Question

1: Using the expected cash flows given above, what is the estimated value of the property , Vo, if purchased using all cash and if

1:

1:

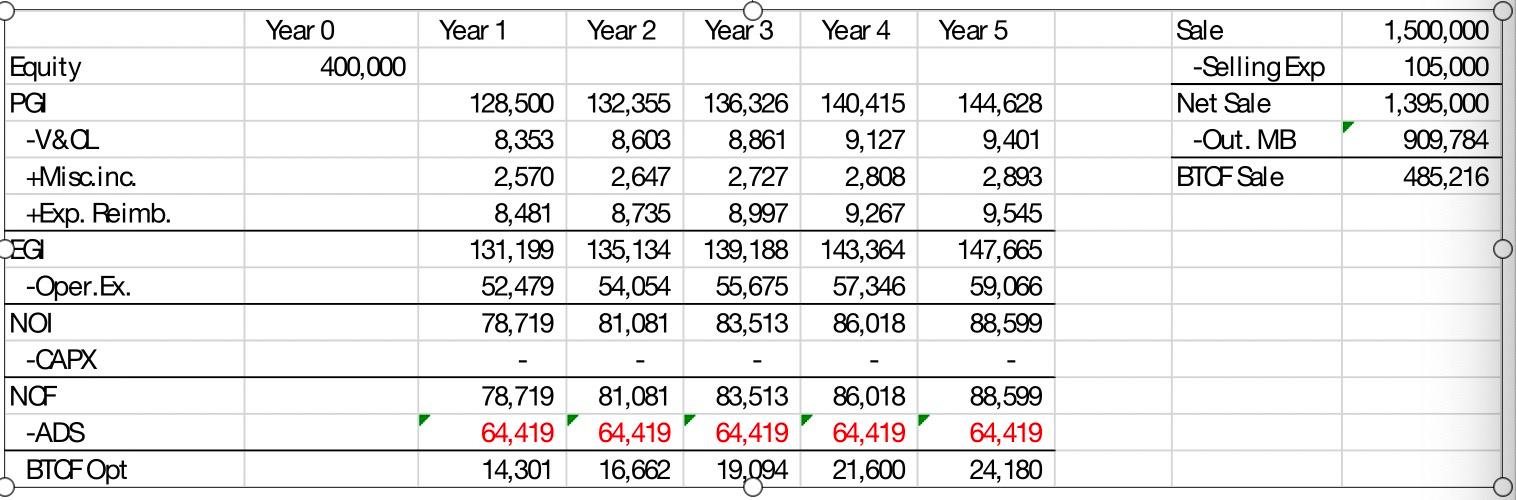

Using the expected cash flows given above, what is the estimated value of the property, Vo, if purchased using all cash and if estimated using the discounted cash flow (DCF) approach? Assume the overall required return unlevered is 8 percent; the required return of the equity investor if levered is 15 percent; the going-in capitalization rate, Ro, is 5.5 percent; the terminal capitalization rate, Rt, is 6.0 percent; and a five-year holding period. (8 pts show work)

2:Using the expected cash flows given above, what is the estimated value of the property today, Vo, if estimated using the direct capitalization approach? Assume the overall required return unlevered is 8 percent; the required return of the equity investor if levered is 15 percent; the going-in capitalization rate, Ro, is 5.5 percent; and the terminal capitalization rate, Rt, is 6.0 percent (8 pts show work).

3:Using the expected cash flows above, what is the internal rate of return, IRR, of the equity investment, if levered? Assume the project can be purchased for $1.4 million with a mortgage of $1.0 million. Assume a five-year holding period. (8 pts show work)

4:Using the expected cash flows given above, what is the present value of the equity, Ve, if purchased using a mortgage if estimated using discounted cash flow (DCF) approach? Assume the overall required return unlevered is 8 percent; the required return of the equity investor if levered is 15 percent; the going-in capitalization rate, Ro, is 5.5 percent; the terminal capitalization rate, Rt, is 6.0 percent; and a five-year holding period. (8 pts show work)

5:Using the value of the equity, Ve, calculated in 29 above and assuming a mortgage loan of $1.0 million, what is the total estimated value of the project, Vo.? Show how you determined this. (8 pts show work).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started