 AC AC Description Debit Credit Debit Credit 100 Cash $26,120 $23,950 105 Accounts Receivable 49,000 50,000 110 Shop Supplies 8,500 5,800 115 Office Supplies 1,500 2,300 120 Prepaid Advertising 4,500 5,000 125 Prepaid Insurance 3.250 3.100 160 Warehouse 140,000 140,000 165 Equipment 126,000 127.200 180 Accumulated Depreciation $63.840 $84,070 185 Land 35,000 200 Accounts Payable-MASC 3,500 4,000 205 Dividends Payable 7.500 5,500 210 Rent Payable 2,800 3.200 215 Salaries Payable 4,800 5.200 220 Utilities Payable 1,100 1,350 225 Interest Payable 330 280 260 Note Payable 85,000 68,950 300 Common Stock 140.000 160,000 325 Retained Earnings 50,000 50,000 330 Dividends 50,000 400 Collision Repair Revenue 615,000 405 Gain on fixed asset disposal 800 500 Advertising Expense 37.500 505 Depreciation Expense 24,000 510 Insurance Expense 13.150 SIS Interest Expense 3.570 520 Miscellaneous Expense 1.050 525 Office Supplies Expense 4,700 530 Rent Expense 37,200 535 Salaries Expense 370,000 540 Shop Supplies Expense 46,700 545 Utilities Expense 17.900 $358.870 $358.870 1998_350 9998350 Additional Information: 1. Debra and Mike Allen (the owners of SCRC) are hoping to retire in the next decade. They have invited Sam Flores a valued employee of many years to purchase the company. Sam made a capital contribution of $20,000 during the twelve months ended 1231 2019 2 SCRC services are in great demand and Sam Mike and Debra believe expansion makes sense. During the twelve months ended 12/31/2019 they purchased a parcel of land in a neighboring community with hopes of using it as a building site for another facility 3. During the twelve months anded 12/31/2019, SCRC had the following two events in the equipment account: ion 7/1 "the company paid $9.200 for new equipment and on June 30, SCRC sold a single piece of equipment 4. The Note Payable (ale 260) is long term. There were no new borrowings taken out during the twelve months ended 12/31/2019. Continued Requirements: 1. Using good form, prepare the company's 4 basic financial statements for the year ended 12/31/2019. Put your work & final answers in the .xlsx provided in my Compass announcement! Professional appearance will matter! Submit this .xlsx to your TA by 11:59 pm on Friday, March 13th - no late submissions will be accepted! The excel has 7 distinct sheets within it, make sure you complete each! I have embedded important notes throughout (cells with a red triangle have a note). Save your file with your last name in the file name i.e. Shapland.xlsx. The balance sheet should be comparative i.e. displaying balances as of 12/31/2018 and as of 12/31/2019 (see pg. 149 of your notes for an example). Regarding the Statement of Cashflows, please use the direct method (which is what we did for Later and what is shown in the MMS solution (solution is posted to 1(d) on Compass). 2. Extra Credit: Add a sheet to the .xlsx and prepare SCRC closing entries for the year ended 12/31/2019. On this same sheet, prepare a T account for R/E. Sources & Uses of Cash: Step 1: Use the T accounts below to calculate the company's cash inflows/outflows for the 12 months ended 12/31/2019. The T accounts will be graded. This is EXACTLY what we did in the mandatory 1(d) video (for Later Company). (9,200.00) Step 2: fill in the "sources & uses" (i.e. the yellow) cells with the amount of the inflow/outflow calculated in the T accounts. Ultimately the inflows & outflows of cash will explain the change in cash between 12/31/2018 & 12/31/2019 (cell C20) The sources & uses schedule will also be graded! Cash collected from customers Cash paid for shop supplies Cash paid for office supplies Cash paid for advertising Cash paid for insurance Cash paid for new equipment Cash collected from sale of old equipment Cash paid for dividends Cash paid for rent Cash paid for salaries Cash paid for utilities Cash paid for miscellaneous items Cash paid for purchase of land Capital contribution from new owner Cash paid for principal on loan Cash paid for interest on loan Step 3: Once you have completed the sources & uses of cash, your next step is to utilize the inflow/outflows (i.e. yellow cells) listed when preparing the company's Statement of Cashflows. (1,050.00) Total Cash Inflow/(Outflow) (10,250.00) Beg. Cash Balance Ending Cash Balance (10,250.00) Accounts Receivable 1 Beg. Balance Accounts Receivable Sales Revenue (1) Sales on Account (ii) Cash collected from customers on a/c Cash Accounts Receivable Ending Balance Shop Supplies Beg. Balance (1) Shop Supplies Accounts Payable-MASC (i) Purchase of Supplies on Account (ii) Supplies consumed Shop Supplies Expense Supplies Ending Balance Accounts Payable-MASC Graded Activity #6 Legal Name: Net ID: TA name & meeting time: In order to earn ANY credit, you must show ALL work in the .xlsx! Eacts Standard Collision Repair Company ("SCRC) has lucrative contracts with a variety of insurance carriers & is hired to repair automobiles after traffic accidents. All sales are made on