Answered step by step

Verified Expert Solution

Question

1 Approved Answer

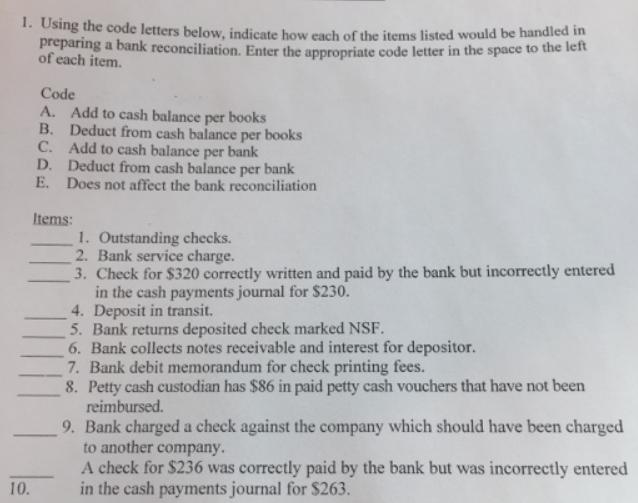

1. Using the code letters below, indicate how each of the items listed would be handled in preparing a bank reconciliation. Enter the appropriate

1. Using the code letters below, indicate how each of the items listed would be handled in preparing a bank reconciliation. Enter the appropriate code letter in the space to the left of each item. Code A. Add to cash balance per books B. Deduct from cash balance per books C. Add to cash balance per bank D. Deduct from cash balance per bank E. Does not affect the bank reconciliation Items: 1. Outstanding checks. 2. Bank service charge. 3. Check for $320 correctly written and paid by the bank but incorrectly entered in the cash payments journal for $230. 4. Deposit in transit. 5. Bank returns deposited check marked NSF. 6. Bank collects notes receivable and interest for depositor. 7. Bank debit memorandum for check printing fees. 8. Petty cash custodian has $86 in paid petty cash vouchers that have not been reimbursed. 9. Bank charged a check against the company which should have been charged to another company. A check for $236 was correctly paid by the bank but was incorrectly entered in the cash payments journal for $263. 10.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The correct answers will be Items Code 1 Outstanding checks D Deduct from cash balance per bank 2 Ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started