Answered step by step

Verified Expert Solution

Question

1 Approved Answer

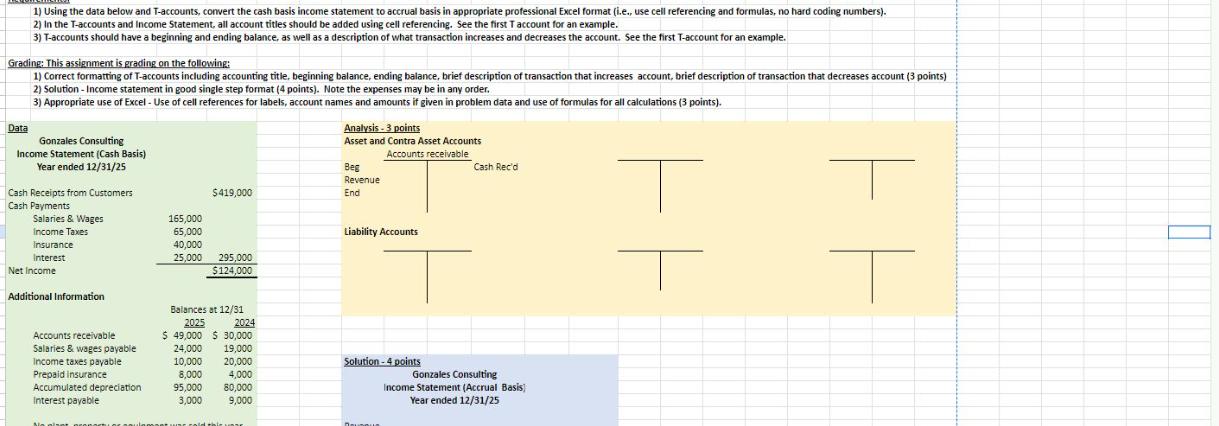

1) Using the data below and T-accounts, convert the cash basis income statement to accrual basis in appropriate professional Excel format (i.e., use cell

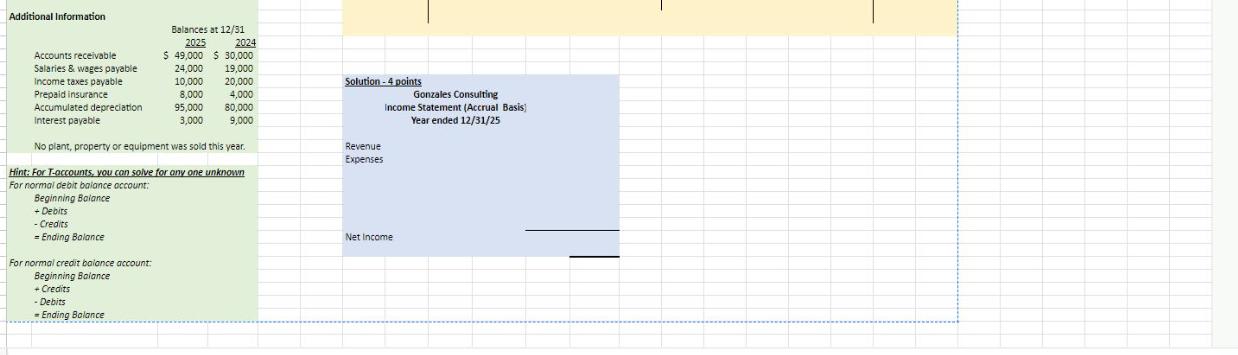

1) Using the data below and T-accounts, convert the cash basis income statement to accrual basis in appropriate professional Excel format (i.e., use cell referencing and formulas, no hard coding numbers). 2) In the T-accounts and Income Statement, all account titles should be added using cell referencing. See the first T account for an example. 3) T-accounts should have a beginning and ending balance, as well as a description of what transaction increases and decreases the account. See the first T-account for an example. Grading: This assignment is grading on the following: 1) Correct formatting of T-accounts including accounting title, beginning balance, ending balance, brief description of transaction that increases account, brief description of transaction that decreases account (3 points) 2) Solution - Income statement in good single step format (4 points). Note the expenses may be in any order. 3) Appropriate use of Excel - Use of cell references for labels, account names and amounts if given in problem data and use of formulas for all calculations (3 points). Data Gonzales Consulting Income Statement (Cash Basis) Year ended 12/31/25 Cash Receipts from Customers Cash Payments Salaries & Wages Income Taxes Insurance Interest Net Income Additional Information Accounts receivable Salaries & wages payable Income taxes payable Prepaid Insurance Accumulated depreciation Interest payable No piset $419,000 165,000 65,000 40,000 25,000 295,000 $124,000 Balances at 12/31 2025 2024 $49,000 $30,000 24,000 19,000 10,000 20,000 8,000 4,000 95,000 3,000 80,000 9,000 rold this un Analysis 3 points Asset and Contra Asset Accounts Accounts receivable Beg Revenue End Liability Accounts Solution-4 points Doupu Cash Rec'd Gonzales Consulting Income Statement (Accrual Basis) Year ended 12/31/25 EE EF Additional Information Accounts receivable Salaries & wages payable Income taxes payable Prepaid insurance Accumulated depreciation Interest payable Balances at 12/31 2025 2024 $ 49,000 $30,000 24,000 19,000 10,000 20,000 8,000 4,000 95,000 80,000 3,000 9,000 No plant, property or equipment was sold this year. Hint: For T-accounts, you can solve for any one unknown For normal debit balance account: Beginning Balance + Debits - Credits - Ending Balance For normal credit balance account: Beginning Balance + Credits Debits - Ending Balance Solution-4 points Gonzales Consulting Income Statement (Accrual Basis] Year ended 12/31/25 Revenue Expenses Net Income

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here is the Taccount and accrual basis income statement solution in Excel TAccounts A1 Asset and Con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started