account and all purchases of Shop Supplies are made on account from a single vender, Midwest Auto Supply Company (MASC) SCRC provides you with the following trial balances (post-closing as of 12/31/2018 & adjusted as of 12/31/2019): As of 12/31/2018 As of 12/31/2019 AC AC Description Debit Credit Debit Credit 100 Cash $26,120 $23,950 105 Accounts Receivable 49,000 50,000 110 Shop Supplies 8,500 5,800 115 Office Supplies 1,500 2,300 120 Prepaid Advertising 4,500 5,000 125 Prepaid Insurance 3.250 3.100 160 Warehouse 140,000 140,000 165 Equipment 126,000 127.200 180 Accumulated Depreciation $63.840 $84,070 185 Land 35,000 200 Accounts Payable-MASC 3,500 4,000 205 Dividends Payable 7.500 5,500 210 Rent Payable 2,800 3.200 215 Salaries Payable 4,800 5.200 220 Utilities Payable 1,100 1,350 225 Interest Payable 330 280 260 Note Payable 85,000 68,950 300 Common Stock 140.000 160,000 325 Retained Earnings 50,000 50,000 330 Dividends 50,000 400 Collision Repair Revenue 615,000 405 Gain on fixed asset disposal 800 500 Advertising Expense 37.500 505 Depreciation Expense 24,000 510 Insurance Expense 13.150 SIS Interest Expense 3.570 520 Miscellaneous Expense 1.050 525 Office Supplies Expense 4,700 530 Rent Expense 37,200 535 Salaries Expense 370,000 540 Shop Supplies Expense 46,700 545 Utilities Expense 17.900 $358.870 $358.870 1998_350 9998350 Additional Information: 1. Debra and Mike Allen (the owners of SCRC) are hoping to retire in the next decade. They have invited Sam Flores a valued employee of many years to purchase the company. Sam made a capital contribution of $20,000 during the twelve months ended 1231 2019 2 SCRC services are in great demand and Sam Mike and Debra believe expansion makes sense. During the twelve months ended 12/31/2019 they purchased a parcel of land in a neighboring community with hopes of using it as a building site for another facility 3. During the twelve months anded 12/31/2019, SCRC had the following two events in the equipment account: ion 7/1 "the company paid $9.200 for new equipment and on June 30, SCRC sold a single piece of equipment 4. The Note Payable (ale 260) is long term. There were no new borrowings taken out during the twelve months ended 12/31/2019. Continued Requirements: 1. Using good form, prepare the company's 4 basic financial statements for the year ended 12/31/2019. Put your work & final answers in the .xlsx provided in my Compass announcement! Professional appearance will matter! Submit this .xlsx to your TA by 11:59 pm on Friday, March 13th - no late submissions will be accepted! The excel has 7 distinct sheets within it, make sure you complete each! I have embedded important notes throughout (cells with a red triangle have a note). Save your file with your last name in the file name i.e. Shapland.xlsx. The balance sheet should be comparative i.e. displaying balances as of 12/31/2018 and as of 12/31/2019 (see pg. 149 of your notes for an example). Regarding the Statement of Cashflows, please use the direct method (which is what we did for Later and what is shown in the MMS solution (solution is posted to 1(d) on Compass). 2. Extra Credit: Add a sheet to the .xlsx and prepare SCRC closing entries for the year ended 12/31/2019. On this same sheet, prepare a T account for R/E. Sources & Uses of Cash: Step 1: Use the T accounts below to calculate the company's cash inflows/outflows for the 12 months ended 12/31/2019. The T accounts will be graded. This is EXACTLY what we did in the mandatory 1(d) video (for Later Company). (9,200.00) Step 2: fill in the "sources & uses" (i.e. the yellow) cells with the amount of the inflow/outflow calculated in the T accounts. Ultimately the inflows & outflows of cash will explain the change in cash between 12/31/2018 & 12/31/2019 (cell C20) The sources & uses schedule will also be graded! Cash collected from customers Cash paid for shop supplies Cash paid for office supplies Cash paid for advertising Cash paid for insurance Cash paid for new equipment Cash collected from sale of old equipment Cash paid for dividends Cash paid for rent Cash paid for salaries Cash paid for utilities Cash paid for miscellaneous items Cash paid for purchase of land Capital contribution from new owner Cash paid for principal on loan Cash paid for interest on loan Step 3: Once you have completed the sources & uses of cash, your next step is to utilize the inflow/outflows (i.e. yellow cells) listed when preparing the company's Statement of Cashflows. (1,050.00) Total Cash Inflow/(Outflow) (10,250.00) Beg. Cash Balance Ending Cash Balance (10,250.00) Accounts Receivable 1 Beg. Balance Accounts Receivable Sales Revenue (1) Sales on Account (ii) Cash collected from customers on a/c Cash Accounts Receivable Ending Balance Shop Supplies Beg. Balance (1) Shop Supplies Accounts Payable-MASC (i) Purchase of Supplies on Account (ii) Supplies consumed Shop Supplies Expense Supplies Ending Balance Accounts Payable-MASC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started