Answered step by step

Verified Expert Solution

Question

1 Approved Answer

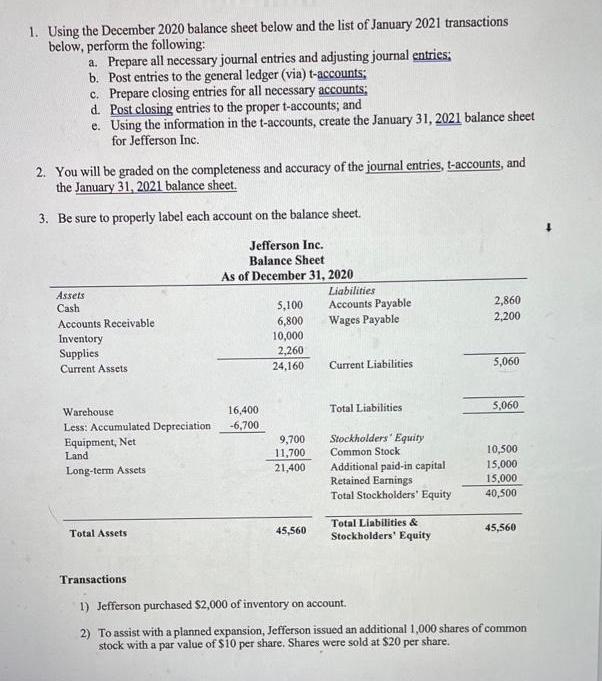

1. Using the December 2020 balance sheet below and the list of January 2021 transactions below, perform the following: a. Prepare all necessary journal

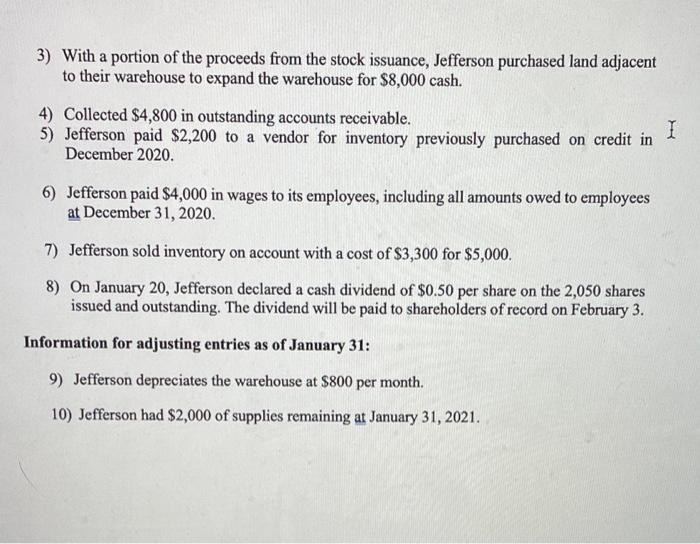

1. Using the December 2020 balance sheet below and the list of January 2021 transactions below, perform the following: a. Prepare all necessary journal entries and adjusting journal entries; b. Post entries to the general ledger (via) t-accounts; c. Prepare closing entries for all necessary accounts; d. Post closing entries to the proper t-accounts; and e. Using the information in the t-accounts, create the January 31, 2021 balance sheet for Jefferson Inc. 2. You will be graded on the completeness and accuracy of the journal entries, t-accounts, and the January 31, 2021 balance sheet. 3. Be sure to properly label each account on the balance sheet. Jefferson Inc. Balance Sheet As of December 31, 2020 Liabilities Assets 2,860 Accounts Payable Wages Payable 5,100 6,800 10,000 2,260 Cash 2,200 Accounts Receivable Inventory Supplies 24,160 Current Liabilities 5,060 Current Assets Total Liabilities 5,060 Warehouse 16,400 Less: Accumulated Depreciation -6,700 9,700 Stockholders' Equity Equipment, Net Land 11,700 Common Stock 10,500 Additional paid-in capital Retained Earnings Total Stockholders' Equity Long-term Assets 21,400 15,000 15,000 40,500 Total Liabilities & Total Assets 45,560 45,560 Stockholders' Equity Transactions 1) Jefferson purchased $2,000 of inventory on account. 2) To assist with a planned expansion, Jefferson issued an additional 1,000 shares of common stock with a par value of $10 per share. Shares were sold at $20 per share. 3) With a portion of the proceeds from the stock issuance, Jefferson purchased land adjacent to their warehouse to expand the warehouse for $8,000 cash. 4) Collected $4,800 in outstanding accounts receivable. 5) Jefferson paid $2,200 to a vendor for inventory previously purchased on credit in December 2020. 6) Jefferson paid $4,000 in wages to its employees, including all amounts owed to employees at December 31, 2020. 7) Jefferson sold inventory on account with a cost of $3,300 for $5,000. 8) On January 20, Jefferson declared a cash dividend of $0.50 per share on the 2,050 shares issued and outstanding. The dividend will be paid to shareholders of record on February 3. Information for adjusting entries as of January 31: 9) Jefferson depreciates the warehouse at $800 per month. 10) Jefferson had $2,000 of supplies remaining at January 31, 2021.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries 2 Adjustin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started